It’s been a long, hard slog for value stocks lately. I’d say we’re long overdue for a value recovery. But what would it take?

Whether you look at one-, three- or five-year results, the cheapest global stocks have logged some of their worst relative performances in 40 years. This losing streak is also the longest on record, far surpassing the average slump of a year and eight months and the previous record of two-and-half years.

Why has value failed so badly this time round? After all, value stocks have outperformed in the prior three recessions and other geopolitical upheavals. But this crisis has been much more severe and tenacious, and its effect on investor confidence has been much more corrosive.

When the range of possible economic outcomes is as wide and unpredictable as it’s been in recent years, investors lose faith in their ability to forecast too far out into the future. They shorten their investment horizons. They want stable earnings, reliable dividend income and immediate payoffs. What they don’t want is controversy or companies with questionable prospects, no matter how temporary their troubles may be or how depressed their stock prices.

This disregard for valuation is atypical. Value stocks have been hands-down winners over the long term, even including this postcrisis lapse. This history is also why I think a value comeback is close at hand. We’ve been through value slumps before, most recently during the Internet craze. But, at some point, valuations relative to earnings power become too enticing to pass up. Investors plow back in, driving value recoveries that have typically lasted many years and more than made up for past losses.

I think we’re at a similar tipping point today. The safe assets that are winning today look expensive and are unlikely to generate the future returns investors need. To get better returns, investors will need to take on more risk — and, in our view, value stocks offer an exceptional opportunity today.

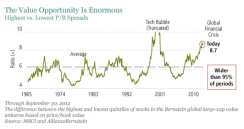

As the first display below shows, if you exclude the tech bubble, the cheapest quintile of global stocks is selling at one of the biggest discounts relative to the most expensive stocks since the mid-1960s. The bigger the discount, the greater the value return potential. Spreads have never stayed this wide for long, and when they normalize, patient value investors are richly rewarded. A recent article by my colleague Vadim Zlotnikov also looked at the opportunity from a different perspective.

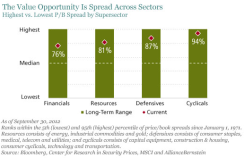

Valuation spreads are wider than usual across all sectors of the economy, as the second display shows. And, unlike times past, taking advantage of this opportunity doesn’t require buying badly damaged companies. The cheapest global stocks today are less leveraged and have higher free-cash-flow yields than usual. These factors create ideal stock-picking conditions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Sharon Fay is Head of Equities at AllianceBernstein.