The Alternative Reality of the Endowment Model

The endowment model pioneered by Yale University’s David Swensen falls short when it comes to the long-term needs of investors and the economy.

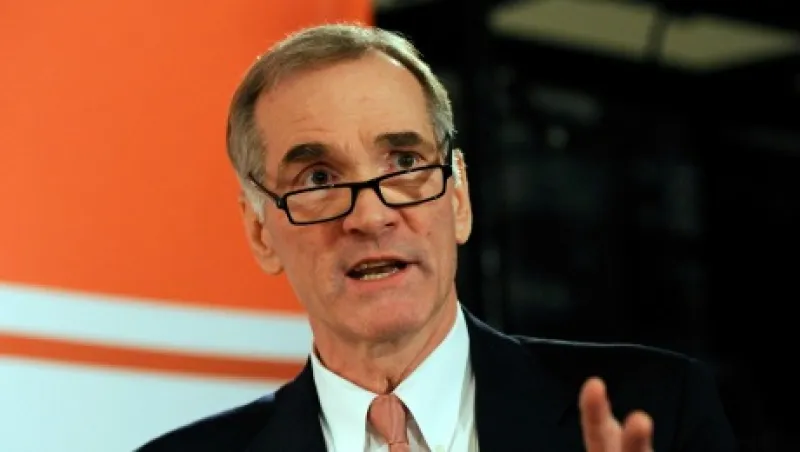

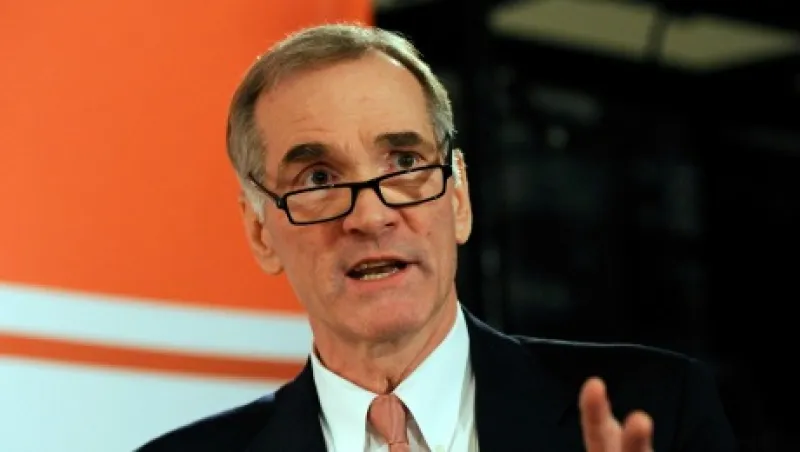

Ashby Monk

September 8, 2014