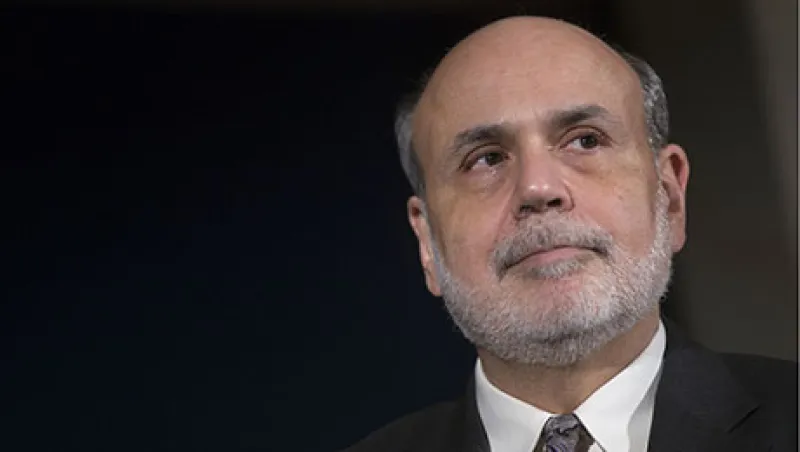

Ben S. Bernanke, chairman of the U.S. Federal Reserve, listens to a question during a discussion at the National Economists Club annual dinner in Washington, D.C., U.S., on Tuesday, Nov. 19, 2013. Bernanke said the labor market has shown "meaningful improvement" since the start of the central bank's bond-buying program and that the benchmark interest rate will probably stay low long after the purchases end. Photographer: Andrew Harrer/Bloomberg *** Local Caption *** Ben S. Bernanke

Andrew Harrer/Bloomberg