As August and summer wind down, market risk narratives are centering on the ultimate timing of tightening by central bankers. Historically low rates, market intervention and an ensuing market confidence for risk assets have been with us for years now and, despite no indication of inflation, policymakers in the U.K. and U.S. at least are again reminding investors that the party has to stop at some point. Today’s Federal Market Open Committee (FOMC) minutes release and the Jackson Hole meeting kicking off on Friday will likely remain squarely focused on the true health of the U.S. labor market. But the message remains clear that even if the move towards tightening is gradual, it is also inevitable. As summer trading sees new highs for U.S. equity markets within the sights of investors, the nagging question remaining appears to be when the music will stop.

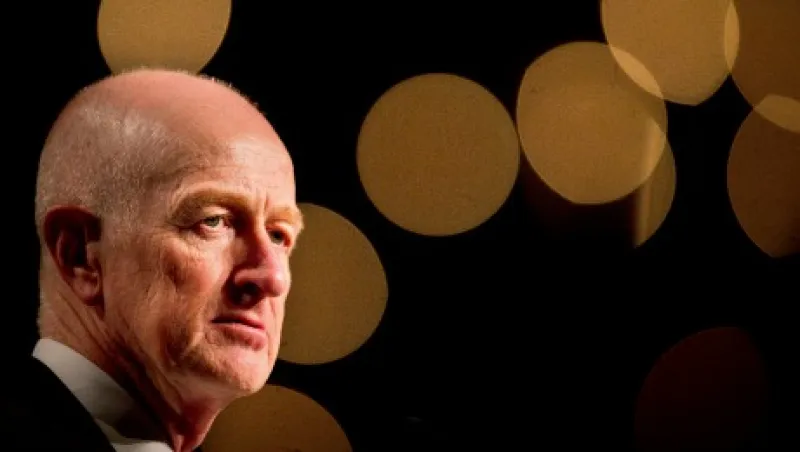

Bank of Australia Governor Glenn Stevens speaks. In semiannual parliamentary testimony today, Stevens said sustained accommodative monetary policy was unlikely to prod any further growth and that organic catalysts would have to emerge to drive economic expansion. Quipping, “I’ve allowed the horse to come to the water of cheaper funding, I can’t make it drink,” he also indicated that Australia’s central bank would likely keep benchmark rates at present levels for the foreseeable future. Critically Steven’s forecasts a moderation in second-quarter 2014 gross domestic product data scheduled for release next month as commodity exports softened during the period.

Minutes from Bank of England and FOMC released today. The most recent meeting minutes are scheduled for release today by the FOMC, providing a window into the current dynamic within the group. In the U.K. this morning, the Bank of England released minutes from the Monetary Policy Committee’s meeting two weeks ago, revealing greater internal division that had been anticipated by many analysts. At 7 to 2, the committee was divided between the majority, led by Governor Mark Carney, who chose to extend historically accommodative rates and a vocal minority that fear the bank now risks delivering shock to financial markets when tightening begins.

Yet more second-quarter 2014 earnings announcements. U.S. companies announcing second-quarter earnings today include Boston–headquartered investment management firm Eaton Vance, Palo Alto–based IT company Hewlett-Packard and Mooresville, North Carolina–headquartered Lowe’s. In Amsterdam today, Heineken announced second-quarter results that bested analyst estimates even as net profits contracted by 1.3 percent versus the prior three months. While currency fluctuations accounted for a portion of the contraction, the global brewer guided expectations slightly lower for the year on softer anticipated sales growth. In response to the better than forecast announcement, Heineken shares rose by 8 percent in trading earlier today.

Argentina pays local bondholders. The government of Argentina announced a fresh bill that will be introduced in the nation’s congress to allow global bondholders to swap existing debts for fresh securities governed by domestic laws only. While the bill will allow the beleaguered nation to circumvent U.S. court rulings and make payments to creditors who accepted earlier haircuts, analysts note that it will not resolve international investor reluctance to take on fresh debts from the nation.

Oil rebounds slightly. Coming off multimonth lows, Brent crude futures rose in trading today as geopolitical jitters and forecasts for a softer Energy Information Administration stockpile report in the U.S. today suggested that the commodity has found a near-term bottom.