Since that famous day in July 2012 when Mario Draghi, president of the European Central Bank, pledged to do “whatever it takes to preserve the euro,” the Spanish stock market has risen strongly.

Draghi’s comments were largely meant to quell speculation that Spain would be forced out of the euro zone, and they succeeded, at least in the eyes of financial markets. Since the central banker spoke two years ago, Spain’s IBEX 35 index had risen nearly 66 percent as of August 21, notwithstanding a modest setback in the past two months. In July yields on Spanish ten-year government bonds fell below 2.5 percent — to a two-century low. The yield closed at 2.40 percent on August 21.

Following those dramatic gains, some investors argue that Spain is looking expensive. The MSCI Spain index, excluding financials, has a forward price-earnings ratio of 16. Several fund managers still see strong opportunities, however.

Providing support for this market recovery has been Spain’s economic turnaround. The country’s gross domestic product rose by 0.6 percent in the second quarter from the first, whereas the economies of Germany and Italy shrank. Two years ago few analysts would have predicted that of all EU countries, Spain would beat Germany, which weathered the euro zone crisis so well, in output growth.

El Segundo, California–based Cambria Investment Management argues that Spain offers good value from a macro perspective. The cyclically adjusted price-earnings (CAPE) ratio, a metric popularized by Yale University economist and Nobel laureate Robert Shiller that compares stock prices with average earnings over a ten-year period, stands at 11.7 for the MSCI Spain 25/50 index, far below the historical developed-market average of 16 or 17 and below current developed-market averages are clustered round 15.

“Spain is one of the cheapest of the 45 markets around the world which we look at,” says Mebane Faber, Cambria’s co-founder and chief investment officer. “It’s not the once-in-a-generation buying opportunity that it was in 2012,” when the CAPE ratio fell to 6.5, but “it’s cheap relative both to other countries and to the historical average,” he adds. CAPE crusaders believe that national stock markets tend to return to close to the historical average, creating opportunities for markets valued below the long-term average. The Cambria Global Value ETF, launched in March, invests in the 11 cheapest of the 45 countries’ stock markets, including Spain. The Cambria fund is down 3 percent since its launch.

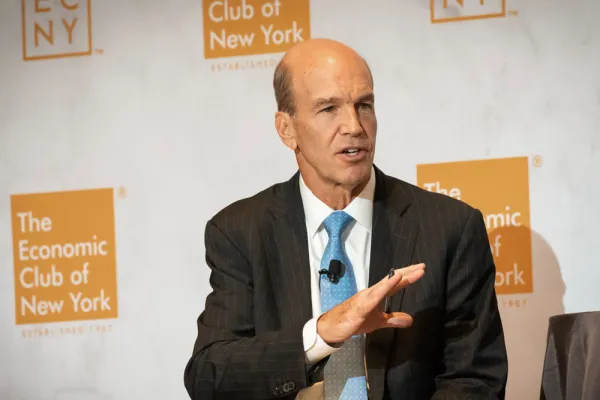

Dean Tenerelli, manager of the European Stock Fund at Baltimore–based $738 billion investment management firm T. Rowe Price, sees promise in Spain from both a macro and a micro perspective. “I definitely think the country is on a strong road to macroeconomic recovery,” he says.

Tenerelli has been so positive about Spanish stocks that the fund’s exposure to Spain reached 13 percent in 2012, “probably” the most overweight the fund has ever been in any country since it was set up in 2005, he says. He notes, however, that the fund invests based on stock specifics rather than taking top-down views on countries. After selling some stocks that reached target prices, the fund’s holding has since fallen to a still heavily overweight 11 percent. Spain’s weighting in the MSCI Europe, the index used by Tenerelli as the basis for his overweight calculations, is 5 percent. Tenerelli sees potential for further purchases of cyclical Spanish stocks. The sector has been hit by a recent aversion to euro zone cyclicals, but that setback does not reflect Spain’s fundamentals, he contends. The European Stock Fund invests in Mediaset España Comunicación and Atresmedia Corp de Medios de Comunicación, which operate Spain’s two remaining big private television stations. The collapse of rivals has shored up their advertising pricing power. Mediaset España, which is 13.45 percent up on the year at €8.53 ($11.33), has a forward price-earnings ratio of 36. Atresmedia, up 48.16 percent on the year at €11.29, has a forward P/E of 28.

For those investors deterred by such relatively high ratios for listed companies, one option is to invest in unlisted small and midsize enterprises (SMEs). This is the approach taken by JZ Capital Partners, a London-listed private equity fund with $900 million in assets that finances European and U.S. microcap companies. David Zalaznick, chair of Jordan/Zalaznick Advisers and JZ International, the fund’s investment adviser, thinks that the continuing credit crunch in the euro zone periphery offers strong value opportunities. Zalaznick estimates that typical multiples for private equity purchases of Spanish microcaps are only five to seven times earnings before interest, tax, depreciation and amortization (ebitda) because of the shortage of bank financing, compared with eight to 10 times in the U.S.

Spanish microcaps are also attractive because of recent labor market deregulation that, according to estimates from Miguel Rueda, head of JZ International’s Madrid office, has cut Spain’s hourly labor costs by 25 to 30 percent. This reform has led Spain “to become the lowest-cost producer in Europe,” he adds.

Some investors remain skeptical that domestically focused Spanish stocks have any distance left to run now that the news of Spain’s economic recovery has been digested by the markets, but they are still interested in Spain’s multinational success stories. Sandra Crowl, member of the investment committee of €49 billion French investment management firm Carmignac Gestion, likes Inditex, the Arteixo, Spain–based company that is the world’s largest fashion group. The company’s Zara retail chain derives only 6 percent of its sales from Spain. Crowl sees Inditex as a good play on a European economic bounce-back. “With Europe recovering, which accounts for 65 percent of sales, we can see new growth here,” she says. Inditex, up 10.18 percent on the year at €22.13, is on a forward P/E of 23.35.

Spanish assets offer the opportunity both for plays on a Spanish recovery and on a broader-based European recovery. August’s euro zone output figures have only sharpened the debate about which of the two is the better bet.

Get more on equities.