"When we try to guess where the euro zone’s politicians are heading, we have lots of information, and the trick is to figure out which parts are real and which are deliberate disinformation," one London-based macro trader explained to me. "When we try to guess what the Chinese are up to, we have much less information, and sometimes it feels like it’s all disinformation."

The Communist Party’s 18th Party Congress, which ended this week in Beijing after picking the country’s new leaders and replacing most members of the Politburo Standing Committee, the party’s ruling body, provided plenty of fresh information but left many market participants struggling to make sense of it all. "When the entire leadership of the world’s second-largest economy changes, surely financial markets have to react," the trader mused. "The question is, react to what?"

How will Beijing’s leadership transition move markets, and what do we watch for clues?

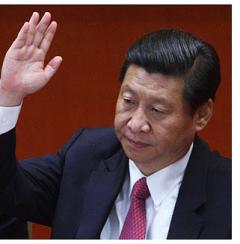

Xi Jinping and Li Keqiang came out on top, as expected, and there were few surprises about the other five members appointed to the Politburo Standing Committee, the party’s ruling body. But the politicking and jockeying for position isn’t over yet. "Now that the top seven are in place, we are going to see ripple effects and reshuffling down the line of all their competing and overlapping patron-client networks," one Beijing-based former diplomat e-mailed me.

The date of the party conference had been pushed back, not so much because of the scandal surrounding Politburo candidate Bo Xilai, whose wife murdered the hapless British citizen Neil Heywood, but rather because of deep disagreement over who would sit around the top table. In Beijing, even more than in Washington, personnel is policy.

Every major policy in China is up for review by Xi, Li and their new team. The Standing Committee meets weekly and makes all the important decisions — political, economic, military, social and cultural.

The transfer of power is staggered. The Politburo this week endorsed Xi as the new secretary of the party. The National People’s Congress is due to confirm him as president, replacing Hu Jintao, when it meets in March, as well as approving Li as replacement to Wen Jiabao as premier. Even when they are formally in office, it will take time for them to consolidate power, considering all the party elders looking over their shoulders (neither Hu nor his predecessor, Jiang Zemin, are going to disappear).

But Xi and Li can begin to affect economic policy fairly quickly if they so choose. There are three key policy areas to watch: trade policy with Japan, which is bound up with a maritime border dispute; exchange-rate management, which will be felt in global financial markets; and macroeconomic rebalancing, which could alter how China interacts with global supply and demand.

Welcome to the open-source intelligence world. During the Cold War, Kremlinology was the rage as analysts tried to discern clues to Soviet decision making. Now we puzzle about Zhongnanhai, the leadership compound of the Chinese Communist Party leaders. What are the observables in a one-party state that is still obsessively secretive, particularly about power transitions?

The most important thing to watch is the people: who gets appointed to the Politburo Standing Committee, the Politburo at large and the handful of other appointments that emerge during or soon after the congress. Cheng Li, a senior fellow at the Brookings Institution, keeps tabs on all the new leaders, including their educations, careers and patron-client relationships. "These so-called fifth generation candidates have more diverse political backgrounds, academic credentials, leadership experience and basic worldviews," he says. "For example, most of them got their academic degrees in economics, politics or the law, in sharp contract to both the third and fourth generation leaders who were predominantly technocratic, engineer-turned-political leaders."

The second observable is the formal communications at the Party Congress, particularly the Work Report that Hu presented at the opening of the conclave. The 64-page document was chock-full of self-congratulation for the party’s achievements, a mind-numbing amount of data, a sometimes frank assessment of shortcomings, challenges and future aspirations, and some veiled signals about political intentions.

"The political report is not a speech by the general secretary reciting his personal views on the issues it addresses," says Alice Miller, a China scholar at Stanford University’s Hoover Institution. "It is a synthetic document that reflects the consensus of the broader party leadership." So the rhetoric may be leaden, but it is authoritative as a lens into the views of China’s collective leadership.

The third observable is the swirling commentary and rumor-mongering by the media, party notables and tens of thousands of Chinese citizens on sites like the Sina Weibo and Tencent Weibo microblogs. The Chinese government has been blocking all Google services since the start of the congress, but the wires and cellphones inside China have been humming.

