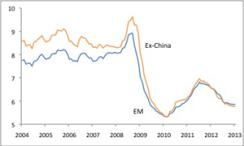

Ongoing weakness in emerging-markets growth has extended a monetary policy easing cycle that has been under way since mid-2011. As of September 2012, eight of the 19 major emerging market central banks that we track closely have cut policy interest rates (not counting Turkey’s central bank, which also eased rates in somewhat more complicated fashion). Even with no moves from heavyweight China, the aggregate emerging-markets policy interest rate has fallen 14 basis points since September, and emerging-markets policymakers have unwound about two thirds of the tightening they implemented in 2010 and early 2011 (see Chart 1).

This year, however, seems likely to bring significant improvement in emerging-markets growth. The business cycle already appears to have turned in China and, perhaps less convincingly, elsewhere in emerging-markets Asia. Following exceptional weakness during the second quarter of 2011 through the third quarter of 2012 — when growth in emerging-markets gross domestic product averaged 5.0 percent, nearly a point and a half below its estimated potential rate — the expansion is likely to return toward its trend rate during 2013. This pickup owes to earlier policy easing (monetary but also in some cases fiscal), and the end of an extended inventory-related weak patch for global manufacturing, to which emerging markets in Asia, in particular, are heavily exposed.

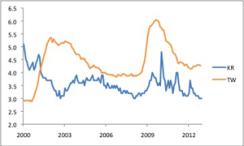

The stronger growth atmosphere will likely shift the direction of emerging-markets monetary policy, beginning in Asia. Having experienced strong rebounds in the immediate postrecession period, these economies appear to be operating with much less slack than is the case in Europe, the Middle East and Africa or parts of Latin America. Unemployment rates in Asia stand more or less in line with long-run averages (see Chart 2). With policy interest rates already fairly low and growth in the process of turning, the monetary easing process in emerging-markets Asia has likely come to an end. Indeed, the last set of rate cuts in the region came in October 2012. (India, where the business, inflation and policy cycles are following an idiosyncratic rhythm, represents a possible exception, and rates may fall there later this year.)

Chart 1: EM policy interest rate (% per annum, GDP-weighted)

Chart 1

Source: Source: JPMSI, Bloomberg, JPMAM; data as of January 2013 |

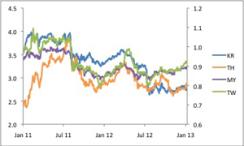

Assuming the business cycle in emerging-markets Asia continues to gain strength, then another shoe will likely drop in the rates market. At some point, swap curves will begin to price in rate hikes. This development, however, may lie a few months down the road, for three reasons.

Chart 2: Unemployment rates (% of labor force, sa)

Chart 1

Source: JPMSI, Bloomberg; data as of December 2012 |

Chart 3: 2-year swap rates (% per annum)

Chart 1

Source: Bloomberg; data as of January 9, 2013 |

Third, the developed markets’ interest rates are likely going nowhere any time soon. Emerging-markets swap rates typically move broadly in line with their developed-market counterparts, for two reasons: Rates in both regions reflect common growth drivers (with emerging-markets growth highly dependent on events in developed markets), and emerging-markets central bankers usually show reluctance to expand significantly the interest rate gap with developed-market economies, for fear of putting strong upward pressure on their currencies. Ultimately, though, developing inflation pressure will spur action.

Chart 4: Consumer prices (% y/y)

Chart 1

Source: JPMSI; data as of December 2012 |

Michael Hood is a Market Strategist for J.P. Morgan Asset Management.