Last month, Brazilian Finance Minister Guido Mantega revived his “currency war” claim. Two years earlier, he had begun talking about such a war between developed economies, primarily the United States, and emerging markets. At the time, the Federal Reserve was poised to undertake its second round of quantitative easing, provoking significant swings in financial markets. Mantega argued that OECD policymakers were attempting to devalue their currencies by keeping interest rates (both short- and long-term) artificially low, pushing capital outward into the emerging world and bidding up emerging market exchange rates. He brought up this charge again during September 2012 in the wake of the Fed’s “QE3” announcement, fearing an upward surge in emerging market currencies.

If it ever took place, though, the currency war ended a while back. Indeed, it consisted basically of a battle between mid-2010 and early 2011, thereafter subsiding quickly. Since that time, emerging-market currencies have come under very limited appreciation pressure, and emerging market policymakers have not had to do much at all to preserve competitiveness. Over the past year or so, emerging-market foreign exchange has responded much more to weakness in emerging-market growth, as well as to the generally cautious behavior being displayed by global investors, than to abnormally modest interest rates in the U.S. and other developed-market economies. This being the case, emerging-market foreign exchange looks somewhat cheap and should do well if emerging-market growth reaccelerates in 2013.

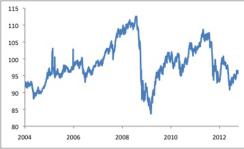

As a whole, emerging-market currencies sold off sharply in August and September 2011, along with other risk assets (Chart 1). Although they staged a partial recovery at the beginning of 2012, they fell again during April and May of this year, and their improvement in the past few months has not yet unwound that most recent round of weakness. In the aggregate, emerging-market foreign exchange remains well below the mid-2011 peak and even farther beneath the pre-crisis zenith -- about 15 percent. Given that EM currencies should likely appreciate over time -- by about 1 percent per year on average, according to our estimates -- their current level, after several years of declines, seems inexpensive.

JPMorgan EM currency index

Source: Bloomberg; data through October 12, 2012 |

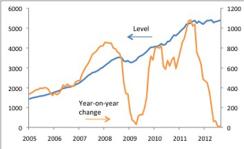

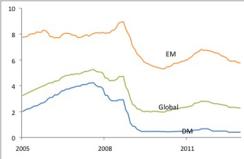

This stability, or outright weakness, in emerging-market foreign exchange is not coming through extraordinary efforts on the part of policymakers to lean against appreciation. Indeed, emerging-market international reserves -- which grow primarily when central banks intervene in foreign exchange markets, buying dollars to resist currency strength -- have barely increased during the past year. They did surge briefly during the start of QE2 but have leveled off since (Chart 2). Nor are policymakers, as a group, using other tools to defend exchange-rate weakness. In contrast with the experience in developed markets, interest rates (Chart 3) are slightly higher today than at the start of the “currency war,” and few major emerging-market central banks -- except for Brazil -- have added significantly to capital controls in an effort to stave off inflows.

EM international reserves (USD bn)

Source: JPMSI, JPMAM; data through August 2010 for a sample of 10 liquid EM currencies |

Policy interest rates (% per annum)

Source: JPMSI, JPMAM; data and forecasts as of October 2012 |

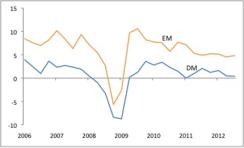

The currency war, then, looks in retrospect instead like a skirmish that ended more than a year ago. While capital did migrate out of the U.S. and other developed economies in the immediate wake of QE2, chasing higher yields on offer elsewhere, the slowdown in emerging-market growth that became evident by mid-2011 put a stop to that flow (Chart 4). Since then, emerging-market currencies have weakened in response to persistent cyclical disappointment. While developed economies are likely enjoying the effects of quantitative easing, this support is coming through declines in local interest rates (and associated other financial developments, like higher stock prices), rather than via currency depreciation. Instead, emerging-market currencies have depreciated as a partial offset to local growth weakness, itself related in part to poor demand in developed markets.

Real GDP (% q/q, saar)

Source: JPMSI, JPMAM; data through 12Q3 (last observation is estimated) |

Despite favorable overall performance by risk assets in 2012, high-beta plays have generally underperformed. emerging-market foreign exchange falls into this category. What can return these currencies to their long-term appreciation trend? Quantitative easing by developed-market central banks, in isolation, seems unlikely to do the trick. Instead, emerging-market foreign exchange needs to draw support from a better global (and, of course, emerging-market) growth environment. Several factors may pave the way for reacceleration in growth during 2013, including the delayed effect of policy easing in China; an end to a vicious circle of global trade weakness, manufacturing slowdowns, and inventory reduction efforts across emerging markets; and reduced global uncertainty (as the euro area benefits from ECB action and as the U.S. traverses the fiscal cliff problem). If this forecast materializes, emerging-markets currencies seem likely to gain, given their apparent undervaluation at present. Such appreciation would benefit not only emerging-market foreign exchange strategies themselves but also emerging-market equities and emerging-market local-currency debt.