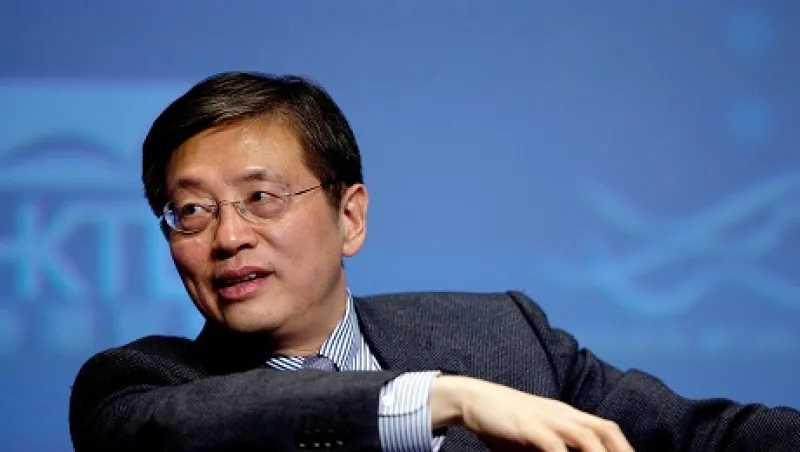

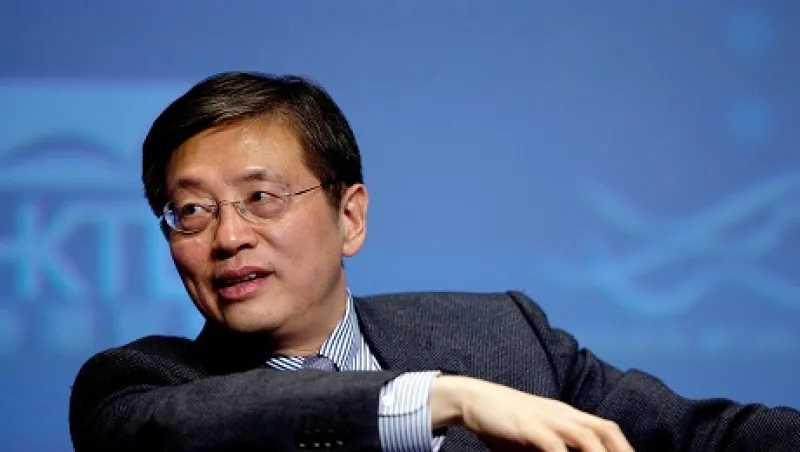

China Set to Appoint Shanghai Vice Mayor as Head of CIC

Tu Guangshao will bring liberal credentials and connections to President Xi to China’s sovereign wealth fund.

Allen T Cheng

May 16, 2013