For investors who think their portfolio companies need to do a better job of providing useful nonfinancial information, 2014 is shaping up to be a good year. But until now there’s been good reason to gripe about the state of corporate reporting on everything from environmental impact to possible links with human-rights controversies.

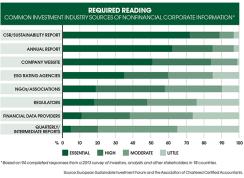

In a recent international survey of investors and analysts by the London-based Association of Chartered Certified Accountants and the Paris-based European Sustainable Investment Forum, 78 percent of respondents said that current disclosure on nonfinancial matters is inadequate. Meanwhile, 93 percent believed that disclosure doesn’t shed enough light on how important these so-called soft factors are to investment decisions. “If investors can’t easily see which companies are outperforming not only on financials but on sustainability performance, it’s just too hard [to use sustainability data in their investing],” says Jean Rogers, founder and executive director of the Sustainability Accounting Standards Board. “Even if they want to use this information, they’re not able to.”

But that may change over the next 12 months, partly thanks to the San Francisco–based nonprofit SASB (pronounced “saz-bee”). The American National Standards Institute in Washington has accredited SASB to set standards for how publicly listed companies disclose sustainability information in their annual 10-K filings to the Securities and Exchange Commission.

SASB invokes the U.S. Supreme Court’s definition of materiality, which deems information material if a “reasonable investor” would consider it important. The group, which hopes to win SEC approval as the official standard setter for nonfinancial reporting, will help companies comply with an existing law that they disclose all material data by giving them the necessary accounting infrastructure. Enforcement will fall to the SEC.

With input from 1,000 participants thus far, including investors and corporations, SASB is covering 88 industries that account for all of the roughly 13,000 U.S.-listed companies, grouping them into ten sectors. So far, it’s only published standards for the health care sector, but by late 2015 it will have completed the standards for all ten sectors. “It’s going to be hard [for companies] not to address these issues once the standards are in place,” Rogers says. “At that point, there’s consensus from hundreds of corporations and investors who’ve been at the table developing the standards.”

Last April the European Commission proposed an amendment to European Union accounting legislation that would require all large public and private companies based in the EU and listed on EU-regulated markets to disclose information on environmental, social and anticorruption risks, policies and results. The changes won’t take effect before mid-2014, but the commission estimates that they will swell the number of EU-listed companies producing nonfinancial reports to 18,000 from 2,500.

The International Integrated Reporting Council, a London-based coalition of investors, companies, regulators, accounting firms and nongovernmental organizations, wants to improve nonfinancial reporting without involving regulators or focusing on standards. The IIRC’s goal: an internationally accepted blueprint for integrated reports, which publish nonfinancial information alongside financial data, with simple guidelines that help companies disclose the former. Mike Lombardo, senior sustainability analyst at $12.5 billion, Bethesda, Maryland–based Calvert Investments, welcomes this effort. “As Calvert and other investors are moving to a more integrated approach in terms of our own analysis, integrated reporting helps us,” he says.

This year the IIRC released its first international integrated reporting framework, the product of a two-and-a-half-year process that drew on its network of corporations and investment firms. In 2014 it will target companies and investors that can adopt the framework, says CEO Paul Druckman. “Let’s not have more and more regulation,” Druckman adds. “The market needs to dictate how this all happens, not the regulators.” • •

Read more about regulation.