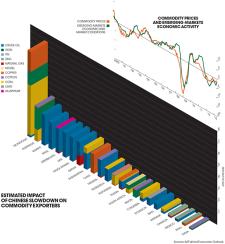

“When the U.S. sneezes, the rest of the world catches a cold.” That old adage described how trade and financial links transmitted economic weakness around the globe. Today’s sneeze is Chinese, and emerging-markets countries are reaching for the Tylenol. China is the world’s largest consumer of a wide range of commodities — from soybeans to copper to crude oil — and its recent slowdown is depressing economies across the developing world, where growth is closely correlated to commodity prices, as the top chart shows.

How is the pain distributed? Big metals and crude-oil exporters stand to suffer the most, according to the International Monetary Fund. If Chinese growth averages 7.5 percent over the coming decade, down from 10 percent previously, Mongolia will take the biggest hit. The country, which sells coal, copper and iron ore to China, is likely to see its gross domestic product reduced by 7 percent in 2025 from what it would otherwise be. Australia, Chile and big oil exporters from the Gulf, Central Asia, Africa and Latin America will also be hurt. For these countries it’s a cold wind blowing from China.

Read more about alternative investments.