Brazilian Finance Minister Guido Mantega made headlines in September 2010 when he raised the alarm about the possibility of a “currency war.” The main concern for Brazil, and a number of other countries, was that the actions the U.S. was taking to try and loosen monetary policy via quantitative easing (QE) were pushing down the value of the U.S. dollar (USD), and thus pushing up the value of a number of currencies against it. This phenomenon led a large number of countries to try to stem the appreciation of their currencies by absorbing the excess U.S. dollars that were flowing into their countries, thus accumulating large currency reserves. In 2010, this phenomenon was largely a concern for emerging markets, but recently currency strength has become a concern for the major central banks of the developed markets too.

Central banks around the world are clearly taking a more active role in managing their currencies. The actions range from explicit intervention in the markets to more nuanced verbal intervention to increases in quantitative easing programs. As currency investors, this changing nature of central banks’ reaction functions to their currency creates both challenges and opportunities. As central banks become more activist in currency management, it is important to adapt the investment process to take account of the new reaction function. And while the traditional drivers of currency markets still have an effect, there are new factors that must be taken into account in any investment decision. It is key for currency investors to understand how this “new world” of nonconventional monetary policy is changing the markets in which they trade.

Open economies with free-floating exchange rates typically view their exchange rate as a stabilizer in times of economic stress. As the economy slows, and the central bank cuts interest rates, investors are given a lower level of compensation (the interest rate) for holding a given currency, causing a reduction in marginal foreign demand, which in turn results in a depreciation of the currency. That process should act as an economic stabilizer in that it should stimulate exports given the price of domestically produced goods would then be cheaper for foreign consumers, and thus more competitive.

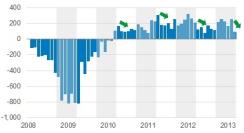

However, a problem for many of the central banks of the developed world is that the interest rate channel is no longer open, as they have reduced interest rates towards zero (see Figure 1). While there is scope for central banks to take interest rates negative, most have indicated that they would be reluctant to do so, hence the exchange rate is one of few policy tools remaining. To that end, there are a number of explicit and implicit actions that central banks have taken to weaken their exchange rate. These range from direct actions such as intervening in the open market to policy action not solely directed at the currency, such as quantitative easing. The effect of QE from global central banks on currencies is a matter of debate, but it is broadly accepted that QE by the Federal Reserve led to a weakening of the USD. While the Fed claims it still believes in a strong dollar, it does seem the weakening of the USD is welcome and is a “positive externality.” This weakening of the U.S. dollar has brought about much criticism from emerging-markets economies, and more recently other developed-market central banks seem to be acting verbally and explicitly to weaken their currencies.

Figure 1: Policy Rates have Sat at Extraordinary Low Levels in Developed Economies

Figure 1

Source: Bloomberg, data as of January 17, 2013 |

Another, and less explicit, way in which a central bank can weaken its currency once rates have reached the zero bound is via quantitative easing. QE can weaken the currency by two channels: firstly by bringing down interest rates further out the yield curve, thus making “safe” fixed-income investments less attractive to foreign investors. Secondly, conventional economic theory would suggest the increase in the money supply brought about by the expansion of the central bank’s balance sheet should lead the currency to depreciate. With a number of central banks around the world continuing to expand their balance sheets, the efforts to weaken an individual currency can be undermined by the actions of other central banks.

The international community broadly supported the intervention in the Swiss franc given that it was understood that the circumstances were somewhat unique and that the real exchange rate had appreciated significantly beyond what could be justified by the economic fundamentals of Switzerland as a result of safe haven flows out of the euro zone. However, the large Japanese intervention did draw criticism, most notably from the U.S. Treasury in their “Semiannual Report to Congress on International Economic and Exchange Rate Policies.”

The actions taken by the Bank of Japan in 2011 did stem the appreciation of their currency temporarily, but it remained at a level that the authorities in Japan deemed to be too strong relative to the fundamentals of the Japanese economy. As a result, the recently elected government led by Prime Minister Abe has engaged in significant verbal intervention to weaken the JPY. This has included signaling the intent to put in place a 2 percent inflation target at the Bank of Japan, thus encouraging the BoJ to institute a much larger QE program. While this larger QE program would be in line with actions taken by the Fed and the Bank of England, another proposal by the Japanese government of an overseas bond buying program of up to $500 billion would be far more controversial. This would be specific action to weaken the JPY over a period of time by buying the bonds of other countries. Given the rhetoric we saw following the direct intervention in the JPY in 2011, an overseas bond buying program to weaken JPY would likely draw further criticism, and there could be potential for retaliatory action by other major economies, bringing the currency wars into sharp focus.

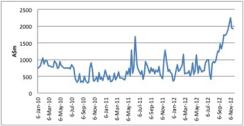

Central banks in developed markets have also become concerned about the reaction of their currencies in any global slowdown. Both the Riksbank in Sweden and the Reserve Bank of Australia (RBA) typically expect to see their currencies weaken during a slowing of growth, which leads them to cut interest rates. However, during recent quarters when global growth has notably slowed and risk assets have been weak (particularly last year, before the European Central Bank pledged to do “whatever it takes” to save the euro), neither the Australian dollar (AUD) nor the Swedish krona (SEK) has responded in the “usual” way, despite both central banks cutting rates in this period. There are two main reasons for this: firstly, while both of these central banks have been cutting rates, other central banks around the globe have also been cutting rates, or extending their QE programs, thus the net effect can be a stronger SEK or AUD. Secondly, there is continued demand for triple-A assets, which has resulted in strong flows into both Swedish and Australian bond markets, causing further strength in the currency. Both the Riksbank and the RBA have reacted to this unexpected and unwelcome currency strength. The Riksbank has made various attempts at verbal intervention, using official speeches and the minutes of its meetings to talk down the currency. Until recently the RBA had also used verbal intervention as their main tool to limit exchange rate strength. However, over the last few months it seems the RBA has turned to more significant intervention. Deposits at the RBA from other official institutions have risen over recent months, and while the RBA has not explicitly announced that it is absorbing flows from other central banks, this data would point to the fact that the RBA is absorbing these inflows by creating AUD, and thus avoid any direct market transaction in the exchange rate.

Figure 2: Australian Central Bank has been Absorbing Capital Inflows from Official Institutions

Figure 2

Source: Reserve Bank of Australia, data as of November 21, 2012 |

Gordon Ibrahim, director, is a portfolio manager for BlackRock’s Model-Based Fixed Income team.