Every year, TheCityUk publishes a sort of ‘state of the state funds’ report detailing the behavior of sovereign funds around the world. And, as luck would have it, this year's report just came out: “Sovereign Wealth Funds 2013”.

Who the heck is “TheCityUK”, you ask? Good question. As I understand it, TheCityUK is sort of a lobby group for London’s financial services industry; its mission is to reinforce London’s status as a global financial center. So it’s no wonder that this organization has decided to focus its attention on the rise and implications of sovereign funds; these funds are the big new players in financial markets (... and, truth be told, they're also one of the few big threats to London's dominance of global finance.) Anyway, let’s get straight to the most interesting bits of the report, shall we:

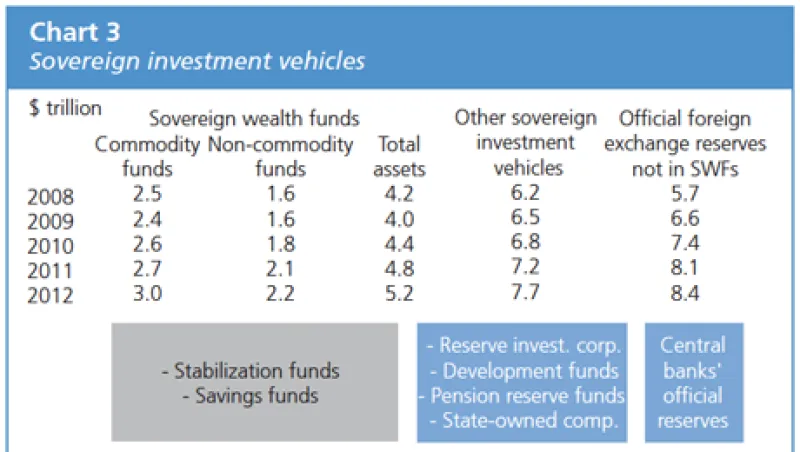

- Sovereign funds are big and continue to get bigger: “Assets under management of SWFs increased by 8% in 2012 to a record $5.2 trillion (Charts 1, 2 and 3). There was also an additional $7.7 trillion held in other sovereign investment vehicles, such as pension reserve funds and development funds.”

- Sovereign funds have predominantly focused their direct investing in the financial services sector since 2005 (which, again, helps to explain why TheCityUK is paying attention): “The financial services sector has been the largest recipient of SWFs’ direct investment since 2005 accounting for around a third of value invested. The energy sector and utilities/infrastructure were also significant recipients of direct investments during this period. Sectors which have seen the biggest increase in investments during 2012 include consumer goods, information technology, materials and real estate. Media and entertainment, financials and telecommunications on the other hand, showed the largest decline.”

- Sovereign funds favorite market is the good old US of A: “The US has been the leading destination for direct investments by SWFs since 2005, accounting for around a fifth of the total during this period. The UK followed with about one-sixth of the total. Other important destinations included China, France, Switzerland, Germany and Qatar.”

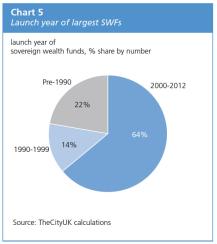

- And, last but not least, the most interesting data-point in this report is the fact that more sovereign funds have been set up in the past decade than in all the years’ prior. (See chart below.) Think of it this way: if you zapped yourself back to the year 2000 in a time machine, 64% of the sovereign funds that are active today simply would not exist. I think that's astounding.

Anyway, you can download the whole report here for free.