One of the recurring themes that came up during panel discussions at yesterday’s Delivering Alpha conference was the historically low levels of volatility in today’s markets. While some observers are worried that this is a signal that investors have become too complacent about the stock market, at least one manager thinks he has found a way to profit from it.

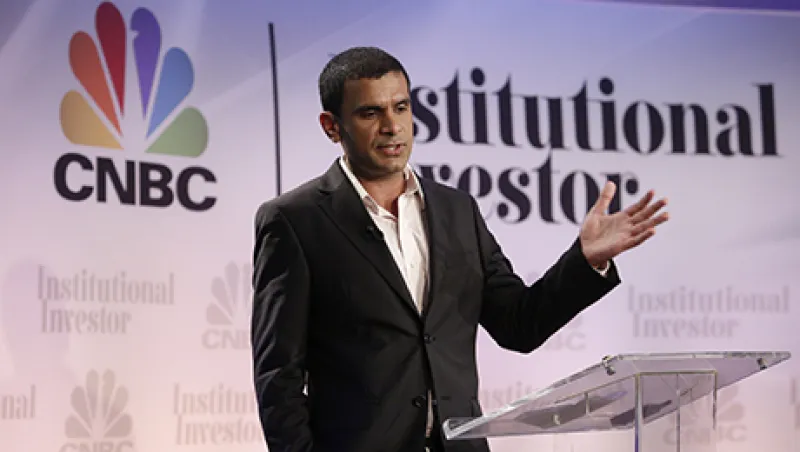

Speaking on the day’s second best ideas panel — this one featuring top trading tips from the hedge fund industry’s next generation of star managers — Deepak Gulati, founder of Zug, Switzerland–based hedge fund firm Argentière Capital, said he has positioned his portfolio to go long volatility. Gulati noted that the Chicago Board Options Exchange Volatility Index, more commonly known as the VIX, hit an all-time low this month. In his view, volatilities across all asset classes and around the world are starting to look “cheap” — which he points out is distinct from being low.

Gulati previously headed proprietary equity trading at JPMorgan Chase & Co., where he produced annualized returns of about 19 percent from 2007 through 2012. His specialty is derivatives; Gulati’s relative value fund focuses on equity volatility and seeks to exploit inefficiencies across the spectrum of equities. His volatility strategies use equity derivatives in search of what he calls “asymmetric payoff potential.”

That’s exactly what he thinks his suggested trade offers. He says the supply of volatility has increased, with sellers dumping options as a last resort in their hunt for yield. At the same time, the demand has fallen, as investment banks have been forced to cut risk, which creates inefficiencies and dislocations. As a result, “You are getting paid to own protection,” Gulati said. He added that he has not seen an opportunity like this since 2007 — a point worth noting since his portfolio generated a 50 percent return for JPMorgan in 2008.

As for how to play the trade, Gulati says he likes cheap options on Asian indexes (Japan, Korea, China), the European financial sector, the U.S. energy sector and technology stocks (including Amazon and Intel). “At this level of volatility, we’re long on everything; we can’t short anything,” Gulati said. “The risk now is far more limited than it was 12 months ago.”

As the panel’s moderator dryly noted, Gulati’s best idea is not one for day-trading hobbyists. Trading volatility can be a complex endeavor best left to experienced hands — and going short volatility can be downright dangerous. That strategy is “an excellent way to get your face ripped off,” as one veteran manager puts it.

But Gulati’s long volatility theme is significantly safer, not least because he is obsessed with minimizing risk. “We believe our edge is in using sophisticated ways to structure and risk-manage those investments, including the use of derivatives,” he told Institutional Investor last month.

Get more on hedge funds.