Would you have outperformed the overall stock market if you bought the stocks that were most overweighted by hedge funds at the end of the third quarter?

The answer: It depends on when you bought as much as what you bought.

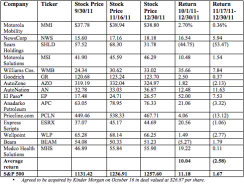

For example, if you bought all 15 stocks on November 16, the day all of the holdings were publicly disclosed, you would have lost 2.58 percent by year-end. This compares with a 1.67 percent gain for the S&P 500, which means you would have lagged the broad market by more than 4.2 percentage points. Not too good.

One stock, however, heavily skewed this performance. Sears Holdings, the beleaguered retailer controlled by hedge fund manager Eddie Lampert of ESL Partners, lost 53.5 percent during the same period. Even if you bought all of the stocks except for Sears, you still would have lagged the S&P benchmark, but you at least would have made 1.05 percent. Much better.

Altogether, six of the 15 stocks lost money during the November 16–December 30 period.

However, just five of the 15 stocks outperformed the benchmark, while a sixth just missed beating it. The best performer, ironically, was another long-time major ESL holding—AutoNation, which was up 11.63 percent from November 16 through December 30.

The story is different is you look at the performance of the most overweighted holdings for the entire quarter. From October 1 through December 30, the 15 stocks climbed more than 10 percent. Even so, this lagged the S&P 500, which rose 11.18 percent for the quarter.

Again, if you held all of these stocks except Sears, you would have been up nearly 14 percent, outperforming the benchmark by nearly 300 basis points, as the retailer lost 44.75 percent during the quarter. But remember, you had to have been privy to these filings before they were made public.

On the other hand, one stock skewed the results to the upside. El Paso Corp. stock surged 52 percent after the company agreed to be acquired by Kinder Morgan on October 16 for about $26.87 per share.

Eight of the 15 stocks outperformed the S&P 500 for the entire quarter.

Besides Sears, the only other stock that lost money for the entire quarter was Beam, the liquor company best known for its Jim Beam, Canadian Club and other brands. In fact, it was the only stock that fared better from November 16 to year-end than during the entire quarter.

Looking further back at second quarter filings, we found that if on August 16, the day the 13f filings were made public, you bought the 15 stocks most overweighted by hedge funds at the end of the period you would have lost 8.53 percent by the end of September. Again, this was worse than the S&P 500’s loss of about 5.14 percent during the same time period.

And even if you had access to these holdings when the second quarter actually ended, you still would have lost 17.33 percent from July 1 through September 30 compared with a 14.3 percent decline for the S&P 500.

The performance of that portfolio of 15 stocks, however, was skewed fairly heavily by the collapse in the shares of Netflix, which gave up more than half its value during both time frames after the web-based movie rental company made its very unpopular announcement in early July that it would change its pricing policy. Looking at a longer time horizon, if you bought the nine stocks that were among the 15 most overweighted by hedge funds at the end of June as well as at the end of September on August 16, the first day they were widely disclosed to the public, and held them until December 30, you would have made 5.10 percent. This would have slightly lagged the S&P 500, which climbed 5.4 percent during that period.

Again, Sears skewed it. Its stock lost nearly 49 percent during that period (Priceline.com was the only other loser, dropping nearly 6 percent.) And if you excluded the old bricks and mortar retailer, you would have made 11.81 percent, even including Priceline.com’s loss. This would have beat the S&P 500 by 640 basis points.

In this case, the biggest mistake one could make following the smart money was to follow them following one of their own, Eddie Lampert.

Here are the 15 most overweighted stocks by hedge funds on September 30 and how they subsequently fared: