Companies around the world enjoyed especially high profit margins in late 2012. But can this trend be maintained or is profitability poised for a collapse that might threaten stocks this year?

Toward the end of 2012, net profit margins of U.S. companies reached historic peaks of 7 percent, about 140 basis points above the 15-year average. International companies also posted high margins of about 6 percent. Globally, net margins are about 24 percent higher than the annual average over 15 years. However, questions are being asked after margin expansion stalled during the third quarter of 2012.

In a recent blog, I explained why weak pricing power — if it persists — could make it harder for global companies to meet earnings expectations this year. Despite meeting lowered consensus estimates in recent reporting seasons, pricing power remains scarce and companies have generally lowered their earnings guidance for 2013.

Still, profit margins are complex. To solve the profitability puzzle, we dissected global data on net profit margins to find out whether they are predestined to revert from record highs to long-term averages and to identify vulnerable sectors or regions. This is the most important issue affecting future earnings growth and it determines whether equities are attractive in the longer term.

First, we looked at ebitda (earnings before interest, taxes, depreciation and amortization) margins, which capture the pre-tax benefits of pricing, leverage, productivity and outsourcing. We found that the increase in ebitda margins for nonfinancial companies accounted for only 20 percent of the higher profitability. Most of the higher net margin came from lower depreciation, lower taxes and lower interest costs (figure below).

Historically, ebitda margins were adversely affected by a collapse in demand, higher labor costs and prices of raw or intermediate materials. Generally, we don’t expect developed economies to face a recession or significant inflationary labor pressures in 2013 that would undermine profitability.

Interest rates are also unlikely to cause problems. Even if rates increase from extreme lows in response to a stronger economic recovery, it also means stronger sales are likely to offset the burden of higher financing costs. Furthermore, corporations have close to $2 trillion of cash, much of which is invested in short-term fixed-income instruments, while debt tends to be longer-dated. So higher rates would initially benefit margins.

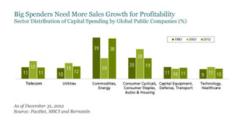

Depreciation is the weak link in the profit margin chain. This risk is really a function of capital spending, which surged to $2.4 trillion in 2012. Industrial commodities and energy accounted for half of the total, while the share of consumer cyclicals and telecom declined. This mix is remarkably similar to capital spending in 1983 — the last cyclical peak for natural resources (figure below).

Our analysis shows that a rise in average capital spending-to-depreciation over one-, three- and five-year periods has a clear impact on the following year’s growth in depreciation — and tends to trigger lower profit margins. In other words, companies that have spent too aggressively are most likely to face a rise in depreciation that could compress net profit margins. The reason is simple: Big spenders need more sales growth to maintain profitability.

Sectors such as energy and commodities — where capital spending has been high — are especially vulnerable to a compression of margins. Since Australia and Canada are home to many large-cap companies in these sectors, they may face more threats to profitability than other regions.

Elsewhere, we think profitability should remain stable. In most other sectors, capital intensity is lower than the 15-year average and financial leverage is generally down. So if you avoid big capital spenders, companies with attractive valuations based on normalized earnings, high profitability and above-average growth prospects should be able to deliver attractive returns as skepticism over profit margin sustainability recedes.

Vadim Zlotnikov is chief market strategist for AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.