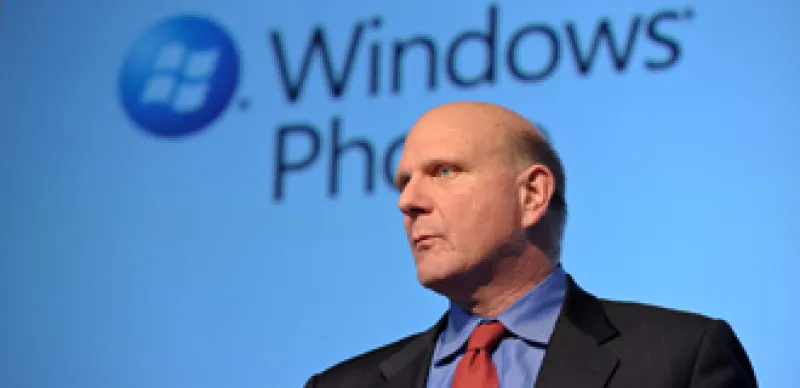

Microsoft Corp. has had a long history of acquiring any software technology it deems necessary to compete in the marketplace — beginning with DOS, the computer operating system it purchased in 1981 from a Seattle company and then licensed to IBM Corp. to run the original IBM PC. But the Redmond, Washington, giant’s $44 billion bid for Internet rival Yahoo!, unveiled in February 2008, was different. Thanks to economies of scale, the gap between the Internet’s winners and losers was widening fast, Microsoft CEO Steve Ballmer warned in his letter to Yahoo!’s board of directors. Tacitly but unmistakably pointing to Google, he wrote, “Today, the market is increasingly dominated by one player who is consolidating its dominance through acquisition.” What Ballmer coveted most about Yahoo! was not its technology but its popularity among Internet users.

That’s why Ballmer is happy with the way things turned out. After three months of talking to Yahoo! and failing to agree on a price, the Microsoft chief withdrew his offer. A year later a new management team at Yahoo! agreed to a ten-year partnership whereby users who type in a search query on Yahoo!’s sites will be handed off to Microsoft’s search engine; the two companies can then share the real bonanza: advertising made more lucrative by all those additional Yahoo! users.“Success in search requires both innovation and scale,” Ballmer said in a statement on July 29, 2009, asserting the complementary strengths of Microsoft and Yahoo!, respectively. In Ballmer’s view, the partnership promises to give Microsoft’s search business the popularity boost it needs to earn competitive advertising revenue and stay in the technological race with Google — without the risks of what would have been by far Microsoft’s largest acquisition.

Wall Street hasn’t exactly been impressed. “They got 80 to 90 percent of what they wanted,” concedes Citi Investment Research & Analysis analyst Walter Pritchard, one of the many analysts following Microsoft who opposed the original acquisition bid. Pritchard saw that deal as too large and potentially disruptive, given that Microsoft didn’t need all the Yahoo! assets.

Investor criticism has been harsher. Where Ballmer sees strategic progress and future profits, investors see billions spent in a losing sideshow. In the past three years alone, Microsoft’s online services unit, which includes Bing and the MSN collection of sites that compete with Yahoo!, among others, has posted more than $5.3 billion in losses. Meanwhile, Google’s share of the world’s search markets has grown to more than 64 percent in the U.S., up from 56 percent in 2007; during the same period, Yahoo! and Microsoft’s combined share fell from more than 34 percent to 29 percent.

Worse still, for many observers, the Yahoo! partnership fits a pattern of Microsoft futilely spending big to catch up with successful first-movers — after all, MSN was launched as an AOL-killer in 1995 and has been unprofitable ever since. Wired magazine, a savvy judge of Silicon Valley credibility and cachet, summed up this viewpoint with a graphic showing Microsoft and Yahoo! as overlapping circles in a Venn diagram. The caption for the intersecting area: “STILL NOT GOOGLE.”

Under Ballmer, who took the CEO reins from Bill Gates in January 2000, the world’s largest software maker has become perhaps the most underappreciated large-cap name in investment circles today. Using a strategy for coping with disruptive technological change that Gates forged in the 1990s, Microsoft faces an almost entirely different lineup of competitors from a decade ago, let alone two decades ago. Yet, while its current competition has gained investors’ admiration, Microsoft battles the perception that it is a dim plodder — despite mounting evidence that its strategic plotting has been consistently shrewd.

