This just in: $57 trillion (!) in infrastructure investments will be required between today and 2030, according to new research by McKinsey. That's a lot. And this begs an obvious question for the global community of institutional infrastructure investors: In what market segments, and in which geographies, will the investment opportunities manifest? Because we know that more investment opportunities will be coming, as the cash-strapped governments of the world simply cannot fund this $57 trillion without the help of the private sector. So, I'll ask again, where will most of these infrastructure opportunities be coming from? To answer that, I grabbed two nice charts from the report that help to clarify things:

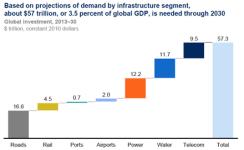

First, let’s look at the market segments:

So, while we hear a lot about ports and airports today, it looks to me as though it will be roads, power, water and telco that will offer the most opportunities in the years ahead. Next, let’s look at the geographic opportunities:

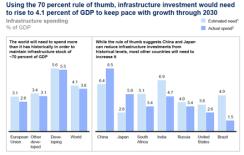

Again, while we hear a lot about China’s infrastructure needs, it looks to me as if Brazil, India and South Africa represent the biggest opportunities today for investors.

That’s all very interesting and valuable to know and understand. However, there are two big constraints raised by this report that need to be addressed:

First, the report notes that there is currently only around $2.5 trillion in assets available from institutional investors for investment in infrastructure. Clearly, this is not enough to fill the gap between the "infra spending need" and the "public funds available". So we still have a lot of work to do to unlock more capital on the institutional investor side of things. Recall that there's roughly $70 trillion in long-term investors today... but these investors aren't interested in the asset class due to unattractive access points. We’re trying to fix this.

Second, the report notes that of the $57 trillion in infrastructure needs, upwards of 70% of this pipeline is in Greenfield assets. As I’ve noted several times, it can be very challenging to attract institutional investors into development-stage projects. They just don't know how to fit the construction risk into their standard infrastructure models and siloed investment operations. And so, once again, this implies that we've got a lot of work to do to help change the way institutional investors think about risk and infrastructure investing generally. Once again, we're working on this...

Anyway, the McKinsey report is quite interesting. Get the whole thing here.