The U.S. government and business community are waking up to opportunities in Africa. It’s about time. This is an exciting development for both regions, and investors should take note as they evaluate the merits of dedicated exposure to Africa.

This newfound interest from the U.S. toward Africa is driven by three realizations: first, a growing concern that the U.S. is falling behind China; second, an understanding that Africa presents growth opportunities for selling U.S. goods and services; and third, an appreciation of Africa’s broader geopolitical significance for global security.

China’s increased role in Africa during the past decade has been much discussed. The numbers are staggering. Since 2000, the amount of trade between China and Africa has increased 20-fold, from $10 billion to $200 billion. According to estimates from ratings agency Fitch, the Export-Import Bank of China supplied $67.2 billion in financing for infrastructure projects in 35 African countries — more than the World Bank’s total portfolio in Africa. Driven by a seemingly unending desire for natural resources and a lower-cost manufacturing base, China has extended its reach throughout the continent. In doing so, China is helping build much of the needed infrastructure on the continent. At the same time, China has come under criticism for exploitative policies. U.S. engagement will likely have a different flavor to it.

Africa’s recent economic performance has been nothing short of exceptional. Economic growth has averaged more than 5 percent over the past decade — making sub-Saharan Africa the second-fastest-growing economic region in the world. National balance sheets are in good shape. In historical context, inflation is relatively low. This performance has not only lifted people out of poverty, but it is also helping expand Africa’s middle class by 5 to 6 percent a year. This growing consumer class is a prime target for U.S. consumer goods and services. And the growing presence of large multinational corporations from the U.S., such as Wal-Mart Stores, IBM, Microsoft and Ford Motor Co., is evidence of the growing attractiveness of Africa for U.S. business. The Export-Import Bank of the U.S. has financed more transactions in Africa during the past five years than in the previous ten years combined, including $1.1 billion during the first seven months of fiscal year 2014.

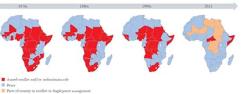

Africa is potentially a pivotal region for the next phase of global conflict. Africa has, however, certainly made significant steps toward peace and democracy during the past three decades. The number of large-scale conflicts has decreased, and recent electoral successes in Ghana, Kenya, Sierra Leone and other nations show that democracy is indeed maturing. But the growing instability in Mali, northern Nigeria and Somalia has reminded the world that challenges remain. In 2007 the U.S. opened military command center AFRICOM, headquartered at the U.S. base in Stuttgart, Germany, which is charged with military relations and security cooperation with African nations and the continent’s surrounding waters. We should expect the U.S. military to have a larger presence in Africa in the years to come (see chart).

(Click to enlarge)

Source: Investec Asset Management, Institute for Justice and Reconciliation

All of this is driving a keener interest from the U.S. toward the continent. But how would the future of U.S.-Africa engagement look?

1. More significant private sector involvement. Much of the recent U.S. engagement on the continent has been through development aid. At approximately $12 billion per year, the U.S. government has provided both general budgetary support to many African nations as well as funds for direct interventions in health, education, agriculture and other capital-starved areas of local economies. Going forward, however, we can expect less government and more business involvement.

Unlike China, for example, the U.S. will not be developing large infrastructure projects on the continent. Instead, it will seek to make it easier for U.S. corporations to sell goods and services and more broadly compete with other actors from China and elsewhere. This intention was made quite clear by then-senator (now secretary of State) John Kerry in January 2013, when he was speaking in his nomination hearing to become the head of the State Department before the Senate Foreign Relations Committee:

China is all over Africa — I mean, all over Africa. And they’re buying up long-term contracts on minerals, on — you name it. And there are some places where we’re not in the game, folks. I mean, I hate to say it: We got to get in it, but it takes a little bit of resourcing. Believe me, somebody is paying for those folks to be over there; somebody is investing in their investment of time. And we have to be prepared because I think what we bring to the table is frankly a lot more attractive than what a lot of other countries bring to the table. People like to do business with American businesses. We’re open, we’re accountable, we have freedom of creativity and other kinds of things. And I think that if we can organize ourselves more effectively in this sector, we can win.

2. U.S.-Africa engagement will be more focused. The U.S. government has made the expansion of power and electricity a key goal in Africa. The U.S. government’s Power Africa initiative has real potential. Two thirds of Africa’s population does not have access to electricity, a basic ingredient of economic growth and development. The Power Africa initiative seeks to combine the efforts of various U.S. governmental agencies — USAID, the Department of Commerce, the Overseas Private Investment Corp. and the Ex-Im Bank — as well as of major U.S. corporations to find solutions to the challenges facing the power sector in Africa, initially focusing on six key countries: Ethiopia, Ghana, Kenya, Liberia, Nigeria and Tanzania.

3. The U.S. investor community will play a larger role. The U.S. is home to one of the largest savings pools in the world, and Africa is the most capital-starved region in the world. There is a natural dynamic here that can be easily directed in a win-win manner. Africa-focused private equity firms have raised record levels of assets during the past decade, peaking in 2007 at $4.7 billion and remaining buoyant since. U.S. investors often incorrectly perceive the risk of investing in Africa and demand returns that are only possible in a few sectors, such as consumer goods. Instead, policymakers and investors should see how to channel these savings into profitable and stable investments in infrastructure, power and other key sectors for broad-based growth on the continent.

On August 5 and 6 President Barack Obama is hosting the U.S.-Africa Leaders Summit in Washington, D.C. This meeting will bring together Africa’s heads of state, as well as top CEOs from the U.S. and Africa, to discuss how the regions can work together more constructively.

Investec Asset Management and the U.S. Chamber of Commerce will be publishing a report providing perspectives on how this relationship may evolve. Investors, policymakers and business leaders should take note.

Aniket Shah is an investment specialist with the Investec Investment Institute, part of Investec Asset Management.

See Investec’s legal disclaimer.

Get more on emerging markets.