Many market observers have recently begun arguing that bond investing is going to be a hard slog for a long time. In an era of financial repression and zero-bounds on yields, it is not surprising that investors are asking if traditional issuance-based bond benchmarks, like the Barclays U.S. Aggregate Bond Market Index, with their increasing durations and lower yields, are still appropriate investments. Investors must consider the asymmetric risk-return profile of duration exposure in the context of the possibility of rising interest rates, and we believe that they need to not only think carefully about the challenges ahead for fixed-income markets but also potentially act to protect portfolios.

The main question that arises in the face of these challenges is how best to deal with the potential risks — specifically that of rising rates — while also balancing them against any new risks that action could engender. To the investor who is set on addressing this issue, there are a few courses of action to choose from, three of which we explore below.

Increase tracking error through sector allocations or yield curve positioning. One potential response to the challenges of the current rate environment is to look for sources of increased returns in exchange for taking increased risk. This may be done to make up for the yield foregone through defensive yield-curve positioning, or to offset losses from holding the interest rate risk level held by the benchmark that ends up dragging on performance. There are many versions of this approach.

The most conservative version involves optimizing the benchmark: Within the traditional benchmark, investors can choose to increase tracking error, that is, break from the benchmark, for example by introducing curve bets (remaining duration-neutral while underweighting the maturities with the most asymmetric return profiles) or asset allocation trades (reducing exposure to securities that are convexly related to rates — like mortgage-backed securities — and replacing them with a moderate amount of investment-grade credit spread risk). This is a low-risk response at the portfolio level, but also generates limited outperformance in a rising-rate environment.

A more aggressive version would involve giving asset managers more freedom to deviate from the benchmark by allowing them to invest in higher-yielding (or potentially riskier) non-benchmark sectors (Treasury Inflation Protected Securities, high-yield and bank loans, or emerging-markets debt). Examples of this would be to migrate capital from so-called Core to Core-Plus bond portfolios (that is, shifting capital to mandates that allow for greater sector diversification outside of the Barclays Aggregate Index). Another approach worthy of consideration can be thought of as a portable-alpha-style strategy, which is to replicate the principal risk of a bond benchmark synthetically through total return swaps (derivatives contracts) and then place the cash that is freed up into a fixed-income hedge fund. These types of options involve a higher degree of trust and obviously carry worse potential downside. These options are also usually more expensive to implement.

Abandon the benchmark and go opportunistic. Another alternative for investors is to declare the market benchmark “broken” and move away from it in favor of a more total-return-focused, opportunistic and flexible product. This type of product may have a completely new benchmark based on nongovernment securities or may simply be benchmarked to cash returns. Many strategies today seek to replace duration risk (interest rate risk) with credit risk (risk of default), given the fact that in a low-rate environment interest rate moves present a greater risk than opportunity. If the manager has skill, these portfolios may be the closest thing to the free lunch of low duration but high income.

The approach is not without its challenges. First, with less of an emphasis on longer-maturity bonds, these portfolios may no longer fulfill the investors’ original intent of playing a diversifying role within a policy plan’s broader portfolio. The negative correla<>tion of duration with equity during stressed periods would not be as powerfully at play. If one is certain that global growth is back on track, there should be no issue. However, in both a slow growth and a negative growth environment, this could mean losing some of the “anchor” function that fixed income has traditionally played in investment portfolios.

Secondly, taking on less interest rate risk may result in a drop in yield that these types of portfolios often respond to by adding a different kind of risk (typically credit risk in the form of high-yield or securitized credit). Unfortunately, this added risk is often significantly correlated with the equity risk in a plan’s portfolio, such that a plan ends up with an equity-like exposure but without the upside potential that equities can provide. In addition, these new credit risks may do poorly precisely in a rising-rate environment, as rates sell off and high-yield bonds extend out in terms of spread duration.

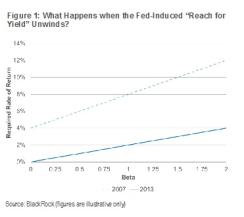

Arguably, the security market line has both shifted lower and also flattened, as the drop in the risk-free rate has pushed previously fearful investors further out on the risk spectrum, causing required rates of return at higher levels of risk to fall faster than at lower levels (see Figure 1). It is unusual, but there have been periods historically where both credit and duration returns have been negative — the rate-hike cycle of 1979-1980 in the U.S. is a prime example.

Buy insurance via interest rate hedge overlays. One final and perhaps underappreciated alternative is to retain a traditional policy benchmark (such as the Barclays Aggregate Index) but identify and manage the specific risk one is concerned about — in this case, the asymmetry of expected bond returns. Once the explicit risk is identified, it can be hedged by buying insurance. For duration risk, this insurance takes the form of buying put options, which pay out in the event of rates rising above a prespecified threshold. There are many different potential structures, from plain-vanilla puts through to caps and corridors, and most of them have limited downside, which is known in advance. Options can be overlaid on a variety of portfolios and are well suited to hedging scenarios rather than betting on a specific rate outcome.

In summary, there are a few different ways of dealing with the challenges of duration in traditional fixed-income benchmarks. What is nice about the first and third options is that they retain the bulk of the bond exposure while still managing the asymmetry (although, as our research has shown, to vastly different degrees). Absent exceptional portfolio manager performance, abandoning a benchmark works primarily in a vigorous growth scenario and conversely may not do as well in both a low-for-long and recession environment; so the choice one makes will also depend on the macro outlook. For investors who will not (or cannot) treat the asset class as a trade, at least there are some alternative routes to follow to protect fixed-income portfolios from the possibility of rising interest rates.

Sami Mesrour is a member of BlackRock’s Asset Allocation Model-Based Fixed Income Portfolio Management Team.