In spite of a slowdown in China — and the economies of nations like Brazil that rely heavily on the export of commodities to China — institutional investors and their advisors remain bullish on emerging market equities.

Enthusiasm for this market has pushed up net inflows into emerging market equities from institutional investors and propelled this market category to number one in investment database research, according to data from Marietta, Georgia-based financial data firm eVestment.

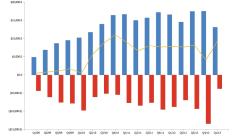

During the first quarter of this year, institutional investors were responsible for $9.3 billion in net inflows into assets in emerging market equity (all cap equities), one of 369 categories used by eVestment to segment 53,000 investment vehicles around the world.

eVestment Emerging Mkts All Cap Equity:

Gross Inflows, Gross Outflows and Net Flows

Chart 1

Source: eVestment |

Not all emerging market equity categories attracted significant new fund flows from institutional investors. For example, emerging markets passive equity received $707.4 million of net inflows in the first quarter. There was even less – $39.3 million – in net inflows into emerging markets small cap. And emerging market large cap assets had net outflow of $2.8 billion to institutional investors.

Favorable views of equity segments in emerging market equities contrasts with a decidedly more skeptical view of equities on a global basis. In the first quarter there were net outflows of $3 billion in equity assets from institutional investors on a global basis, down from $38 billion in net outflows in the fourth quarter of 2012, according to Rich Donnellan, product manager at eVestment. For all of 2012, there was a net outflow of $120 billion from global equity investments.

The outflow of funds from equities on a global basis “simply means investors are saying that the valuations across equity markets are not something they feel like putting a lot of money towards,” says Peter Laurelli, vice president of research at eVestment.

Emerging market all cap equities also became the favorite search category during April, according in eVestment, which publishes a monthly report on search activity. This category received an average of 30.3 searches per investment vehicle tracked in the Advantage database.

| Top 10 Searched Universes for April 2013 | |||

| Name | Avg Search Per Product | ||

| Emerging Markets All-Cap Equity | 30.3 | ||

| ACWI ex-US Large Cap Value Equity | 27.5 | ||

| Global Multi-Sector Fixed Income | 26.5 | ||

| ACWI ex-US All Cap Growth Equity | 25 | ||

| Emerging Mkts Large Cap Equity | 24 | ||

| Emerging Mkts Small Cap Equity | 23.6 | ||

| ACWI ex-US All Cap Value Equity | 22.5 | ||

| ACWI ex-US All Cap Core Equity | 22.1 | ||

| Global Balanced - Hedged | 21.6 | ||

| Floating-Rate Bank Loan Fixed Income | 20.8 | ||

| Source: Data from eVestment | |||

A number of factors are driving institutional investor interest in emerging market equities, according to Michael Ho, chief investment officer for active emerging market equities and global macro at State Street Global Advisors.

| Top 10 Searched Products for April 2013 | |||

| Product Name | Quantity of Searches | ||

| Walter Scott: Global Equity | 236 | ||

| Aberdeen: Emerging Markets Equity | 225 | ||

| Aberdeen: Global Equity | 178 | ||

| Eagle Capital: Eagle Equity | 174 | ||

| Sands Capital: Select Growth Equity | 174 | ||

| PIMCO: Unconstrained Bond | 166 | ||

| Thornburg: Thornburg International Equity Strategy | 160 | ||

| Brown Advisory: Brown Advisory Large Cap Growth | 155 | ||

| Eaton Vance: Senior Floating-Rate Bank Loans | 148 | ||

| Brandywine Global: Global Opportunistic Fixed Income | 145 | ||

| Source: Data from eVestment | |||

One trend driving investor interest is a renewal of risk appetite over the last five months for assets that can generate higher returns in the future, according to Ho. Equities represent one way to generate higher returns — “but why emerging market equities?” he asks. Part of that interest lies in the fact that simply investing cash in emerging market currencies can yield 3 percent to 4 percent from currency appreciation. Investing in equities can provided even higher yields, Ho explains. “Rising currencies and rising interest in emerging market equities could be tied together,” he adds.

Ho agrees with other observers that current prices for equities in emerging markets make them comparatively less expensive than equities in the developed markets. “People are looking ahead instead of looking behind. The fact that developed markets have done well in the last six months while prices have fallen in the emerging markets means that emerging market equities are now even cheaper in comparison. It may be an even better time to rebalance their portfolios,” he says. An added attraction is that emerging markets typically have a higher return on equity for investors. “Depending on the year, it’s typically a few 1 or 2 or 3 percentage points higher ROE than in the developed markets,” he says.

A lot of emerging markets like Brazil, where economies are heavily reliant on the export of commodities, much of it to fuel China’s massiveinfrastructure investment will face a challenge as China’s growth slows, “as it inevitably must do,” says Ho. Investors will need to decide how this will play out and to what extent future earnings in some exporting companies based in commodities may be less than current forecasts.

An alternative view is that “we are in a positive feedback cycle where growth is going to continue, consumption is going to increase, the building of manufacturing facility infrastructure is going to continue and therefore commodity prices are going to be fine,” he says. But this is not assured and investors worry the opposite may occur. “The market is grappling with that at the moment,” says Ho.