On Ballmer’s watch, Microsoft’s revenue has grown by 172 percent; earnings per share have tripled. But over the same period, the company’s stock has been dead money. “Mister Softee,” as the shares are known on the Street, probably deserves the most credit for adding “software tycoon” to America’s lexicon. The company’s 1986 initial public offering was the über-IPO for a generation of Silicon Valley entrepreneurs, venture capitalists and ordinary Americans, the archetype for how technology’s winners are rewarded — even nerdy ones. Microsoft’s shares turned Gates into the richest man on the planet in 1995, while making “Microsoft millionaires” out of thousands of the company’s employees and investors worldwide. But since the tech bubble burst in 2000, Microsoft’s MSFT ticker has traded flat, mostly in the mid-$20 range; on a split-adjusted basis, the stock has lost more than 50 percent of its value since Ballmer took over as CEO. Whereas Microsoft’s stock price outpaced the company’s profits in the 1990s, today — to the astonishment of anyone who remembers the go-go years — its price-earnings ratio lags that of the Standard & Poor’s 500 index. Mister Softee’s diminished stature was certified in May with the news that Apple had overtaken Microsoft as the world’s most valuable technology company, as measured by market capitalization.

Few would assert that Microsoft has had as good a decade as Apple. But Mister Softee’s below-average valuation is baffling to many, not least of which are the three dozen Wall Street analysts who cover Microsoft. As with their predecessors last century, many of the current generation of analysts have had a buy on the stock more often than not: This summer, 28 out of 38 tracked by S&P rated the stock either a buy or a buy/hold. (Nine of the other ten rated it hold, and one rated it “weak hold.” There were no sells.)

Indeed, many top software analysts have recommended the stock for most of their careers. But this century that recommendation hasn’t worked out so well. For many on Wall Street, Microsoft has become a paradox: a high-tech leader with the valuation of a low-tech laggard. “In Microsoft you have a stock that’s overcovered but underfollowed,” says Morgan Stanley software analyst Adam Holt, who’s led his firm’s coverage since 2002.

The company is hard to follow, but analysts don’t blame Microsoft’s investor relations. “They provide investors with a lot of access,” notes Holt, adding that over the past year and a half, Microsoft’s accessibility to Wall Street has been as high as he’s seen during his career. (Holt, the top-ranked software analyst on this year’s All-America Research Team, has covered technology stocks since 1997.) Long considered a standout in the tech sector for its outreach efforts, Microsoft, under IR director Bill Koefoed, has added nondeal road shows to the already full schedule of meetings and conferences it regularly hosts or attends. Sell-side analysts surveyed by Institutional Investor voted the company’s investor relations the best in its sector (Institutional Investor, February 2010). And the days when private audiences with executives were arranged for certain analysts, such as Goldman, Sachs & Co.’s longtime AART first teamer Rick Sherlund — who squired Gates around Wall Street when Goldman brought the company public — are long gone. (Sherlund quit sell-side research in 2007 and now runs his own private fund.)

“There’s no one who’s family anymore,” says Citi’s Pritchard, a ten-year Street veteran who like most Microsoft analysts today has covered the company only since Ballmer became CEO. “It’s just been democratized.” In recognition of Regulation FD, which prohibits companies from selectively disclosing material information, Microsoft has opened events like its financial analyst meeting — a daylong affair held annually in Redmond — to anyone with an Internet connection.

But unraveling the mystery of Microsoft requires more than an Internet connection. It requires command of a company that seeks to make money using a variety of business models, some confounding and even contradictory, while competing against rivals that succeed using yet other models, which might differ from the ones their founders started with, in markets that didn’t even exist a few years earlier. Except, that is, when these same rivals are not competing at all: Currently, Microsoft counts among its bitterest competitors such past partners as Apple, IBM and Sony Corp. — and, yes, even Yahoo! (Another reason that Ballmer, who declined to speak with II for this story, is probably happy about not buying Yahoo! is that three months of negotiations convinced him that melding the two companies’ cultures would have been difficult.)

