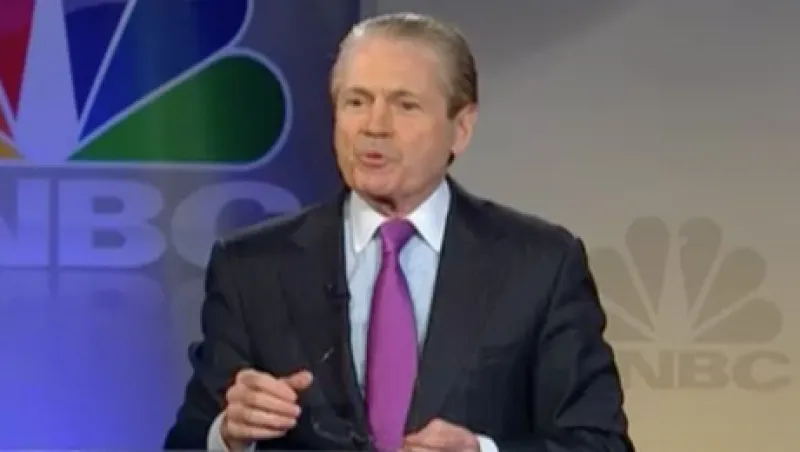

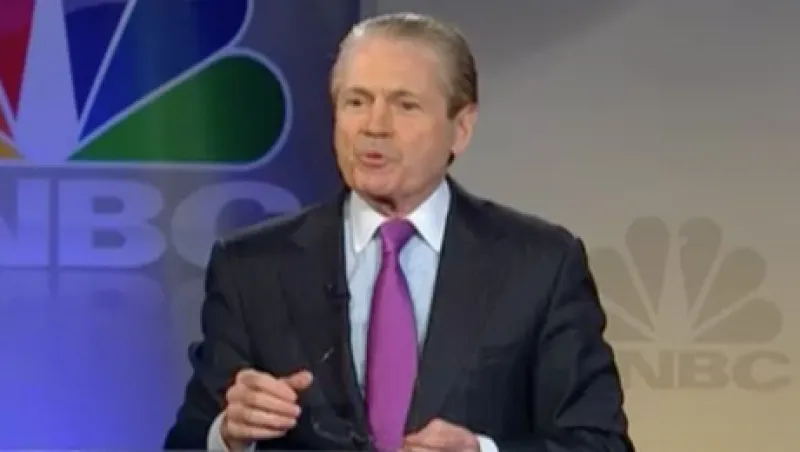

Delivering Alpha: Tom Hill Made Good Call on Mortgages

Blackstone Alternative Asset Management CEO’s view that mortgage securities would come back has helped the firm outperform in the past year.

Anastasia Donde

July 13, 2012