With no economic data release scheduled from major economies, markets this morning are awaiting what is likely to be dovish sentiment from the central bankers presenting at the Kansas City Fed’s annual Jackson Hole confab, which kicks off today. More troubling news from eastern Ukraine has brought geopolitical risk back into focus for European markets as a Russian convoy entered the region with neither consent from Kiev nor Red Cross participation. As the Western business week comes to an end, global market sentiment appears relatively unchanged as macro data continues to send mixed messages.

Jackson Hole gets underway. Federal Reserve Chair Janet Yellen is slotted to give the Fed head’s customary address today at the Jackson Hole symposium. Consensus expectations among analysts are for a reiteration of dovish sentiment, as U.S. labor markets remain weak. Also on today’s Jackson Hole roster of speakers is European Central Bank President Mario Draghi, who will also speak on labor markets.

Canadian consumer numbers released. July consumer price data and June retail sales levels are scheduled for release this morning in Canada. Consensus forecasts call for a marginal fall in prices at the cash register for the month that will put the year-over-year level at 2.2–2.3 percent on the back of lower gasoline and food prices. Forecasts call for a slowdown in retail spending from the prior month with analysts ascribing the May figures as inflated by unusual automotive sales activity. Minneapolis–headquartered retailer Target reported sharp losses in its Canadian unit in its recent second-quarter earnings releases. Sears Canada on Wednesday announced losses per share that was more than double the same period in 2013 at 74 cents.

Canadian banks report quarterly earnings. Royal Bank of Canada will report third fiscal quarter earnings today, with forecasts for the bank to register a gain of C$10.56 ($9.64) per share, an increase of 7 percent over the same period last year. Earnings for the banking sector in aggregate are expected to be positive, as national mortgage and commercial lending continue to expand and the capital markets franchises of Canadian financial firms continue to reap the benefits of U.S. regulatory changes that have led U.S. banks to cut back on their trading and investment banking activities. Bank of Montreal, Canadian Imperial Bank of Commerce, Scotiabank and Toronto-Dominion Bank are all on deck to report financial performance next week.

Oil continues to sink. West Texas Intermediate crude futures have declined nearly 4 percent for the week as expanding supplies continue to weigh on the market. Data from the U.S. Energy Information Administration for stockpiles at Cushing, Oklahoma, reported on Wednesday saw crude supplies expand by 1.8 million barrels to a total in excess of 20 million.

Japanese bond markets mull growth and taxes. In a research note released yesterday, Barclays analysts recommended buying Japanese government bonds on weakness, particularly if a postponement of a consumption tax hike, scheduled for next year, weighs on prices temporarily. The increase on consumption taxes in April from 5 to 8 percent had a negative impact on most recent growth data as Prime Minister Shinzo Abe’s government moves better to fund the nation’s massive debt levels, worth 227 percent of gross domestic product. Political support for further increases will be weakened if GDP does not rebound.

Portfolio Perspective: Emerging Outperformance By Consumer Discretionary? — John Kosar, Asbury Research

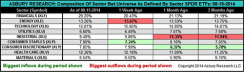

The previously downtrodden U.S. consumer discretionary equity sector is not only showing some signs of life, but also the power to sustain it. The Consumer Discretionary Sector SPDR ETF (XLP), which had previously underperformed the S&P 500 SPDR ETF (SPY) by 7 percent between January 2 and July 25, has since quietly outperformed SPY by 2 percent. Moreover, our own metrics, which track current versus historic market sector-related exchange-traded fund asset flows, show that the biggest inflows over the past one-month and three-month periods have been into the consumer discretionary segment — which has fueled the recent outperformance. As a result, XLP has been the second-best-performing sector SPDR ETF during the past month, posting a 1.6 percent gain versus 0.4 percent in SPY, and the third-best performer over the past three-month period, posting an 8.1 percent return versus 6.1 percent for SPY.

I view these asset flows as fuel for a market trend because they typically lead relative performance. As long as these positive inflows continue, so should recent relative outperformance in consumer discretionary.

John Kosar is the director of research at Schaumburg, Illinois–based financial information services provider Asbury Research.