As part of its move into international equities, from the beginning of the crisis in 2008 Artisan Partners purchased shares in European multinationals with attractive growth prospects in developing nations. The $85 billion San Francisco–based investment manager acquired shares in such companies as Unilever, an Anglo-Dutch consumer products maker, and Anheuser-Busch InBev, a Brazilian-owned brewer based in Leuven, Belgium.

"A lot of great franchises were priced for global economic meltdown" despite the fact "they have products that people are going to consume regardless of what happens in any global scenario," says Andrew Euretig, portfolio manager for global equity strategy.

Artisan's investment choices are paying off for its $22.2 billion non-U.S. growth fund strategy, which is outperforming the median return for its peers during the first half of the year, according to Marietta, Georgia–based eVestment, which tracks the performance of 53,000 investment products around the globe. During the first half of 2013, the Artisan Non-U.S. Growth strategy had a return of 7.4 percent, ranking in the 7th percentile — that is, very near the top. The median return for the eVestment peer group — the EAFE All Cap Growth Equity — was 4.77 percent.

Interest in Artisan is part of a broader shift in focus this year by investors. U.S. institutional investors in particular hear opportunity knocking as expectations rise for higher returns in international equities. Evidence of interest in this broad asset class can be found in the June data on search activity by investors, advisors and money managers. European investors, too, have shifted more assets into international equities, but on a smaller scale than in the U.S.

"You have U.S. investors kind of leading the charge in allocating assets into global equity," observes Rich Donnellan, product manager at eVestment.

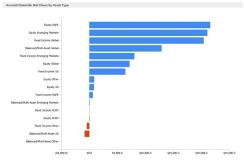

The data reveal the size of this shift. During the first quarter, U.S. investors poured $50.6 billion in net new cash into equity investments outside the United States — their largest broad asset-class shift for the quarter, according to eVestment. European investors, excluding those in the U.K., put $9.7 billion in net new flows into international equities in the quarter, the firm's data show.

Traders work on the floor of the New York Stock Exchange (NYSE) in New York, U.S., on Friday, July 19, 2013. U.S. stocks fell after benchmark equities gauges rose to records yesterday, after disappointing earnings from Google Inc. and Microsoft Corp. overshadowed better-than-forecast results from General Electric Co. Photographer: Scott Eells/Bloomberg

Scott Eells/Bloomberg

Source: eVestment |

What's driving the move into international equities? Primarily, it is the prospect for improving global growth, both in developed and emerging markets economies, according to Todd Rosenbluth, director of mutual fund research at S&P Capital IQ in New York.

One key driver is the expectation that Europe will end its recession by year's end and resume "slight economic growth" next year, according to Rosenbluth. "We think investors are feeling more comfortable about investing in European equities, especially large cap companies and financials in northern Europe."

In addition, Rosenbluth adds, emerging markets remain attractive despite slowdowns in some nations. For example, even though China's economic growth has slowed to an annual pace of 7 percent to 7.5 percent, "it still offers stronger growth prospects than what we are seeing in the U.S. and other developed nations," he says.

For U.S. investors, the first quarter move into international equities was a stark departure from the allocation shifts made in the fourth quarter of 2012. Then, the most significant shift was a net $78.1 billion reduction in investments in U.S. equities coupled with a net flow of $61.5 billion into U.S. fixed-income investment products. The Federal Reserve Board launched its open-ended quantitative easing program late last year, sending bond yields tumbing and bond prices climbing.

U.S. investors found something to like across several international equity classes, according to the data. The largest international shift was a $26.1 billion net increase in holdings of European, Australasia and Far Eastern equity products. U.S. investors also put a net $21.1 billion into emerging market equity funds and $7.2 billion into global equity funds, which invest across the world.

Contintental Europe showed a strong preference for emerging markets equity funds. They put a total of $7.3 billion in net new investment into that sector, followed by a $2.5 billion increase in holdings of U.S. equity products.

Investor interest in international equities can also be seen in search activity by institutions, advisers and money managers around the world. International equities represented 7 of the top 10 investment universes searched in June, according to eVestment.

Individual investment funds in the international equity sector took six of the top 10 slots for the total number of searches received. The Walter Scott Global Equity Fund of Edinburgh, Scotland, was number one with 143 searches. Search activity for a given fund or category can show up later as a shift in allocation by investors. It is difficult, however, to tell just from searches whether or not investors are considering adding holdings or reducing them, according to Donnellan.

Artisan's non-U.S. growth fund ranked eighth in eVestment's top 10 searched funds and products, with 118 searches in June. Although Artisan's strategy outperformed most of its peers in the first half of 2013, most of the other international equity funds ranked in the top 10 did not, according to eVestment.

Read more about equities.