"Reform" was a major theme of the event, with that word dominating state media coverage in the weeks leading up to the congress. Reforms include reining in the privileges of state-owned enterprises, easing restrictions on rural migration to cities and dealing with widespread official corruption — all of which made it into Hu’s keynote speech. He hit the bribery point early on: "The phenomenon of passiveness and corruption has occurred easily and repeatedly in certain realms. The situation for anticorruption struggles is still grave."

Political reform as we know it in the West, however, is not likely. Stability and one-party rule remain top priorities as some senior officials fear that open debate could split the party. Yet the transition could produce a move toward some inner-party debate.

In one important decision, the total number of Standing Committee seats was cut from nine to seven, neatly eliminating the seat of the top public security overseer, Zhou Yongkang, who stepped down. According to Brookings’s Li, "The elimination of this slot sends a signal that a political reform agenda is in the making."

Others view the removal of Zhou as a blocking move rather than a reform. "I call this the Beria effect," e-mailed the former diplomat, referring to Lavrenti Beria, who led the Stalinist purges as head of the Soviet Union’s secret police. "Xi and the new generation of leaders are worried about the risk of a ‘soft coup’ by an ambitious contender like Bo Xilai in cahoots with Zhou and the security services."

Lest anyone mistake what he meant by reform, Hu threw cold water on political reform from the very beginning of his speech. As Hong Kong University’s Qian Gang observed, "Mr. Hu’s speech hit on almost every antichange phrase used by Chinese Communist leaders." He referred to "perfecting the socialist deliberative democratic system" — quite a set of qualifiers to "democratic" — and restricted intraparty democratic discussion to "perfecting the party’s grassroots democratic system."

There are deep cleavages within the party. The final Politburo appointments fall across these cleavages and the multiple patron-client networks within the party. The biggest cleavage is between the princelings, children of so-called revolutionary notables, and the tuanpai, whose roots are in the Communist Party Youth League. Xi is from the former group, Li from the latter. Jiang Zemin is the center of the princeling faction, which represents the interests of the wealthier coastal provinces and is (relatively) more market- and export-oriented. In contrast, Hu is the center of the tuanpai faction, which represents the interests of the poorer inland provinces and is (relatively) more command-oriented and interventionist — not exactly New Left. There are other interest groups within the party as well, some rooted in wealthy cities or provinces like Shanghai, others from industrial sectors such as petroleum or steel. And of course the military and internal security forces have their own power bases. The mosaic of factions and patron-client networks is extraordinarily complex and extends from Beijing down to every township and city in the country.

It is important to recognize how deep the patronage system goes in China. It’s not simply the top seven slots that were at stake this week. Each party member beneath the top tier has spent his or her lifetime allying with certain party officials. Depending on whether or not their patron gets promoted this decade, they can advance or be sidelined. Chinese business executives in the public and private sectors watched the outcome like hawks; their jobs, incomes and maybe even their personal freedom depended on how well or poorly their own patron-client network fares at the congress.

Just like these anxious observers, we can get a sense of how policies may change by examining the appointments, formal communications and informal commentary.

China-Japan Relations

One issue that has already had a major economic effect is China’s dispute with Japan over a group of small uninhabited islands — the Chinese call them Diaoyu, the Japanese, Senkaku — in the East China Sea. Anti-Japanese riots in China have already caused the sales of Japanese auto firms in the country to crater. Many other exports are hurting too.

If the new leadership decided to escalate the confrontation — and there are signs that they may do so — then the negative effects could spread beyond Japanese sales to China as the threat of a shoot-out over the contested islands becomes a bona fide "risk off" event. A flight to quality by portfolio managers would hit asset prices around the world; yen assets, in particular, would get pounded.

How likely is this? Uncomfortably high, in our view, at least in the short term, until the transition is clear and the new leaders, Xi in particular, can consolidate their power over the military. In the current atmosphere, no contender wants to look even remotely weak on hot-button issues of national sovereignty.

In the medium-term, say a few months out, the new leaders are very unlikely to deliberately pick a fight with Japan or China’s Southeast Asian neighbors, with whom Beijing is disputing claims over the South China Sea. A heightening of tensions would have negative economic effects just when Beijing is concerned about growth falling below the 7.5 percent path. It would also force them to assert control over the People’s Liberation Army and the security forces fairly quickly. Despite the personal connections that some princelings such as Xi have with the PLA, none of the fifth generation civilian leaders has true military credentials. Forcing the PLA and other hawks to back off over the disputed islands could be an unpleasant, and early, test of their political legitimacy.

