Hedge funds, under pressure to cut fees and improve performance, may want to eschew slick new developments in Manhattan or those trendier neighborhoods whose commercial rents are being driven up sharply by tech companies if they want to find real estate bargains.

That’s because commercial rents at premier midtown Manhattan buildings — where many hedge fund firms are based — have increased at half the pace of trendier neighborhoods like Flatiron and Chelsea over the past nine years, according to the most recent statistics compiled by real estate firm Jones Lang LaSalle on neighborhoods popular with hedge funds.

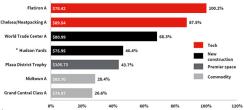

Cynthia Wasserberger, author of the Hedge Fund Activity Report and an executive managing director at JLL who specializes in providing real estate services to hedge funds and investment management firms, says rents at midtown Manhattan Class A buildings — which are ranked slightly below trophy buildings such as 9 West 57th Street — only rose 28.4 percent between 2009 and 2017.

That compares with rent increases of 100 percent over the same time period for the Flatiron district. She explains that what she describes as midtown “commodity buildings” are now competing with new construction like the Hudson Yards development on the west side of Manhattan, as well as with trendy neighborhoods like Flatiron and Chelsea. According to the Jones Lang LaSalle report, asking rents in the Flatiron neighborhood have reached about $78 per square foot on average.

Submarket DriversCurrent average asking rent per sq. ft. and % increase in asking rent gains since 2009

the average asking rent increases to $95 per sq. ft. Source: Jones Lang LaSalle IP, Inc.

Commercial rent for Class A buildings in the Chelsea/Meatpacking district neighborhoods has risen approximately 87.5 percent since 2009, the year the U.S. stock market hit bottom after the financial crisis. Chelsea runs between 14th Street and 30th Street from Fifth Avenue on the east to the Hudson River on the west.

The Meatpacking district covers the area between West 14th Street, south to Horatio Street, and from the Hudson River to Hudson Street. Although the increase in rent isn’t as dramatic as that in the Flatiron, rents in Chelsea and the Meatpacking neighborhoods have become among the most expensive in New York. Rents have reached almost $90 per square foot.

Wasserberger explains that the increasing rents in Flatiron, Chelsea and the Meatpacking district have been fueled by growth in New York’s technology sector. Tech firms have been clustering around older loft-like buildings between 14th Street and 23rd Street and west of Fifth Avenue. Some hedge funds have had to compete with Silicon Valley-backed tech firms looking for attractive and hip space close to restaurants and bars in New York, she adds.

Other real estate executives say midtown Manhattan buildings are looking dated compared with Hudson Yards and new construction downtown. In Class A buildings in the World Trade Center area, rents are now almost $81 per square foot, according to JLL. The newly constructed 3 World Trade Center has 1.7 million square feet available, about half of the commercial office space in the neighborhood.

Trophy buildings in midtown are still the most expensive space, with rents reaching an average of $105.73. But the percentage rise over the period covered in the report was less than half of what it was in the Flatiron district, at 43.7 percent. Class A buildings near Grand Central rose the least, at 26.6 percent.

Recent hedge fund real estate deals, according to JLL, include a lease renewal by Marathon Asset Management for 21,598 square feet at One Bryant Park; activist Soroban Capital Partners signing a new lease for 22,500 feet at 55 West 46th Street; and Pretium Partners renting 17,320 square feet at 810 Seventh Avenue, also a new lease.