By most financial measures, Microsoft appears healthy, and its juggernaut across the tech sector has been relentless. Earnings for its latest fiscal year handily surpassed the Street’s expectations, and it posted a profit margin that rivals in other industries can only dream of: just under 40 percent. That’s about twice IBM’s and well above the profit margin of every large-cap name in tech, including Apple (30 percent) and Google (35 percent). Among its fellow members of the Dow Jones industrial average, which Microsoft joined in 1999, only drugmaker Merck & Co. coins it at a higher rate.

And Microsoft’s latest results are no fluke. Over the past five years, despite the recent recession, operating margins never strayed outside a band of 34 to 37 percent; over the past ten years, they’ve averaged 35 percent — two points above the 33 percent average achieved from 1986 to 1995, Microsoft’s first decade as a public company.

Nor has the company shown any backtracking from its larger mission. The corporate motto that Gates himself says he fashioned in Microsoft’s earliest days — “A computer on every desk and in every home, all running Microsoft software” — is still chiseled in stone on the company’s Redmond campus. (Gates stepped down in 2008 to pursue the work of his charity; he remains chairman of the board.) The company boasts that in the past decade it has created no less than eight new product lines with sales of more than $1 billion each, ranging from the Exchange and SharePoint server systems that help workers send e-mail and collaborate on documents to Xbox, the gaming console that Microsoft pits against Sony’s PlayStation and Nintendo Co.’s Wii. And customers say Microsoft’s infamous take-no-prisoners sales and marketing culture has survived the scrutiny of trustbusters. One IT executive recently involved in shutting down a failed hedge fund groans over the “pointlessly legal” demands Microsoft placed on the firm to prove that it was no longer using licensed software.

As for its prominence in the American psyche, the company’s position seems as entrenched as ever. Google’s unofficial corporate motto, “Don’t be evil,” for example, carries an implied corollary that’s understood by millions of Americans, and not just Silicon Valley–types: “Don’t become Microsoft.” But the past decade has seen important shifts in the public’s image of Microsoft. To be sure, Gates’s company has attracted envy, resentment and even hatred from the outset, but ridicule of Microsoft became a mainstream phenomenon during the 2000s thanks to products that became punch lines rather than hits: operating system Vista, media player Zune and smartphone Kin. Microsoft fans may find some solace in the fact that the company contributed to one of the decade’s cultural touchstones, Apple’s popular “I’m a Mac/I’m a PC” ad campaign (which chaffed Microsoft without even naming it — another sign of the company’s continued prominence, at least). But the jeers of the generation that came of age this century are unlikely to draw laughter in Redmond. (Sample joke among today’s teenage geeks: “The day that Microsoft starts making things that don’t suck will be the day it starts making vacuum cleaners.”)

Analysts aren’t laughing, either. For Wall Street researchers, Microsoft has become something of a shaggy-dog story: long, complex and full of woolly detail, with — worst of all — a letdown at the end. “We spend more time on Microsoft than on any other company [in our universe],” says Citi’s Pritchard. “It’s bigger, more complicated, in more markets than the rest.” For example, Microsoft breaks out its financial results for its five business divisions (down from seven, after a 2008 reorganization), each of which “is like a company in itself,” notes Sarah Friar, who took over Sherlund’s Microsoft coverage at Goldman in 2007. “You have to delve into a lot of minutiae to be able to tell a client something worthwhile about Microsoft,” Friar sighs. “There are maybe 20 percent of my [portfolio manager] clients who want that kind of minutiae — and 80 percent who just don’t care.”

Another challenge for analysts stems from all the bumping around that goes on in the tech sector. Wall Street usually groups Microsoft with enterprise software companies like Oracle Corp. and SAP that compete with it for corporate clients; also included in the typical software analyst’s universe are companies that have succeeded by carving out niches in the desktop market, such as Intuit, the maker of QuickBooks, and Symantec Corp., which provides security and storage management solutions.

But the competition that’s weighed heaviest on Microsoft’s stock this decade hasn’t come from this universe. Instead, Microsoft’s analysts have been obliged to assess the latest smartphones and tablets from Research in Motion and Apple, hardware vendors that are outside their regular purview. Likewise, most sell-side firms assign two other perceived threats, salesforce.com and Google, to an Internet analyst, who’s typically not the same person who leads Microsoft coverage. (Citi’s separate software industry and Internet research teams recently joined forces for a “deep dive” study of the Microsoft-Yahoo! partnership.) When it comes to covering Microsoft, says Katherine Egbert, a software industry analyst at Jefferies & Co., “there are just unlimited things to know.”

A GENERATION BEFORE APPLE’S iPhone App Store opened many eyes to the benefits of a software-centric ecosystem, Microsoft pioneered the concept with its migration from the DOS operating system to Windows. Though not the first operating system with a graphical interface, Windows became the easiest and cheapest way for most PC users to discover this user-friendly technology in the 1990s, thanks to Microsoft’s prodding the industry on all fronts. Some of its efforts to tip the market in Windows’ favor were criticized, leading to a series of high-profile antitrust actions, but others were welcomed. For example, the company made sure that developers had the support and tools they needed, such as Visual Basic (a coding kit that debuted in 1991).

The benefits that Microsoft reaped from leading this migration quickly became obvious. In 1991 then–Sanford C. Bernstein & Co. analyst Mike Kwatinetz coined the term “Wintel” for the emerging PC standard that combined Windows with Intel Corp.’s microprocessor hardware. “I named it that because IBM had lost control,” recalls the former II-ranked software analyst, who currently works in venture capital. Microsoft’s mastery over Windows enabled its applications programs, led by the spreadsheet Excel and word processor Word, to vault past competitors and dominate their markets. At the same time, with Windows NT (launched in 1993), Microsoft began to add networking capabilities comparable to those offered by Novell’s NetWare; Novell’s domination of the PC networking market, in turn, vanished.

Wall Street took notice. Kwatinetz says Microsoft was his top stock pick for his entire nine-plus years on the Street, from 1991 to 2000. Early in 1993, Microsoft’s market capitalization overtook IBM’s. Over the course of the decade, Mister Softee showered investors with gains averaging nearly 60 percent a year, or a cumulative return exceeding 9,300 percent.

By the end of the 1990s, nine out of every ten PCs were sold with Windows. Hundreds of millions of users, and nearly every IT supplier of any kind, whether in hardware or software, from coders to chip makers, were building their efforts around it. In addition, while Microsoft’s applications programs ruled users’ desktops, the company was using its Windows NT beachhead to expand into corporate data centers, first with products like BackOffice Server and Exchange and later with server systems marketed under the Windows brand. Meanwhile, with Visual Basic and its 1997 successor, Visual Studio, Microsoft remained the dominant supplier of tools required by Windows coders, both those working within the company itself and those operating independently, whose efforts completed the virtuous circle.

Such is the ecosystem that Microsoft has been defending over the past ten years. So where’s the shagginess in all this? The answer: There isn’t any. During the 2000s the three business units through which Microsoft manages the Windows ecosystem accounted for about 84 percent of the company’s revenue, which totaled $439 billion, and all of its profits, a cool $155 billion. Microsoft’s Windows-related businesses account for less of the company’s total revenue today than they did at the beginning of the decade, but this shift has been slight, dropping from an average of 85 percent over the first half of the decade to about 83 percent in the second half.

The trouble is, too many of today’s investors see potential weakness instead of strength in this carefully tended, walled-in garden. The longer Microsoft stretches out Windows’ annuitylike income stream, the more investors seem to view it as a vulnerability. In their simplified view, anything that threatens the primacy of the Windows PC becomes nothing less than an existential threat to Microsoft.

Take the iPad, the tablet computer that has become a popular hit for Apple this year. In the same way that smartphones like RIM’s BlackBerry and Apple’s iPhone demonstrated that users don’t need a PC to keep up with e-mail — in particular, corporate e-mail managed by Microsoft’s widely used Exchange system — the iPad points to a future in which ever more tasks that today require a Windows PC will be handled without one. Thus investors seem to have concluded that tablets can mean only one thing for Microsoft: “The iPad comes out in April, and by summer people are predicting the death of Microsoft,” observes Egbert.

Such thinking is not new, of course. Microsoft famously faced its first existential challenge even as it was leading the migration to Windows during the 1990s, with the rise of the Internet, marked in particular by the web browser pioneered by Netscape Communications. In 1996, a year after Netscape’s wildly successful IPO, venture capitalist Roger McNamee gave a talk to an industry panel titled “Why Intel and Microsoft Don’t Matter Anymore.” By then, Gates had fully grasped the threat and directed his people to redesign Microsoft’s entire product line with web connectivity (“Net awareness”) in mind. Microsoft started by offering Internet Explorer as a free add-on to purchasers of Windows 95, and the so-called browser wars began. Forced to give its browser away for free too, Netscape eventually fell behind both financially and technologically. By mid-2000, IE’s share surpassed 80 percent.

