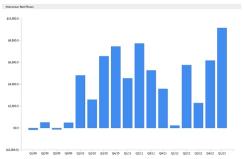

The current bout of global market stress, like many others in recent years, has taken a toll on the Mexican peso (MXN). Even after a modest rebound during the past week, the peso has depreciated by more than 7 percent against the U.S. dollar since the end of April. The exchange rate, roughly $14 at the moment, stands near its weakest level since the start of the expansion back in 2009, and the currency remains quite cheap compared with its pre-crisis range (around $11 during 2004-07 and $10 at its peak in mid-2008). Even taking account of higher inflation in Mexico than in the U.S., the real effective (trade-weighted) exchange rate looks quite inexpensive by medium-term standards.

Mexico real effective exchange rate (2010 = 100)

Source: BIS; data through April 2012 |

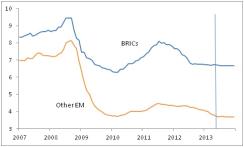

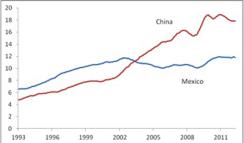

Why has MXN proven so vulnerable? In part, it suffers from being one of the more liquid emerging market currencies, and one with fairly low short-term interest rates (4.5 percent currently), making it an attractive short as a proxy for overall EM sentiment. More generally, though, structural factors in the balance of payments explain its persistent weakness. The peak in the real effective exchange rate occurred soon after China gained WTO entry. From that point on, Mexico lost market share in the U.S., with China accounting for much of the deterioration as labor-intensive manufacturing shifted to a newly available, low-cost base (Chart 2). With exports growing sluggishly, Mexican GDP growth persistently underperformed the U.S. during the first half of the 2000s (a particularly poor outcome given Mexico’s considerably lower per-capita income, Chart 3).

U.S. imports from Mexico and China (% of total)

Source: JPMSI; data through April 2012 |

More recently, Mexico has largely missed out on the beneficial effect of rising commodity prices despite being a major oil producer. This failure reflects significant declines in output associated with the aging of major local fields and the inability of the constitutionally closed Mexican oil industry to exploit new but technically challenging opportunities both in the Gulf and onshore. Lack of space for private companies in the Mexican oil sector has also cut the country off from the large-scale foreign direct investment inflows into commodity industries received by, for example, Brazil and Colombia in recent years. Outside of commodities, Mexico has suffered from bad publicity surrounding its drug violence, which has probably deterred foreign investment and may have dampened tourism receipts at the margin, too. The relatively small equity market (Mexico represents 4.7 percent of the MSCI EM index, compared with 13.5 percent for Brazil) also deters foreigners from taking minority stakes in Mexican enterprises.

Mexico and U.S. real GDP (% q/q, saar, 8-quarter moving average)

Mexico has struggled, then, both in terms of merchandise trade (having lost market share to China, and with oil export volumes falling) and in capital inflows (with little commodity-seeking investment and with perceived instability perhaps deterring other potentially interested parties). What can change? First, the country’s presidential election, scheduled for July 1, could represent something of a turning point. If elected, the current front-runner, from the centrist PRI, would likely enjoy fairly strong congressional backing. During the past two administrations, presidents from the right-wing PAN have struggled to muster support from a divided Congress in which the PRI has often represented the leading force. This has led to sluggish legislative activity. The PRI, which in its one-party rule days nationalized the oil sector, now talks about opening the industry at least partially. Such a shift could support the exchange rate almost immediately by attracting capital flows and then over time by boosting oil output and hence exports. Second, the secular loss of market share to China appears to have played itself out. With Chinese labor costs having risen, its export growth has cooled a bit. Mexico’s market share in the U.S. has risen from its trough. The revival of U.S. manufacturing suggested by anecdotal evidence will benefit Mexico, which remains an important support platform for U.S. industry. Renewed rise in market share would put gradual upward pressure on Mexico’s real exchange rate. And the combination of the oil and manufacturing stories would give Mexico a “story” that it has lacked in recent years, in turn promoting financial inflows. All these factors would give MXN an anchor, promoting greater resilience during episodes of market stress and stronger appreciation during more favorable climates.

Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.