Not long ago, we wrote about the caution being displayed by emerging-markets (EM) central banks, who for the most part were holding policy rates steady in the face of growth concerns and continued easing by their developed market (DM) counterparts. Conditions have changed abruptly, with a considerably wider group of EM central banks now cutting rates. At the moment, the jump in certain food commodity prices does not appear likely to derail this process, but this issue deserves careful monitoring in coming months.

During the past month, forecasters have generally revised down estimates for global GDP growth, not only for the second quarter but also for the second half of 2012. Prevailing uncertainty seems likely to weigh on business decision-making, including both capital spending and hiring, for some time to come. Our own forecasts for global GDP growth in the third and fourth quarters of 2012 have dropped by about half a percentage point in recent weeks and the pace of global expansion now looks set to remain below its medium-term trend or potential rate until well into 2013.

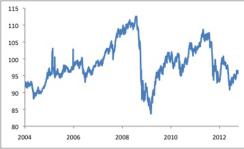

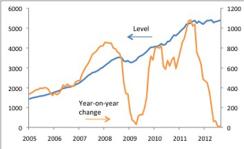

As a group, EM central banks have maintained fairly upbeat views about global growth prospects through the course of this year. Consequently, they have generally been reluctant to echo the easing pursued by DM policymakers. The weakening of U.S. growth through the second quarter, the ongoing sluggishness in China, and the atmosphere of uncertainty surrounding the future of the euro area and U.S. fiscal policy, by damaging expectations for the second half of 2012, have stirred EM central banks into action. Where easing was underway before, most obviously China, it has intensified (with a second rate cut in as many months). More strikingly, the easing process has broadened beyond the BRICs. Within the past two weeks, central banks in both Korea and South Africa have surprised markets with rate cuts. Elsewhere, rhetoric has turned more dovish, including in Poland, where the central bank raised the policy interest rate as recently as May, and Colombia, which also was hiking earlier this year. The aggregate EM policy interest rate has fallen below 6 percent, a move of more than 25bp in the past two months, and it will likely drop further, to around 5.75 percent, by the end of 2012 (Charts 1 and 2). This amount of easing will not touch off an EM growth boom, and it would leave the overall EM policy rate above its 2010 trough, but it should serve as a cushion against downside growth risk and provide a fillip to EM equity markets.

Chart 1: Policy interest rates (%, GDP-weighted)

Chart 1

Source: JPMSI, JPMAM; data and forecasts as of July 2012 |

Chart 2

Source: JPMSI, JPMAM; data and forecasts as of July 2012 |

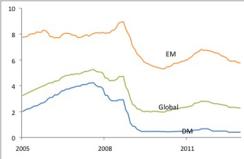

Chart 3: U.S. grains prices (US cents/bushel)

Chart 3

Source: Bloomberg; data as of July 19, 2012 |

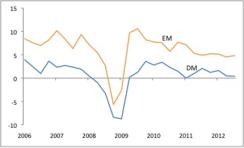

For now, though, the danger to EM inflation looks manageable. While U.S. grains prices naturally capture attention in this country, food commodity prices more broadly have risen significantly less. The CRB food index has increased a more modest 11 percent since early June, and even that pickup follows an earlier decline that leaves overall food commodity prices below year-earlier levels (Chart 4). Rice, the staple in most of Asia, has not felt much upward pressure thus far, and even grains prices have not surged in every country to the same degree. That said, the food price story deserves careful attention. Food price shocks sometimes broaden over time, thanks to substitution effects as well as input cost shocks (grains represent a major component of the livestock cost structure, for example). And Asian weather could take a turn for the worse later this year, as a possible El Niño phenomenon builds. So far, the move in food seems unlikely to affect EM central bank policy significantly, but a broader increase in these commodities could halt or even reverse the current easing trend, similar to the pattern in 2010.

Chart 4: Food commodity prices and EM consumer prices (% y/y)

Chart 4

Source: JPMSI, Bloomberg, JPMAM; data as of July 2012 |