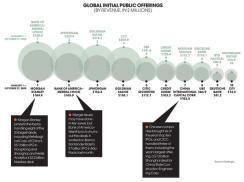

Just when bankers were getting ready to give up, the rally in global equity markets has sparked a recovery in the IPO business. Banks pulled in $2 billion in IPO fees from January to late October, down 16.8 percent from the same period a year ago but a much better result than most would have predicted at this point last year, when capital markets were effectively frozen.

Not surprisingly, China is a big reason for the revival of public offerings. Eight of this year’s 20 largest IPOs were in China, a fact that helps two of the country’s big firms, Citic Securities and China International Capital Corp., break into the league table. Although New York has lost a big chunk of IPO market share — U.S. companies accounted for only four of the top 20 deals — American investment banks with their global franchises stay at the top of the table, led by a resurgent Morgan Stanley.