Fears are growing that escalating Middle East tensions could prompt a spike in oil prices, which would disrupt the global economic recovery and spoil the equity-market rally. While we can’t predict what will happen between Israel and Iran, we can do our best to put those fears in perspective.

Research conducted by our analysts suggests that a spike in oil prices triggered by an Israeli or U.S. strike on Iran would be painful but short-lived. This isn’t based on geopolitical analysis — which is not our forte — but on a study of the underlying dynamics of the global energy market.

When oil prices spiked in June 2008, the forward curve for Brent crude implied that oil would jump to $140 a barrel and stay there for years. Today is different. Although oil currently trades at more than $120 a barrel, forward curves anticipate that this tightness will not last. Some of the recent market tightness has been driven by above-average winter demand in Europe and Asia, as well as the shutdown of Japanese nuclear facilities and supply disruptions in Sudan. Although the forward curve has steepened a bit today versus last year, it also reflects expectations that oil prices will subside within a few months, ultimately dropping to about $90 a barrel.

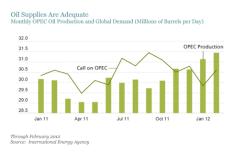

That’s where we think it should be, based on supply-and-demand fundamentals. To meet current demand, the world needs OPEC countries to produce more than 30 million barrels a day of oil. Currently, OPEC is producing more than 31 million barrels a day, as the display below shows. Meanwhile, demand growth softened significantly in the second half of 2011. Taken together, this means that oil prices should fall.

So why does the market still seem tight? Mainly because OPEC’s spare capacity of 4.4 million barrels per day is a bit lower than usual. In this environment, the possibility of disruption in Iran — which produces 3.7 million barrels a day — looks worrying. It’s not helping matters that another 8 million barrels a day comes from other OPEC countries that face varying degrees of instability, such as Iraq, Syria, Sudan and Nigeria.

A conflict that brought Iran’s exports to a halt would probably push oil prices to around $200 a barrel. But these types of price spikes are usually short lived. If it were to last two or three months, global GDP growth would be likely to plunge from the consensus forecast of 2.6% this year to less than 1percent. But our analysis of past oil crises suggests oil would not stay that high for more than a few weeks, which would mitigate the blow to economic growth.

There are potentially more severe scenarios, but we think these are less likely. For example, a total shutdown of Iranian production or a full blockade of the Strait of Hormuz, through which more than a third of the world’s seaborne oil passes, would send oil skyrocketing and deliver a very harsh blow to the global economy and markets.

In any conflict scenario, equity markets would get hit by the setback to economic growth. But some stocks might do well, such as those of liquefied natural gas producers, who would benefit from a shift away from oil. Stocks of integrated oil companies with relatively little exposure to the Middle East, as well as those of oil producers outside the region, would probably gain as well. However, I’d beware of oil service companies or oil producers with heavy Middle East exposure and engineering groups with operations in the region. Israeli energy groups, or energy companies with exposure to Israel, could also suffer from the risk of a counterattack.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Kevin Simms is chief investment officer of International Value Equities at AllianceBernstein.