Microsoft called its strategy for ensuring Windows’ relevance to the Internet “embrace and extend.” By offering IE as a free add-on to Windows, the company sought to make Internet browsing part of Windows’ standard feature set. Microsoft’s success in vanquishing Netscape led some wags to add a third “e” to this Internet strategy — “and extinguish.” It also gave impetus to what would become the second existential challenge Microsoft would face during this period: the series of antitrust actions filed against the company in the U.S. and Europe. The U.S. Department of Justice and 20 U.S. states sued the company for antitrust violations in 1998 and eventually produced a court order that would have split it in two. (That decision was reversed on appeal in 2001.) In the final settlement, accepted in 2002, Microsoft agreed to unbundle IE in future Windows licensing deals. Provided that Microsoft remains in compliance with these and other terms of the settlement (which by all accounts it has), judicial oversight of the company in the U.S. is set to expire in May 2011.

Financially, the impact of Microsoft’s long-running antitrust saga has been immaterial. The stock dipped in response to some of the headline-grabbing charges, but never for long. But with the benefit of hindsight, many observers attribute the company’s recent sluggishness to its antitrust headaches. Company insiders refer to the first half of the past decade as the “dark ages of Microsoft,” reports IR director Koefoed, who himself joined in 2004 from Pricewaterhouse

Coopers Consulting, where he specialized in high-tech strategic planning. When Jefferies analyst Egbert added Microsoft to her coverage universe in 2006, she found a company besieged. “When you have 90 percent of the world’s governments on your back,” she observes, “it’s very hard to innovate.”

Egbert credits Microsoft’s stellar past to its success as a “fast follower” rather than as an innovator per se. “Microsoft’s best growth came as they adopted technologies, mostly invented by others, to the mass market,” she wrote in a July note to clients following the company’s fiscal year 2010 earnings release. “They are in the early innings of mass adaptation of products developed by others — this time for tablet PCs, a mobile phone OS, cloud computing and online search.” Egbert’s advice to frustrated investors: “Stop expecting from Microsoft innovation à la Apple and start expecting low-cost mass market adaptations of popular technologies, à la China.”

Even analysts who agree that adaptation, rather than innovation, is Microsoft’s core competency worry that the company has yet to demonstrate that it has emerged from its postantitrust stupor, let alone that it has recovered its 1990s mojo. “It feels like they’re being hit by these waves and letting them wash over themselves before they react,” says Citi’s Pritchard. “They want to do it right, and so they end up with a long-term plan. But it takes longer than anyone expects, and many investors just don’t want to be along for the ride.”

For Microsoft investors, this year’s chief anxiety producer has been the popularity of tablet computers like Apple’s iPad. A July report produced by Goldman Sachs’ IT research team named Microsoft the primary loser in this nascent trend, asserting that a significant part of the stock’s underperformance this year “has been due to the risk from iPad traction and lack of a satisfactory offering for this emerging and popular form factor.” Goldman’s report predicted that Windows will power just 13 percent of tablets sold next year and that in the long run the tablet category “represents a threat to Microsoft’s dominance of the PC world as users choose non-Windows tablets as an incremental device, instead of a Windows-enabled notebook or netbook.”

But other analysts, though concerned by Microsoft’s late arrival to the tablet party, see the situation less grimly. For one thing, the growth prospects for the PC ecosystem are enhanced by the continuing decline of hardware prices; as desktop PCs approach $500 or less, they’ve become affordable to the burgeoning middle classes of Brazil, China and India. For another, Microsoft has managed to embrace new form factors, like netbooks, despite being absent at their creation. The first wave of netbooks was powered by the Linux operating system, but the devices were returned in droves after users found them incapable of running Office applications like Excel. Today more than 80 percent of netbooks sold run a specially designed version of Windows.

