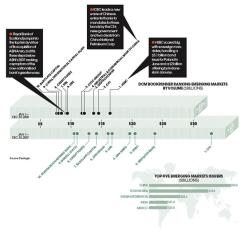

The credit crisis has depressed bond issuance in many sectors of developed markets, but emerging markets have been a source of relative strength. Issuance by emerging-markets entities was off just 1.4 percent in 2008, to $400.9 billion. Much of the growth was driven by Chinese borrowers: Their offerings more than doubled, to $93.4 billion from $44 billion a year earlier. This prominence enabled three Chinese banks — Industrial and Commercial Bank of China, CITIC Group and China International Capital Corp. — to break into the ranks of the top ten underwriters globally for emerging-markets debt, a potential sign of things to come. The U.K.’s HSBC Holdings jumped to first place from third a year earlier, acting as bookrunner on 210 deals worth $16.7 billion. Citigroup slipped one notch, to second. Notably absent is JPMorgan Chase, which dropped out of the top ten after having ranked sixth in 2007.