Where else can we look for clues about the new regime’s stance over the island dispute?

If the foreign affairs portfolio is given to someone with a position on the Politburo, it could be a sign that diplomacy has more of a chance. We won’t know this for a few more weeks, though.

On the other hand, if Beijing continues to voice the kind of hardline comments that followed the Japanese government’s recent purchase of the islands, which the Foreign Ministry labeled "a blatant denial of the victorious result of the world’s antifascist war and a serious challenge to the postwar international order," then it’s time to batten down the hatches — and short the Nikkei index.

"Beijing has already irreparably damaged the economic relationship with Japan," says one Hong Kong–based investor. "This will continue to have a long-term negative effect not just on auto sales but on the whole way Japanese firms view doing business in China."

There are reports that General Liu Yuan, one of Bo Xilai’s princeling friends and the son of revolutionary hero Liu Shaoqi, may be shut out from a top PLA spot due to his ties with Bo Xilai. Liu has made a number of belligerent comments about the U.S. and China’s neighbors, and any move to shunt him aside might signal diplomacy. But Bonnie Glaser, a China scholar at the Center for Strategic and International Studies in Washington, is dubious about a civil-military split over the border disputes. "As for potential differences between the civilians and PLA over how to deal with territorial disputes, I think there is no evidence that there is any daylight between the two, at least not yet. The civilians are equally tough when it comes to defending territorial integrity and sovereignty."

Contrary to rumors before the congress, Hu stepped down from the chairmanship of the Central Military Commission, which exercises control over the PLA, handing the post to Xi. This was a notable departure from the previous transition a decade ago, when former president Jiang retained the CMC chair for two years after stepping down as president.

Glaser believes this change has profound implications. "This would make for a much cleaner transition, without blurred lines of authority," she contends. "Hu had to cope with having Jiang remain on the CMC for two years after he took power in 2002, and he undoubtedly recognizes the complications that it created. When Xi becomes CMC chair immediately, he can consolidate his power sooner. Whether that enhances the likelihood of the collective leadership’s adoption of a reformist path remains to be seen, however."

Though Hu contributed to modernizing and increasing the capabilities of China’s military, he has taken a moderate stance on issues such as Taiwan and territorial disputes in both the South China Sea and East China Sea. As Brookings’s Cheng Li observes, "One of Hu’s hot button issues in his leadership has been the notion of a peaceful rise, and his speech emphasized this aspect of China’s strategic interests, specifically mentioning a possible peace agreement with Taiwan."

Passively Pegged to QE3?

The new leaders also face hard choices in two closely related policy areas: Managing the renminbi exchange rate as well as China’s $3.3 trillion in foreign exchange reserves.

The status quo of a pegged exchange rate and short-term dollar denominated reserve assets is risky from both an economic and a political standpoint and may not prove sustainable. The pegged exchange rate effectively ties China’s domestic money supply to the apparently indefinite quantitative easing operations of the U.S. Federal Reserve Board. Sterilization operations by the People’s Bank of China are increasingly unwieldy, and holding the bulk of the foreign exchange reserves in the form of dollar-denominated claims on the U.S. government is risky if the U.S. government continues to fail to get its fiscal act together.

So what should we look for to see if the new leaders will maintain the FX status quo?

Two keys will be to see who replaces Zhou Xiaochuan as president of the PBOC when he steps down, and who replaces Wang Qishan as the vice premier with the de facto economics portfolio. If another sophisticated technocrat like Guo Shuqing, current chairman of the Chinese Securities Regulatory Commission, or Shang Fulin, the banking regulator chief, steps into Zhou’s shoes at the PBOC or Wang’s in the State Council, continuity in Beijing’s conduct of monetary policy is likely. If a New Left functionary or tuanpai ideologue takes over, watch out. We may not know these personnel moves for a few more weeks.

Another piece of evidence is how the PBOC manages China’s money supply and interest rates, either by directly setting reserve requirements or, as they have begun to recently, by indirect market intervention and tolerating slightly higher levels of volatility in the renminbi. The former suggests a continued command economy approach; the latter implies a more market-oriented approach and would be an important step in a financial reform agenda.