Besides, says Jefferies’s Egbert, “Microsoft knows how to compete against Apple.” With tablets, many analysts see the two longtime rivals following the same playbooks they used in the 1980s, when Apple attracted the premium-paying customer with advanced technology and Microsoft tagged along later but won the masses. At Microsoft’s annual meeting for financial analysts this summer, Ballmer declined to say what he expected Windows tablets to look like or when they would appear on the market. But he seemed certain that price would be a key differentiator of Windows-powered tablets. “As I think everybody knows, you can buy two netbook PCs for the price of one iPad,” he said.

INVESTORS PERCEIVE ANOTHER ILL wind for the Windows ecosystem in the trend that lately goes by the name of — appropriately enough — cloud computing. In this scheme, instead of using software that’s been paid for up front and installed in a corporate data center or office PC, customers fetch the programs and data they need from an outsider’s “cloud” — that is, from software hosted on a vendor’s remote facilities and accessed via a network (typically, but not always, the Internet). Web-based e-mail is a simple example. All that’s needed to access a Microsoft Hotmail or a Google Gmail account, for example, is an Internet connection and a web browser — which could be running on a Windows PC, a smartphone or a tablet. Companies like salesforce.com and Google offer more-sophisticated cloud-based apps, ranging from spreadsheets to sales management systems, and argue that for customers the cost savings over traditional IT solutions are compelling.

After a couple of years of indecisiveness, Microsoft last year released a cloud framework of its own called Windows Azure. “The cloud is the future of IT,” chief financial officer Peter Klein stated unequivocally in his address at the company’s annual analysts’ meeting on July 29, 2010. He added that Microsoft believes this shift would increase its revenue and profits, not shrink them as some observers fear, for three reasons. First, via the cloud, Microsoft will be able to offer more — and more expensive — products to customers who lack the resources or expertise to run them on their own premises. Second, it will be harder for customers to pirate software that runs on Microsoft’s facilities rather than the customers’ own. That’s not insignificant for a company that estimates that one of every two copies of Office currently in use, and one of every four copies of Windows, is unlicensed. Last, Microsoft believes that by controlling the hardware as well as the software that customers use, its products will simply run better than they do today. “And in the long run,” Klein told his audience, “customer satisfaction is probably the single biggest leading indicator of our financial performance, obviously.”

For investors, the only trouble with Microsoft’s migration to the cloud is that it’s likely to be gradual. The resulting revenue boost is unlikely to move the needle of total revenue, or the stock price, several analysts say. “They’ve laid a really good groundwork,” says Jefferies’s Egbert. Unfortunately, she adds, “they get zero credit [for this] in the stock.” By comparison, Wall Street has no trouble giving credit to salesforce.com. One of the few pure plays in cloud computing, the company’s shares are up more than 700 percent since its 2004 IPO, including a 300 percent rise in the past 18 months alone.

Wall Street has acknowledged Microsoft’s efforts in phones and search; unfortunately, it hasn’t been the kind of recognition that management in Redmond is seeking. Analysts say spending in both areas amounts to a drag on the stock. Without apologizing for any of the spending, Ballmer has publicly acknowledged that Microsoft isn’t where he’d like it to be in either area. Yet Microsoft’s problems are not merely a matter of its own performance. To the contrary, an even bigger problem for the company is what its competitors have done in its absence.

None of Microsoft’s competitors is more formidable than Google. Among its resources: total domination of a rarefied but fast-growing, highly profitable and global business; hundreds of millions of active, even passionate, users; thousands of the world’s smartest engineers; and billions in cash. Plus, Google has a visionary management willing to pour current profits into money-losing projects aimed at exploiting long-term technology trends. Sound familiar?

When it comes to phones, the resemblances between Google and Microsoft are even more apparent. Stealing a page from Microsoft’s 1990s playbook, Google is leading the most important trend under way today in the technology sector: the mass migration from basic, keypad-centric cell phones to Internet-savvy smartphones with graphical, touch-sensitive screens. By distributing its Android operating system to developers, telecommunications carriers and handset makers — in most cases for free — Google is positioning itself at the center of an emerging ecosystem that may eventually rival Microsoft’s in importance. Unit sales of Android-powered handsets (there are at least 50 models) this spring collectively caught and now surpass those of the early touch-screen market leader, Apple’s iPhone.

