Emerging-markets currencies have begun 2013 in slightly better form than their equity counterparts.

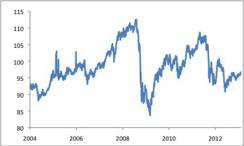

The JPMorgan Emerging Markets Currency index has risen 0.7 percent against the U.S. dollar so far this year, while the normally higher-beta emerging-markets equity market has been roughly flat. Moreover, emerging-markets currencies’ mild appreciation against the dollar has come against the considerable headwind of yen weakness, which has generated additional gains for emerging-markets foreign exchange against a broader, trade-weighted basket. But even considering the improvement both this year and in late 2012, emerging-markets currencies remain well below previous peaks. The index stands 14 percent below its 2008 high and more than 11 percent under the level reached in April 2011 (see Chart 1). Given today’s still-favorable levels, a likely acceleration in the emerging-markets business cycle this year — already evident in China and elsewhere in emerging-markets Asia — should provide support for a further climb by EM currencies.

Chart 1: JPMorgan emerging market currency index

Chart 1

Source: Bloomberg; data through February 11, 2013 |

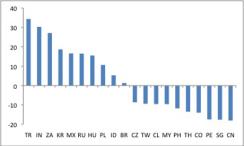

Chart 2: Spot FX rate versus 2007 average (%)

Chart 2

Source: Bloomberg, JPMAM; data through February 12, 2013 |

Taking those currencies out of the picture leaves South Korea and Mexico, countries that share two characteristics. First, their currencies tumbled particularly sharply in the early days of the global financial crisis, in part because of worries related to local corporate positions in foreign exchange derivatives. Second, they represent possibly the two most liquid emerging-markets currencies. As a result, they have been used extensively by traders in the past several years as proxies for the overall risk environment, thus selling off noticeably during tense periods for global markets. Today’s calmer atmosphere should lessen that persistent drag, allowing fundamental cheapness to show through. Moreover, both economies are levered to a cyclical pickup in global manufacturing after last year’s extended industrial funk.

Additionally, Mexico stands to benefit from the structural revival of manufacturing activity in the United States. Admittedly, in the short run, the South Korean won faces a formidable obstacle in the form of yen depreciation, considering the sizeable overlap in export products between Korea and Japan. Recent won depreciation very likely reflects this blow, and a return to appreciation will likely occur only once the yen has settled.

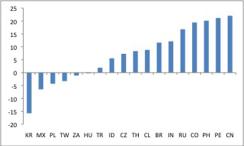

Inflation differentials matter less for currencies today than in the era of high emerging-markets inflation (especially in Latin America). But both inflation and trade baskets deserve consideration in evaluating foreign exchange cheapness. Chart 3 shows the level of each country’s real effective (inflation-adjusted and trade-weighted) exchange rate, as of December, compared with the precrisis period (here taken as the January 2006 to June 2008 average).

Chart 3: Real effective exchange rate vs. pre-crisis period (%)

Chart 3

Source: JPMSI, JPMAM; data through December 2012 |

The overall emerging-markets foreign exchange level, then, hides significant cross-country differences. Mexico and South Korea stand out as currencies that have lagged in their recoveries after especially large earlier depreciation. Favorable performance of each country’s external accounts — Mexico’s long-standing current account deficit has just about closed, and Korea now runs persistent surpluses — provides partial corroboration of their competitiveness. Both currencies seem particularly likely to benefit from this year’s revival in emerging-markets growth — especially, in the case of Korea, once the yen’s depreciation has run its course.

Michael Hood is a market strategist for J.P. Morgan Asset Management.