Risk managers tend to reduce their market exposure (or increase hedging) in response to signs of escalating risk, extrapolating from current volatility and correlation trends. Investors, tending to bet on mean reversion, typically focus on returns, frequently adding to their highest-conviction positions in the face of rising uncertainty.

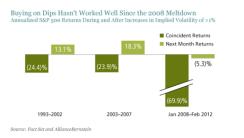

The investor approach was long an engine of success. From 1993 through 2007, buying the market on dips paid off. While the S&P 500 fell at an annualized rate of more than 20 percent during months when the CBOE’s volatility index (VIX) rose more than 1 percent, it bounced back smartly in the following months.

Since 2008, however, the risk-management approach has triumphed. In months when market volatility has risen by 1 percent or more, the market fell at an annualized rate of nearly 70 percent on average — and continued to lose ground in the following month as well, as the display below shows.

We strongly suspect that the poor performance of active managers over the last several years has been at least partly tied to the inherent conflict between relying on shorter-horizon risk management while seeking returns from investments that can take years to play out.

Last year, for example, investors who took a flier on long-horizon stocks in mid-year were burned at first. The S&P 500 lost 14 percent in August and September. But those who exited during the market drop missed the rally that began in October and has intensified more recently. The problem was a risk/return mismatch: seeking short-term gratification from a long-term asset.

Hence, in the current market we believe that paying attention to systemic sources of risk and return will be at least as important as the selection of specific securities.

In 2011, the systemic exposures that really mattered were dividend yield and low-volatility/low-beta. Stocks with these characteristics outperformed. But as a result, such stocks have become extremely crowded and expensive — making some traditionally low-risk strategies very risky.

Today I see three themes that offer a powerful upside: dividend growth (rather than yield); compellingly valued beta or cyclicality, and companies attractive on the basis of normalized cash (candidates for leveraged buyouts).

How much to invest in each of these themes depends on each investor’s investment horizon. Longer-horizon investors would generally emphasize undervalued cyclical stocks and LBO candidates, which I expect will return to favor over time. Short-horizon investors should emphasize dividend growth.

Rebalancing will also be crucial. I favor adding to risk exposures as volatility rises and reducing risk as the markets become calmer. Today, with the markets charging ahead, I think a modestly defensive tilt is in order.

While there are clear signs of economic improvement and some of the sovereign-debt problems have been ameliorated, the basic risk-management philosophy has not been altered by these recent events. Hence, increases in perceived risk will be accompanied by outsized market drawdowns and investors will be well served by maintaining a highly diversified stance and rebalancing position sizes in line with market volatility.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio management teams.

Vadim Zlotnikov is Chief Market Strategist at AllianceBernstein