It’s no wonder that Microsoft’s current smartphone ambitions are met with skepticism. After halting development of its non-touch-capable phone operating system in 2006, Microsoft has been focusing on its next-generation phone OS, Windows Phone 7, which is expected to show up on handsets this holiday season. A developer’s package was distributed last summer, and in July the company announced that it intended to give a Windows Phone 7 handset to all 89,000 of its employees as soon as the first models become available, in an effort to spur app development for the new platform.

“It’s really hard to figure out exactly how the company achieves their goals in the smartphone area,” Citi’s Pritchard said during an appearance on CNBC in late July.

The view from inside the Windows ecosystem is less skeptical but still cautious. “Microsoft totally dropped the ball [when it discontinued development of its previous phone operating system],” says one longtime Windows loyalist, Michigan-based small-business systems specialist Amy Babinchak. Recently recognized as a Microsoft “partner of the year” at the company’s annual gathering for independent resellers and consultants, Babinchak says she has outfitted her own firm with iPhones and recommends them to clients. Still, she expects it won’t be long before she’ll also be plugging Windows 7 phones: “When Microsoft sets their sights on something, they have yet to fail.”

Microsoft’s hope is that it’s still early days for smartphones — and indeed, the enterprise-computing garden hasn’t been ripped up utterly yet, either by iPhones or Android devices. According to New York–based independent developer Jonathan Westfall (another ecosystem member “recognized” by Microsoft), Microsoft’s forthcoming phone operating system will support unique integration capabilities with its enterprise server systems, making possible handsets that “play better” with Exchange and SharePoint, for example, than ones based on Android. “Microsoft has the potential to be the best at Exchange integration,” Westfall says.

No one in the industry is counting Microsoft out just yet. But investors are close to doing so. In its July earnings call, management stressed that all five of its business divisions had delivered double-digit top-line growth. Sales for the Windows unit grew 24 percent year-on-year, twice the division’s average for the decade; for the fourth quarter, year-on-year growth shot up 44 percent. Although that bounce follows a recession, the company cited independent research showing that in laptops, the fastest-growing category in the U.S. PC market, Windows’ market dominance had recently risen. All told, Microsoft had sold 175 million licenses of Windows 7, CFO Klein told listeners on the earnings call, making it the fastest-selling operating system by any company, ever.

The market, however, was unimpressed. In after-hours trading following the call, Microsoft’s stock fell 12 cents. “I don’t have a good reason for the stock not to be up,” Goldman’s Friar told the Seattle Times.

Clearly, investors and management value Microsoft’s assets differently these days. In Redmond some refer glumly to a “conglomerate tax” slapped on Microsoft by the market. “I don’t think people understand the breadth of the company,” observes IR director Koefoed, adding that “it’s particularly interesting how much we leverage our assets across our properties.” Unlike a cloud-computing specialist such as salesforce.com, Microsoft can spread the costs of the huge server farms required for its cloud-computing buildout across other businesses, such as search and Xbox Live. Koefoed says the company’s Office unit is busy working on porting Office apps to the forthcoming Windows 7 phone platform. “The combination of all those things is really unique,” he says. “That’s why we feel so [convinced] that bigness is an asset.”

Many analysts think the way for Microsoft to rouse investors is by first exciting its customers. The trouble is, the days when people lined up at midnight to purchase an operating system are long past. Outside its own ecosystem, Microsoft and its engineers have never received the credit they deserve for getting Windows to embrace the innovations of others — which sounds a lot easier than it really is. Though the latest Xbox should dissuade anyone who thinks bigness has smothered Microsoft’s ability to innovate, the company’s living room business isn’t large enough to change its numbers for investors. “They’re no longer perceived as a growth company,” says Egbert, who figures Microsoft has about a 12- to-18-month window to become relevant again.

Or else — what? Prospects for deal making on the order of the Yahoo! bid have since dimmed, analysts say. Some saw a chance for Ballmer to buy his way into the smartphone race when Palm, whose latest phone operating system was designed from the ground up for touch, announced it was putting itself up for sale last spring. (Hewlett-Packard Co. purchased the beleaguered handset maker in April for about $1.2 billion.) But Microsoft’s dark reputation in Silicon Valley serves to dampen enthusiasm for such deals, and value-oriented investors would rather see Microsoft spend its cash — $37 billion at last count — on boosting its dividend or buying back stock. An indication of just how important such financial engineering is to investors came when shares of Mister Softee jumped 5 percent on heavy volume one afternoon last month (their largest gain this year) after a wire service reported that the company would finance its dividend and buyback program with new debt. But the shares gave back much of that gain a week later after Microsoft announced that it was increasing its dividend by 23 percent (investors evidently were hoping for more).

