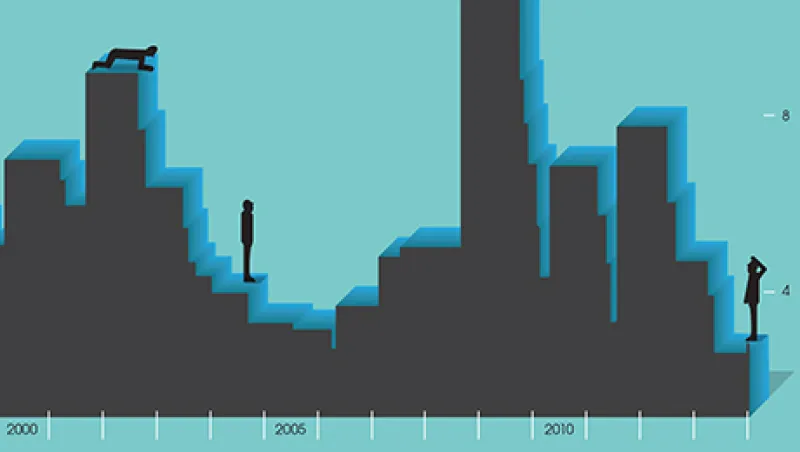

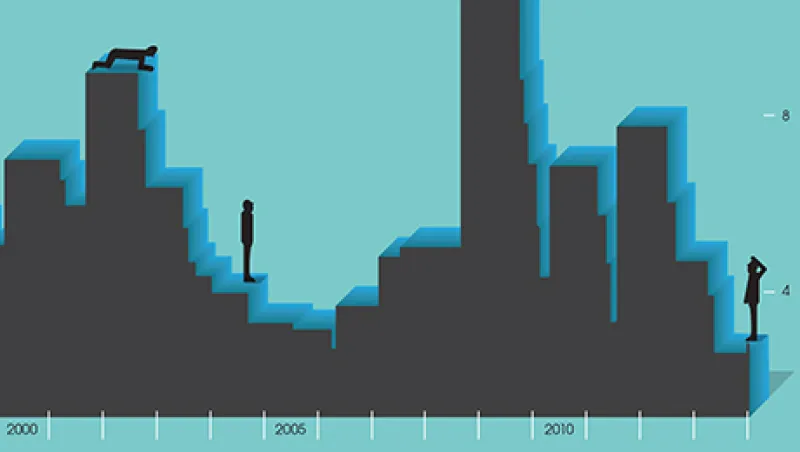

Recent Stock Market Volatility May Be a Taste of What’s to Come

Hang on to your seat belts. Volatility, long suppressed by the Fed’s QE, is back and heading to more-normal levels.

Editors

February 23, 2014