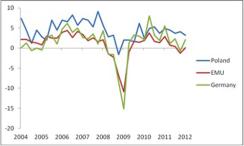

Poland stood out during the 2008-09 recession for the relatively light beating it absorbed at the hands of the global economy. GDP fell briefly and mildly, dropping 1.6 percent Q/Q -- seasonally adjusted annual rate (SAAR) -- in the fourth quarter of 2009 and returned to growth subsequently. The formerly tight relationship between Poland and EMU (or German) growth weakened during this period, with Poland’s large neighbors contracting sharply (Chart 1). With the euro area again mired in recession, can Poland defy gravity a second time? Through the first quarter, at least, growth appeared to be holding up reasonably well. Indeed, the National Bank of Poland (NBP) responded to this resilience with an official interest rate hike. The high-frequency data flow has weakened since then, though, and foreign weakness now seems to be taking a toll on Poland. The economy seems unlikely to outperform this time around to the same degree as in 2008-09.

Chart 1: Real GDP (% q/q, saar)

Source: JPMSI; data through 12Q1 |

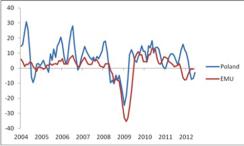

The economy held up well during the Great Recession not because it avoided all damage from the international slowdown. Indeed, Poland’s manufacturing engine sputtered, with industrial production shrinking significantly in late 2008, though not quite as dramatically as it did in the euro area (Chart 2). The national accounts measure of exports dropped for four consecutive quarters (from the third quarter of 2009 to the second quarter of 2009), with double-digit declines in the third quarter of 2009 and the first of 2009. The domestic economy, though, did fairly well throughout this period. Private consumption dropped only in the second quarter of 2009 and just marginally even then (-0.3% Q/Q, SAAR). Fixed investment fell much less than exports.

Chart 2: Industrial production (% 3m/3m, saar)

Source: JPMSI; data through June 2012 |

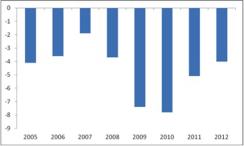

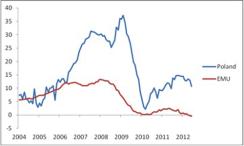

What shielded the domestic economy during the Great Recession? Essentially, fiscal policy and monetary conditions provided powerful support. On the fiscal side, the general government balance began worsening in 2008 and continued to do so in 2009, in part reflecting an income-tax cut that benefited households in particular (Chart 3). Adjusting for cyclical effects, the Polish fiscal balance slipped by 1.9 percentage points (pp) of GDP in 2008 and by 2.2 pp the following year, compared with 0.9 pp and 1.5 pp, respectively, for the euro area during those same two years. Fiscal thrust, then, was adding nearly a full percentage point of growth to Poland relative to the euro area during the downturn. On the monetary side, Poland went into the recession feeling a tailwind from a credit boom that had begun just a year or so previously and which continued into early 2009 (Chart 4). In contrast with many of its Central and Eastern European peers, Polish credit growth had not been growing rapidly enough for long enough to reach alarming levels by 2008, and less of its financial system was owned by foreigners. Polish credit conditions thus did not face the same pressure to tighten abruptly as was felt elsewhere in the region or, indeed, in the euro area. Extra help on the monetary front came from the currency, as the euro appreciated more than 50 percent against the zloty between mid-2008 and the first quarter of 2009.

Chart 3: Poland general government balance (% of GDP)

Source: Credit Suisse, IMF; data and forecasts as of June 2012 |

This time around, the same forces are not working to protect Poland, at least not to the same degree. Fiscal policy has tightened, with the general government balance improving by 2.7 p.p. of GDP in 2011 and with plans for further shrinkage, to the tune of 2 p.p. of GDP, this year. After picking up last year, credit growth has decelerated in the past few months. While it continues to run faster than in the euro area in year-on-year terms, it dropped in level terms during June 2012, similar to the eurozone trend. The earlier NBP rate hike may create further downward pressure on credit. And the currency has not done much over the past year and indeed has been on an appreciating trend recently, likely reflecting Poland’s relatively high-rate environment. All of this suggests that the domestic economy will benefit from much less of a policy shield today than was the case during the Great Recession. While external conditions do not look as hostile today as they did then, and the economy’s absolute growth performance may exceed its 2008-09 record, it seems much less likely that Poland will sharply outperform the rest of the European economy on this occasion. Polish industrial production growth has already weakened in the past few months, bringing it in line with euro area trends. With less offset from the domestic economy, overall growth will likely fade as well, dropping to a below-trend clip in the remainder of 2012.

Chart 4: Private sector credit (% y/y)

Source: JPMSI; data through June 2012 |

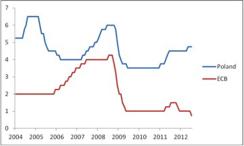

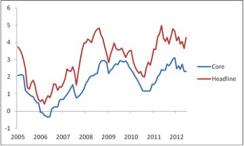

What does all this mean for central bank policy? The NBP is one of the few emerging market central banks to tighten this year, raising its reference rate 25bp in May to 4.75 percent, at a time when the ECB has been moving in the other direction. The gap between NBP and ECB rates has thus widened to 400bp, compared with 250bp during the immediate post-recession period (Chart 5). With euro area weakness persisting and the Polish data flow slipping, further rate hikes seem highly unlikely. Indeed, a rate cut seems probable at some point before the end of 2012. Admittedly, headline inflation represents an obstacle to easier monetary policy (Chart 6). Consumer prices rose 4.3 percent Y/Y in June, and inflation has been above the top end of NBP’s 1.5 to 3.5 percent target range since the start of 2011 (moreover, the NBP now emphasizes the 2.5 percent midpoint of the target, rather than the tolerance band). Core inflation, though, is running much lower, at 2.3 percent Y/Y as of June, and the overall CPI inflation rate seems likely to fade in coming months. NBP will likely proceed cautiously, but a moderate rate-cutting cycle may begin later this year, extending into 2013.

Chart 5: Policy interest rates (% per annum)

Source: JPMSI; data through July 2012 |

Chart 6: Poland consumer prices (% y/y)

Source: JPMSI; data through June 2012 (core excludes food and energy) |

Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.