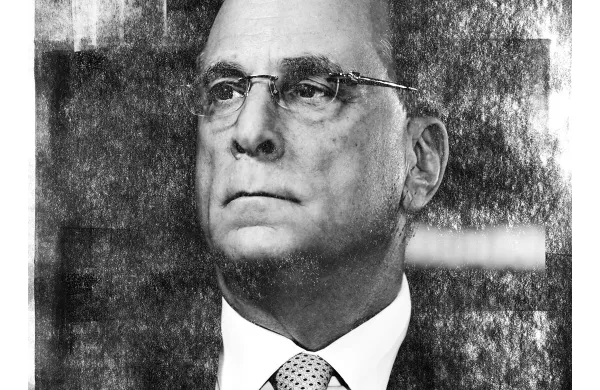

| As head of $4.1 trillion asset manager BlackRock, Laurence Fink knows that transforming the defined contribution market will be key to changing the U.S. pension system. Fink, 61, takes a wide-angle view of the challenge that Americans face in accumulating enough savings to live comfortably in retirement. Big reforms, such as safeguarding money market funds, are needed to restore investors’ faith in the markets, he contends; only then will people save more, invest and have a chance of meeting their retirement goals. New York–based BlackRock is also calling for policymakers to reshape existing retirement savings programs so “the blessing of longer life is not wrought with financial hardship,” in the words of a recent white paper, coauthored by vice chairman Barbara Novick, on the problems of longevity. The paper supports measures that include making Social Security a safety net, not a retirement program, and keeping tax incentives for defined contribution plans. The authors also want government to encourage all employers to offer plans to full- and part-time workers. Los Angeles–born Fink co-founded BlackRock in 1988 as a fixed-income specialty firm after doing pioneering work in the mortgage securitization market at First Boston Corp. | |||||

| < 7. Kevyn Orr | Back to Article | 9. Tom Harkin > |

The 2013 Pension 40: Laurence Fink

November 12, 2013