According to Cheng Li, the problems of foreign exchange management and reserves "are not a major issue from the top leadership’s perspective. It was only vaguely discussed in the Work Report and in parallel commentary — basically echoing Wen Jiabao’s muted recommendations that ‘we will further improve the mechanism for setting RMB exchange rates. We will closely monitor and control cross-border capital flows and prevent the influx of hot money.’" This in turn implies that Timothy Geithner’s successor as U.S. Treasury secretary is more likely to get an earful about fiscal responsibility from the new Chinese leadership in private, rather than in public.

One particular aspect of foreign exchange management is a genuine hot-button issue for the new leaders, but even Hu’s reference to it was oblique. The Party has long been concerned with capital flight from China, especially remittances of bribes and legitimate assets by officials to locations abroad, ranging from Hong Kong to London to Vancouver. It is an open secret that some of Macau’s booming casinos are a conduit for such transfers. So hot is this button that Hu tiptoed around it in his speech, limited himself to bromides such as "Love the motherland, love Hong Kong: Love the motherland, love Macau."

"Much of Macau is basically money laundering on a massive scale," a close observer in Hong Kong says in an e-mail. "High-roller VIP junkets are the heart of the business of some casinos, helping money out of the mainland and into Hong Kong, Canada, the U.S., Europe and elsewhere. A lot of it is coming from the party elites; the patronage network is massive. The new leaders will have a daunting task trying to take away their newfound family wealth."

Underscoring Beijing’s sensitivity on the subject, the authorities blocked access to The New York Times’ web site when the newspaper published an article in late October detailing the wealth amassed by the family of Premier Wen Jiaboa, which it estimated at $2.7 billion. "The Wen story was almost certainly fed by information provided by the surviving Bo faction, which is still alive and not so well, since they are being ‘reorganized’ by the party disciplinary organs," the Hong Kong observer writes. "The rifts in the party, the pushing and shoving, will go beyond the Party Congress well into the spring."

Business as Usual or Bite the Rebalancing Bullet?

The biggest question mark is how quickly the new leaders will move to rebalance China’s economy.

Everybody on the new Politburo knows that the current driver of growth, and the source of sustained demand for foreign-supplied steel-making materials and energy, has been fixed investment, particularly in infrastructure and real estate. No economy can sustain China’s sky-high levels of fixed investment, which account for about 50 percent of GDP. The country is already in the midst of what could be the mother of all real estate bubbles. Everybody on the new Politburo also knows that millions of Chinese have plowed their savings into real estate because they can’t get a return on their money in China’s state-owned banking system, which pays low interest rates.

Rebalancing has just one way to go: increasing the share of personal consumption in the economy. This implies higher real wages, higher returns on household savings, lower taxation and provision of a host of social services, whose absence is one of the drivers of high personal savings. In short, it requires a massive transfer from the state and state-controlled sectors to citizens.

What does the Party Congress tell us about the prospects for rebalancing?

A strong showing of economic reformers in the new Politburo, according to Cheng Li’s database, suggests momentum for reform. Conversely, a strong showing of state-owned enterprise leaders at the top levels suggests that China’s vested interests will continue to resist these reforms. It’s hard to conclude from the biographies of the new top seven which way this will go. Shifting Wang Qishan from economic overseer to chief of the party disciplinary apparatus removes a possible reformer and raises a question mark.

Hu’s reference to China’s "Income Distribution Reform" plan in his Work Report may be an indicator that the new leaders are serious about addressing inequality. Hu said all the right things in his keynote. "We must firmly grasp the strategic base of expanding domestic demand, move faster to set up a long, effective mechanism for boosting consumption and expand the domestic market scale," he said.

How soon can we look for signs of real change? "After the Party Congress, the new leaders understand the prospects for macroeconomic rebalancing. To make the middle class happy, or at least less resentful, and to make the poor and migrant workers hopeful, or at least less hopeless, will be their top policy agenda," says Brookings’s Cheng Li. "The next few months will tell whether the new leadership can deliver."

James Shinn (jshinn@princeton.edu) is a lecturer at Princeton University’s School of Engineering and Applied Science, and chairman of Teneo Intelligence. After careers on Wall Street and in Silicon Valley he served as the national intelligence officer for East Asia at the Central Intelligence Agency and then as assistant secretary of Defense for Asia at the Pentagon. He serves on the advisory boards of Oxford Analytica and CQS, a London-based hedge fund, and is a regular reader of Party Work Reports.