Faith-based communities across America are talking about unloading their fossil fuel investments, but what shall those words herald? Where some observers see such discussions as proof that fossil fuel divestment is going mainstream, others point out that the largest religious institutions haven’t fully converted to the cause.

The divestment movement, spearheaded by U.S. environmentalist and author Bill McKibben and his grassroots group, 350.org — with help from Tom Steyer, the billionaire founder of hedge fund firm Farallon Capital Management — turns two this fall. True to its campus roots, it began by targeting college endowments, but resolutions related to fossil fuel divestment are increasingly cropping up at religious bodies’ general assemblies.

“Climate change and environmental concerns have not been a top-tier concern for most religious denominations,” says Reverend Fletcher Harper, an Episcopal priest and executive director of Highland Park, New Jersey–based GreenFaith, an interfaith environmental advocacy group calling for fossil fuel divestment. “The fact that you’ve got a large audience in the U.S. in terms of faith communities that are starting to debate divestment seriously is, I think, a clear signal that this issue is entering the mainstream in terms of our society’s moral discourse.”

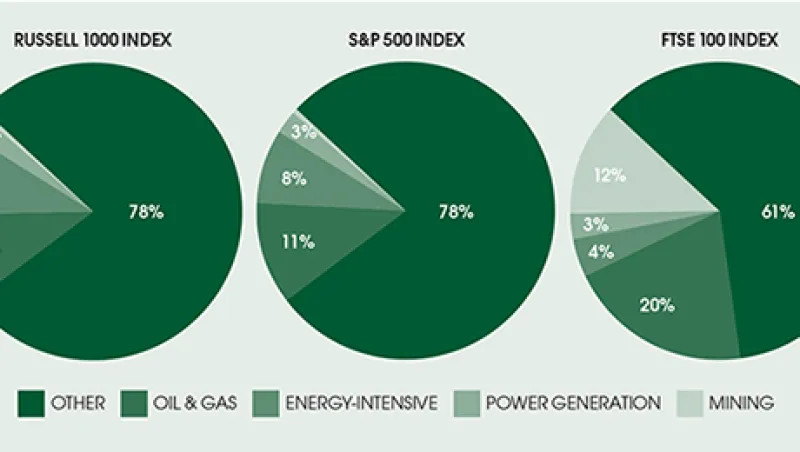

A 2013 report from the University of Oxford’s Smith School of Enterprise and the Environment charts the typical progression of effective large-scale divestment campaigns, highlighting the important early role of organized religion. The authors note that U.S. college endowments tend to invest 2 to 3 percent of their assets in public fossil fuel equities; religious institutions allocate a comparable share. Although “the amounts divested in the first phase tend to be very small,” this activity helps to “create wide public awareness about the issues,” the report states.

U.S. religious groups don’t have to report income or spending, but those that apply an environmental, social and governance filter to their investments managed a total of some $53 billion in 2011, according to Washington-based US SIF – the Forum for Sustainable and Responsible Investment.

In July 2013 the United Church of Christ became the first U.S. denomination to pass a resolution at its general assembly charting a path toward fossil fuel divestment. The new rules pertain to its $3 billion pension fund and the United Church Funds, its $800 million roll-up of UCC institutions’ and local churches’ endowments. This June the Unitarian Universalist Association resolved to divest from fossil fuel companies in the $180 million Common Endowment Fund; the Presbyterian Church (USA) determined that its socially responsible–investment committee should “discern and act on fossil fuel divestment” within the church’s $9.2 billion pension fund and $1 billion Presbyterian Foundation, and give a progress report at the next assembly in 2016. Meanwhile, the Union Theological Seminary in the City of New York voted unanimously to start divesting the school’s $108.4 million endowment of fossil fuel companies.

“I think it’s safe to say most of the large religious institutions in the U.S. have now encountered some vocalization around the fossil fuel divestment debate,” says Douglas Cogan, vice president for asset owner accounts at MSCI ESG Research in Boston.

It’s part of a global shift. In July the World Council of Churches, which holds SFr8.7 million ($9.6 million) in endowment investments, amended its finance policy to dictate that, though the Swiss-based body has held no fossil fuel investments, it will officially never do so. Despite the tiny size of the WCC’s endowment, this change could make a big impact by influencing member churches to follow suit. A number of smaller, regional religious organizations in the U.S. and elsewhere, including the Philadelphia-based Shalom Center, the Rabbinic Council of Progressive Rabbis of Australia, Asia and New Zealand, and several Quaker groups, have also divested or taken steps in that direction.

But for the big American players, wholeheartedly embracing divestment may be too great a leap. The UUA says its managers can remain invested in fossil fuel companies with which it is doing shareholder advocacy work. The UCC resolution calls for identifying “best-in-class” oil and gas producers — according to criteria yet to be determined — so the church can purge its portfolio of all others by 2018. Both resolutions originally called for total divestment, but they had to be softened to win the support of finance committees and general assembly voters.

Reluctance to divest is typical in a movement’s early stage, GreenFaith’s Harper says: “I think over time the debate will get sharpened about whether shareholder activism is really a plausible strategy to impact the fossil fuel industry.”

Reverend Jim Antal, president of the Massachusetts conference of the UCC and the person who brought the fossil fuel divestment resolution forward, also dismisses shareholder advocacy, contending that his church’s recent actions must be a prelude to full divestment. “I will continue to point out the absurdity of ‘best-in-class’ fossil fuel companies,” Antal says. Within three years the UCC will be fully divested of fossil fuels, he predicts.

Don’t tell that to Richard Walters, director of corporate social responsibility for the UCC pension boards. Walters is committed to shareholder advocacy, but he doesn’t think full divestment from fossil fuels will ever be a reality for the pension fund. He sees the main obstacle as fiduciary responsibility laws that require it to put beneficiaries’ financial interests first.

Although it remains to be seen whether the faithful will start dumping fossil fuel stocks, they’re hardly meek when it comes to grilling companies on climate change. “Many religious institutions are speaking up on this,” says MSCI’s Cogan, “though the majority are still preferring to be vocal in the sense of engaging these fossil fuel companies around climate change rather than opting for divestment.”

Kathryn McCloskey, director of social responsibility at UCC’s United Church Funds, believes the 350.org-spurred climate conversations have “moved the needle” within faith organizations like hers. Noting that the UCC has made shareholder advocacy work a priority as a result of its recent resolution, McCloskey isn’t convinced that divestment lies ahead. “Denominations are going to respond to this,” she says. “But are they all going to divest wholesale of the fossil fuel industry? I don’t think that’s going to happen.”

Get more on equities and on investors.