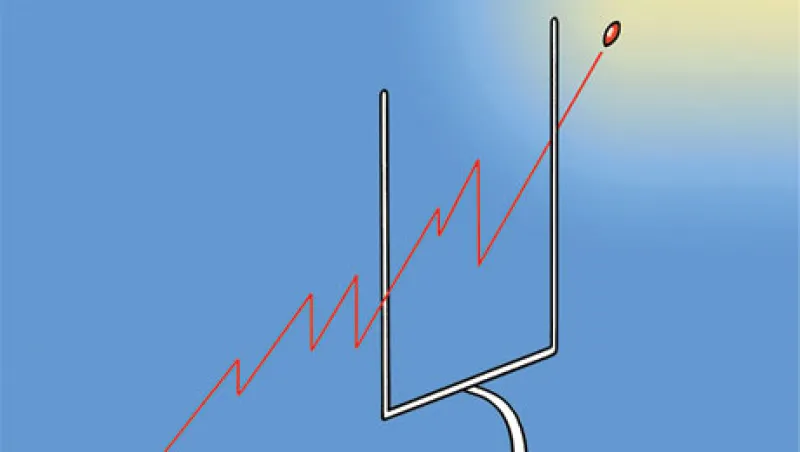

The increased legitimization of sports gambling in the U.S. raises an interesting question: How similar is betting on sports to investing and trading in financial markets?

Many market analysts see strong commonalities. “They are more similar than dissimilar,” says David Rothschild, an economist at Microsoft Research who does extensive work on markets.

Parallels are particularly strong between sports gambling, day trading of stocks, and investing in commodities, as all three areas involve short-term bets, analysts say. In sports gambling, a bet is often placed on a single event. Day trading has a short time horizon by definition. And commodities are often bought with a short-term strategy in mind because prices tend to fluctuate rather than rise over time as historically seen in the stock market.

There are other similarities. Just as commodities and stocks held for less than a day don’t provide income, neither does a sports bet. Plus there’s a cultural connection: Day traders and sports bettors are largely younger males and risk-takers who are mathematically inclined, according to John Rekenthaler, vice president of research at Morningstar.

“Fifteen years ago guys at home were doing stock day trading,” he says. “Now it’s sports gambling. You don’t see TV ads for day trading anymore, but you do for sports fantasy leagues. It’s the new day trading.”

Another common feature is that sports gamblers and investors try to anticipate what others think will happen, whether it be the outcome of a game or how shares and commodities will perform, says Rekenthaler. What others think in financial markets determines the price of a commodity or stock. And in the sports gambling world, what others think sets the odds or point spread of a bet.

Like financial markets, sports betting is extremely efficient due to all the statistical analysis used to create odds and point spreads. Advances in big data have made it much more difficult for investors to beat indexes and for casual sports gamblers to make a profit, says Martin Fridson, chief investment officer at money management firm Lehmann Livian Fridson Advisors.

In the daily sports fantasy leagues now proliferating, amateurs have virtually no chance of winning money, Fridson says, adding that the story is the same in day trading of stocks. “People are doing it full-time with sophisticated quantitative tools, and those pros are gaining virtually all the profits,” he says.

Of course, in both financial markets and sports gambling, analysis often goes beyond pure numbers. “There are psychological factors,” says Rekenthaler. They might include the psyche of a sports team or investors’ hankering for a specific industry in the stock market.

“There is an opportunity for a lot of human judgment” in both spheres, he says. “The thinking is, ‘I can take in this information in a way that others can’t.’”

One crucial difference between sports gambling and trading or investing in financial markets is that more information is available in the sports market, according to Microsoft’s Rothschild. While publicly available sports statistics are “very deep,” he says, in financial markets “there is more hidden, idiosyncratic information” that investors have to gather.

Sports betting generally carries higher fees than trading in financial markets, mainly because much of it remains illegal in the U.S. Still, there is the potential for lower sports betting fees, as evidenced by the fact that sports bettors on the website Betfair pay much less in fees than they would to their bookie or to the house in Las Vegas, according to Rothschild. He says that if there were a free market for sports gambling, fees would shrink rapidly.

“The government has determined financial markets are productive and sports gambling isn’t, so it has created costs,” says Rothschild. “But there’s nothing that says it has to be that way.”

Long-term markets could develop for sports, he adds. An exchange already has been created to allow investors to participate in athletes’ earnings streams. And if teams were publicly traded, people could make long-term investments in them. While rules against cheating are much stronger in financial markets because of the vigilance of the Securities and Exchange Commission, the Commodity Futures Trading Commission, and various attorneys general, more protections may be placed in the sports gambling market as it matures, according to analysts.

“The difference is all about how markets are structured,” says Rothschild. “It’s a story more about regulation than a difference of assets and how the market functions.”