Optimistic About the Economy, Less So About Politics

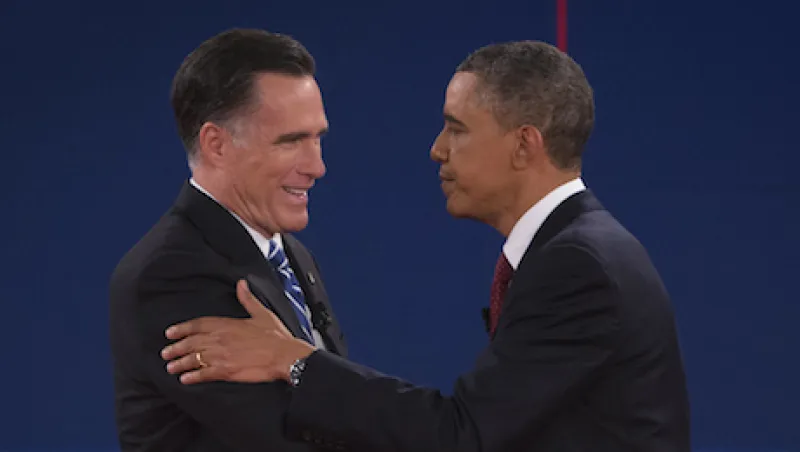

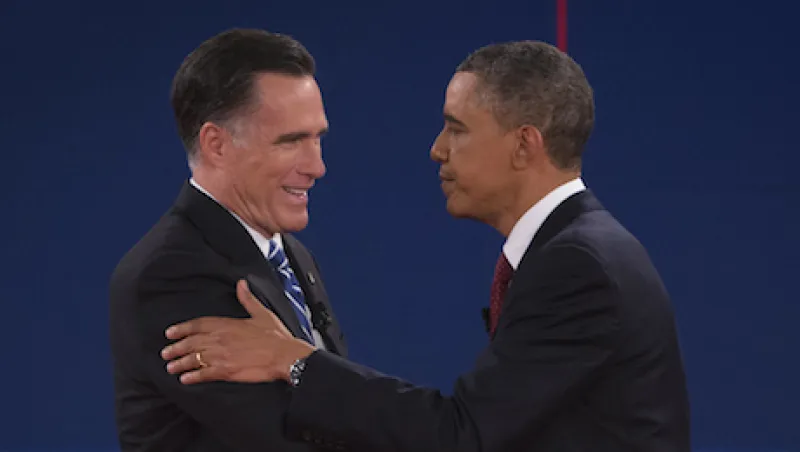

Jim O’Neill of Goldman Sachs Asset Management weighs up the issues facing either a returned President Obama or a new President Romney.

Jim ONeill

October 29, 2012