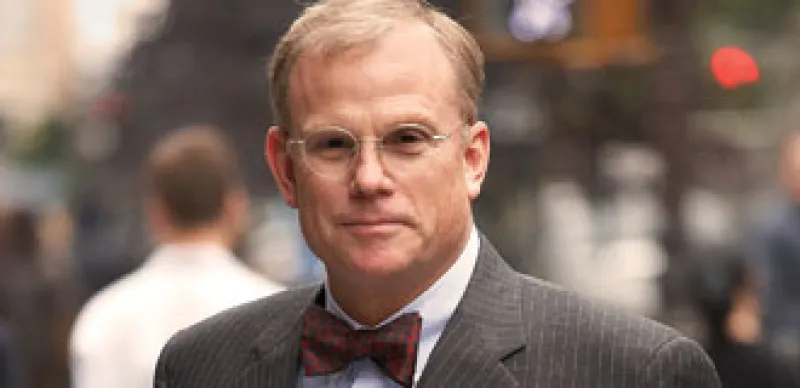

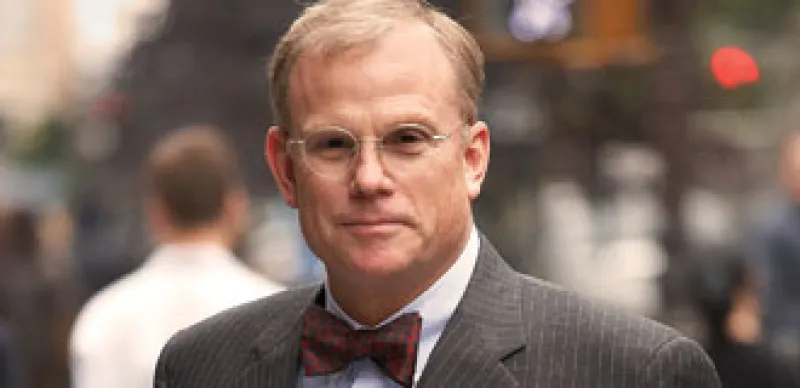

Ash Williams Works to Restore Broken Trust At Florida SBA

Ash Williams left a New York hedge fund to return to the Florida State Board of Administration and set things right.

Frances Denmark

October 11, 2009