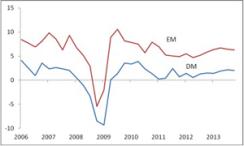

As the second quarter draws to a close, emerging-markets (EM) economic growth appears to have gone through its weakest patch since the current expansion began in 2009. Using our estimates, EM GDP grew 4.7 percent Q/Q, (seasonally adjusted annual rate, saar) in the second quarter of 2012, down from 5.5 percent in the first quarter of 2012 and below the 4.9 percent figure recorded in the fourth quarter of last year (note that no country has yet published GDP figures for the second quarter, and the estimate mentioned is thus purely a forecast). The up-and-down swing in the first half of this year closely mirrors the pattern in developed market growth, which picked up to 1.4 percent Q/Q, (saar) in the first quarter of 2012 after a 0.7 percent gain in the fourth quarter of 2011 but slipped to an estimated 0.6 percent in the quarter now ending.

Real GDP (% q/q, saar)

Chart 1

Source: JPMSI, JPMAM; data and forecasts as of June 2012 |

Unfortunately, two problems surround this forecast. First, the risks to these projections appear tilted to the downside. Expected improvement depends on a series of favorable developments, including a pickup in China, broad stabilization in euro area financial conditions to avoid an intensification of stress in EM banking systems, and U.S. growth pulling out of what seems to be a funk and returning at least to the roughly 2 percent pace that has characterized the past year or so. In coming months, U.S. growth does indeed seem likely to regain its footing, given support from significantly lower gasoline prices as well as apparent stabilization in the housing market. China, too, should benefit from the current turn toward more aggressive policy easing, but the timing of an eventual improvement there remains uncertain. And the euro area continues to represent a ticking time bomb that could disrupt growth elsewhere through financial contagion at any moment. In other words, a bit of luck seems necessary in order for the forecast of better EM growth in the second half of this year to come true.

Second, even assuming that growth follows the expected path, it will remain noticeably below the trend or potential EM GDP growth rate, which we estimate at roughly 6.4 percent. In a world characterized by ongoing DM weakness and only gradual acceleration in China, overall EM expansion will stay sluggish by medium-term standards. Below-trend growth typically carries two consequences. First, unemployment rates tend to rise. Luckily, in contrast with the developed economies, jobless rates in most EM countries currently do not look particularly high, so a small rise in coming months should prove less devastating than a similar move would be at the moment, for example, in the United States. Second, corporate earnings growth tends to disappoint. EM equity markets may still respond to the pickup in growth, especially if investors expect that trend to continue, but they will likely have to make do without the benefit of upward earnings surprises. At a minimum, EM economies will likely have to wait until 2013 before enjoying a return to trend-like or above-trend growth.

Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.