We at J.P. Morgan Asset Management just published our Long-Term Capital Market Return Assumptions for 2015. These are our central case expectations for asset class returns, volatilities and correlations over the next ten to 15 years and are built to reflect long-term market trends and be independent of the present stage in the business cycle.

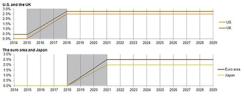

The overarching theme is that the global economy is back on track toward normalization. We expect to continue to see global monetary policy divergence over the next ten to 15 years. In particular, we expect the U.S. Federal Reserve and the Bank of England to begin to raise interest rates and continue to do so over the next three years, whereas the European Central Bank and the Bank of Japan are both set to extend accommodative monetary policies. We don’t expect these central banks to start raising rates until 2018.

We expect inflation to remain broadly within central bank target ranges and economic growth to be slower than in recent years.

The link between macroeconomic conditions and asset class returns is complex and uncertain. When we set our forecasts for asset class returns, we start with our long-run macroeconomic outlook and then integrate the specific characteristics of each asset class over the time period in question. With these factors in mind, our long-term nominal expected returns for U.S. Treasuries, corporate bonds and equities are generally lower than they were last year, and the implied risk premiums suggest a lesser mitigation of risk than was assumed last year.

The expected returns that we publish for each asset class are meant to be a summary of our views, rather than an exact forecast. It is, of course, difficult to predict asset class returns over a horizon of ten to 15 years. Some investors fall into the trap of directly applying the long-term capital market assumptions into portfolio construction algorithms without taking into account any uncertainty and also without considering potential asymmetry in asset class returns. In other words, traditional approaches to portfolio construction assume that predicted long-term expected returns are correct to the decimal place, rather than being a general overview. They also assume that returns are just as likely to exceed as to fall below expectations. In reality, asset class returns are typically asymmetrical. It is essential to model asset class returns and risks correctly, taking proper account of the nonnormality of asset returns and looking beyond volatility as the main measure of portfolio risk. By doing so, the long-term capital market assumptions can enable investors to better quantify the trade-offs between the relative risk premiums across asset classes and across different geographical regions; understand how to think about portfolio diversification; and determine which nominal or real return target is appropriate for a given target volatility or downside risk measure.

This year, as last year, we analyzed the accuracy of our long-term capital market assumptions over the past ten years. This was a particularly volatile and uncertain decade characterized by a credit boom followed by a spectacular bust, resulting in a negative outlook for asset values and economies around the world. Over this period, a strategic portfolio weighted 50 percent in equities, 30 percent in bonds, 12 percent in hedge funds, 5 percent in private equity and 3 percent in direct real estate would have achieved an annualized return of 7.3 percent, compared with our expected annualized return of 7.1 percent. This is a reassuring result.

Alexandre Christie is a global strategist for the Investment Management – Solutions Group at J.P. Morgan Asset Management in London. For more information, please visit our Long-Term Capital Market Assumptions 2015 website.

Get more on banking and capital markets.