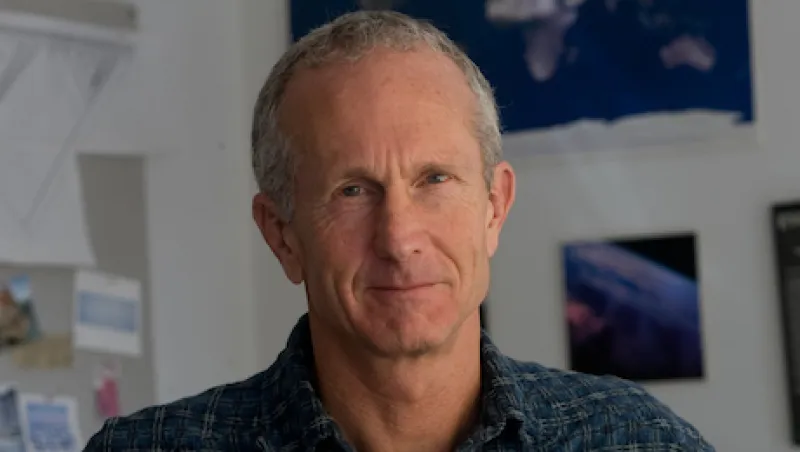

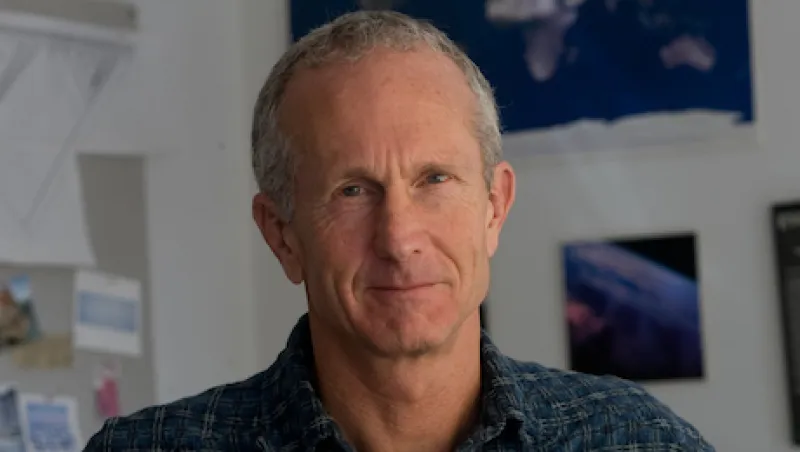

J. Doyne Farmer on Agent-Based Modeling

The Oxford academic and Los Alamos alum says the insights of classical and behavioral finance can be much refined by using computers to simulate how real people act — and interact — when making economic decisions.

Ben Baris

September 27, 2012