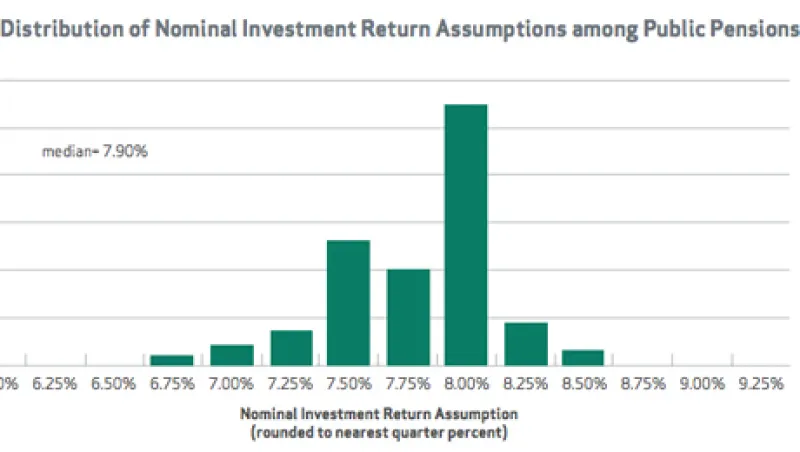

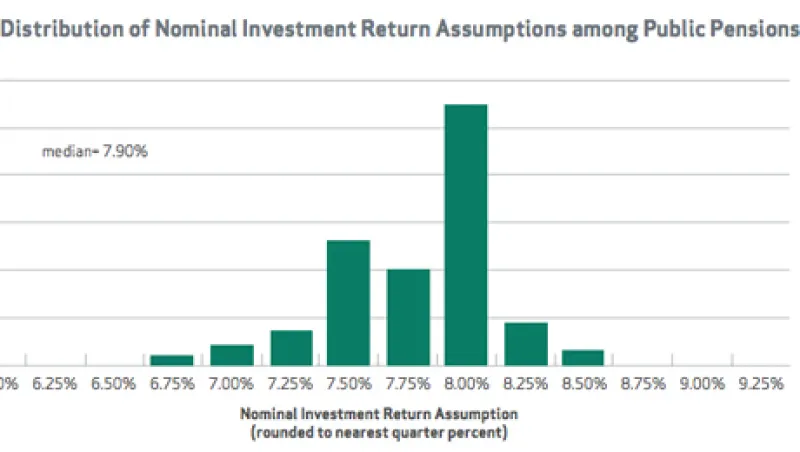

Discount Rates and Pickup Lines

The discount rate of public pension funds is one of the most pressing topics of our generation, so I do think it should be a more frequent topic of conversation…

Ashby Monk

February 5, 2013