One solution that has been bandied about since Bill Gates’s reign as CEO is the U.S. Justice Department’s proposal to break Microsoft into multiple companies. Supporters of the breakup remedy, ranging from Apple CEO Steve Jobs (who voiced his support for such a step as early as 1994) to Forbes blogger Victoria Barret (in a post this summer), would probably agree that a voluntary vivisection under Ballmer is unlikely. But one can’t help observing how many of Microsoft’s problems such a move might solve. Consider if Ballmer were to divide his domain into three separate companies: one focused on platforms (Windows, including Azure and an operating system for mobile devices, servers and Xbox); one on applications (Office, phone- and Azure-based apps, games and developer tools); and one on the web (Bing and MSN). The first two combine enough profitable business lines to stand on their own, and they’d be motivated as never before to open the Windows ecosystem to competitors’ innovations. As for the third, Ballmer could make it viable by first buying Yahoo! — these days the company could probably be had for half the $44 billion he offered in 2008 — and then merging it with this unit. Yahoo! would get the part of Microsoft it needs (search technology), without the part it seems to fear and loathe (Ballmer himself). Ballmer, and the new platforms and apps units, would get what they really need: a company with the resources to provide genuine competition to Google. (In the bargain, Yahoo! would get a purpose — something most analysts think it needs.)

Granted, there’s no real precedent in the tech industry for such a move. Unlike IBM’s spin-offs of its PC and printer lines, the aim would not be to rid Microsoft of businesses no longer valued by senior management. A more apt precedent might be Standard Oil Co., which created more wealth for John D. Rockefeller and his fellow shareholders in pieces than it ever did as a single, monopolistic entity. Similarly, the goal of breaking up Microsoft would be to show the world what it’s really made of — to expose the assets that Ballmer and company (but not enough others) see, for the benefit of Microsoft’s employees, customers, competitors and investors. The engineering and management talent trapped within Ballmer’s behemoth would be unlocked; the competitive landscape of technology would be transformed from one in which Microsoft’s sluggishness slows the pace of innovation within its own vast ecosystem to one in which smaller, hungrier companies, including the Microsoft spin-offs, have a chance to compete in other ecosystems, not just Windows, and be rewarded for their success in doing so.

By embracing competition in this way, Microsoft might even rid itself of its Evil Empire designation once and for all.

The platforms company would put its phone and tablet project in high gear or suffer the wrath of shareholders. The apps company might build products that people want to use instead of ones they have to build because everyone else does. Unleashed, one of the new mini–Mister Softees might even endear itself to Wall Street. Sure, the breakup would be a little messy (imagine trying to figure out how to allocate Microsoft’s sales and marketing force of 25,000-plus, more than the total employee ranks of Google). But nothing like — well, nothing anyone could call shaggy, exactly.

In fact, plotting the restructuring of Microsoft has long been a popular parlor game on Wall Street. Newly profitable Xbox, seen as an outlier for its hardware expertise and focus on the consumer, has been drawing the most attention from investors this summer, with speculation ranging from a spin-out to perhaps a tracking stock, analysts say. And high-profile jobs landed by Microsoft senior executives — including ex-CFO Chris Liddell, who became General Motors Co.’s CFO early this year, and ex–business division head Stephen Elop, who took over as Nokia Corp.’s CEO last month — serve to remind investors of the deep bench at the ready in Redmond. But the latest speculation persists not because analysts and investors believe any such plan is in the cards — to the contrary, most believe it’s a nonstarter — but rather because assessing the behemoth’s breakup value provides a quantifiable way of determining just how underappreciated the stock has become.

For its part, management in Redmond has consistently refuted the logic behind any breakup speculation by arguing that the company’s assets are complementary and worth more intact than in pieces. Which means that analysts are likely to have a shaggy-dog story in Microsoft for some time to come. The bullish case for the next couple of years has the company’s revenue growing about 6 to 9 percent annually. For a mega-large-cap stock like Microsoft, that kind of growth is nothing to scoff at — though it doesn’t mean investors won’t. The bearish case, of course, leaves Mister Softee looking like a plain old dog.