Joseph Burschinger, former chief risk officer and head of investment operations with Los Angeles–based TCW Group, has left the firm to join Guggenheim Partners in the same role. Burschinger played a prominent part in TCW’s 2009 firing of CIO Jeffrey Gundlach, the star bond fund manager whose fixed-income group oversaw about 65 percent of its $110 billion in assets under management at the time.

Burschinger’s departure closes another messy chapter in TCW’s imbroglio with Gundlach, now CEO of $53 billion DoubleLine Capital, the fastest-growing mutual fund firm ever. Gundlach co-founded Los Angeles–based DoubleLine a couple of weeks after he was fired.

“We are pleased to have Joseph Burschinger join Guggenheim Partners Investment Management as Chief Risk Officer, reporting to Scott Minerd, Global Chief Investment Officer,” a spokesman for New York– and Chicago-based Guggenheim said in an e-mail statement. “Adding Joseph’s deep expertise to our existing team of experienced risk managers underscores our unwavering commitment to safeguard our clients’ assets by continuously analyzing and actively managing all categories of potential risks.” Burschinger and TCW declined to comment.

The TCW-Gundlach saga began in January 2009, when TCW’s then-owner, French bank Société Générale, under pressure from losses because of events including a high-profile 2008 trading scandal, decided to put the asset manager up for sale. (Washington-based private equity firm Carlyle Group and TCW management bought the firm this February.) Gundlach, a 24-year veteran of TCW with one of the best records in fixed income, proposed buying majority control of its bond and equity businesses, assuming a valuation of $700 million.

TCW and SocGen never responded to the proposal by Gundlach, who was let go in December 2009. In January 2010, TCW filed a lawsuit in Los Angeles County Superior Court accusing Gundlach of conspiring with TCW staff to open a rival firm and of stealing proprietary information. Gundlach countered by accusing TCW of wanting to steal fees that he had earned from managing client money. In the ensuing trial TCW claimed that it decided to fire Gundlach in what it perceived to be a preemptive strike and acquire fixed-income manager Metropolitan West Asset Management to run the assets managed by Gundlach’s group.

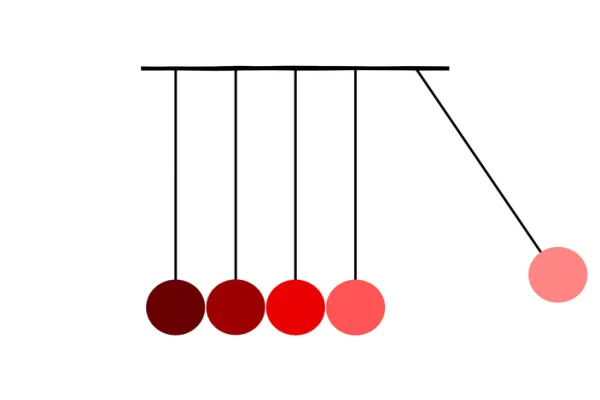

With Burschinger’s exit, most of the seven executives involved in so-called Project G — the internal code name for the firm’s plan to replace Gundlach — are no longer with TCW. As chief risk officer at TCW, Burschinger conducted a secret study, completed on August 24, 2009, of the firm’s ability to keep Gundlach’s mortgage-backed securities team, regarded as critical to retaining client assets, if Gundlach were to leave.

In his August 25, 2011, testimony during the trial, CEO Marc Stern said Burschinger advised that there was only one MBS team member at high risk of leaving. Burschinger graded the rest of the group, including portfolio managers and traders, as low or moderate flight risks. Burschinger believed that Philip Barach, who had co-founded the MBS group with Gundlach and would go on to co-found DoubleLine, was at a low risk of departing. On August 27, 2009, six of the seven Project G members, including Burschinger and Stern, met and discussed terminating Gundlach, according to notes of the meeting that were introduced at the trial. (Gundlach’s lawyers submitted a list of the Project G insiders as evidence.)

Burschinger’s flight risk study was dead wrong. The Saturday morning after TCW fired Gundlach, 14 staffers — all portfolio managers and traders with the authority to run mortgage-backed securities, the vast majority of assets under Gundlach’s oversight — followed him out the door. In the end, 45 TCW employees joined him at DoubleLine, including Barach, co-manager of many TCW strategies with Gundlach.

On December 4, 2009, hours after Gundlach left, TCW announced that it would buy MetWest, a Los Angeles fixed-income firm with $30 billion in assets and about 100 employees. Headed by well-respected manager Tad Rivelle, MetWest was to oversee Gundlach’s former mandates in a similar style and keep managing its own fixed-income funds.

But by January 2010 consultants voiced skepticism about TCW, given the departures of Gundlach and his team. Consulting firm Ennis Knupp & Associates advised all clients with MBS exposure that month to terminate their relationships with TCW. The firm ultimately suffered about $30 billion in institutional and retail outflows, according to a December 2012 report by Standard & Poor’s that rated TCW’s debt below investment grade.

On September 16, 2011, after a six-week trial in Los Angeles Superior Court, the jury reached a split verdict and awarded Gundlach $66.7 million. TCW and DoubleLine issued a joint news release on December 29, 2011, announcing that the two firms had settled all claims between them.

Since the exodus of TCW veterans, much of MetWest’s leadership has taken on key roles at TCW. Besides Burschinger, Project G executives who have left include CEO Stern (who was replaced by MetWest’s David Lippman; Stern remains on TCW’s board of directors), general counsel Michael Cahill, head of corporate strategy Michael Conn and former head of marketing Mark Gibello.

Several other top TCW executives and department heads have also left since the high-profile axing of Gundlach, including head of human resources Jeannie Finkel, chief compliance officer Hilary Lord, head of institutional marketing Garrett Walls and Richard Wiener, head of the request for proposals group.

Gundlach has one of the best long-term track records among fixed-income managers. For the ten years ended November 30, 2009, the TCW Total Return Bond Fund, managed by him and Barach, posted a 7.75 percent annualized return, versus 5.17 percent for managers in Morningstar’s intermediate-term bond fund category. In 2007, Gundlach was particularly prescient, warning investors about problems in subprime lending. The TCW Total Return Bond Fund was one of the few bond funds with positive returns in 2008. With a 6.03 percent annualized return versus the average of 3.57 percent, the DoubleLine Core Fixed Income Fund ranked No. 4 in Morningstar’s intermediate-term category for the three years ended October 23.