The upturn in global growth in recent months for the most part has occurred in developed markets, with the euro zone leaving recession (and boosting neighbors like the U.K. in the process), Japan benefiting from massive stimulus and the U.S. expansion holding steady, despite higher interest rates. In J.P. Morgan Asset Management’s investment forecasts, emerging-markets economies stand to benefit from this acceleration, mostly through the export channel. Gross domestic product growth in emerging markets averaged a weak 4.3 percent during the first half of 2013. We estimate mild improvement, to a 4.6 percent clip, during the second half and a further pickup, to 5.2 percent, during the first two quarters of 2014. Tighter global credit conditions and stable commodities prices will likely weigh on the momentum generated by stronger exports. The direct benefit from the foreign trade effect should outweigh these negative factors, however.

A survey of recent data, captured in the following charts, suggests that EM economies indeed are beginning to feel a tailwind from stronger developed-markets growth. This support has not yet become convincing, however, and thus far, any spillover has been concentrated in Central Europe. Emerging-markets export strength will need to broaden and intensify if our forecasts for the coming year are to play out.

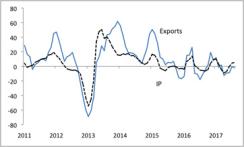

In Asian emerging markets as a whole, exports in recent months have appeared to stopped shrinking but have not yet begun to expand (see chart 1). While this aggregate includes a variety of countries, including commodities-dependent Indonesia, the recent export performance of Asian manufacturing economies closely connected to the global cycle also appears mixed. Korean exports have staged a mild rebound recently, but Taiwanese export growth has faded after earlier strength, and Singapore’s exports look quite sluggish. Taiwanese export orders improved significantly in September, however, pointing to a possible uptick in shipments during coming months.

Chart 1: EM Asia Exports (%)

Source: JPMSI, JPMAM; data through August 2013

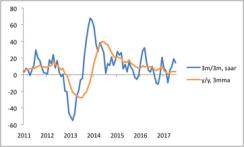

Meanwhile, industrial production growth in Asia has also come off its low point and in fact has moved somewhat ahead of export gains (see chart 2). That improvement, likely associated with the end of an inventory correction, bodes well for near-term overall growth figures but will require further strengthening in exports to be sustained. Given the historical pattern, the current upturn in developed-markets manufacturing should boost EM Asian exports by year-end (see chart 3). This lift may fall short of past cycles, however, given the weak Japanese yen, which should allow Japanese producers to benefit from global strength, in part at the expense of its EM Asian counterparts.

Chart 2: EM Asia Exports and Industrial Production (% 3m/3m, saar)

Source: JPMSI, JPMAM; data through August 2013

Chart 3: U.S. ISM New Orders Index and EM Asia Exports

Source: JPMSI, JPMAM; data through September 2013

As for Latin America, Mexico’s economy has been struggling in 2013. Exports have barely risen, and overall expansion, while not negative, has been slow. Sluggish GDP growth is due in part to a slump in construction, itself connected with the change of presidential administration last December, when Enrique Peña Nieto took office. On the export side, Mexican shipments have expanded in line with U.S. imports, which in 2013 have not shown spectacular performance in their own right. Assuming U.S. growth picks up into 2014, imports should begin rising. Mexico, in turn, should feel a stronger tailwind from its northern neighbor and major trading partner next year. Manufacturing exports, the bulk of which go to the U.S., have indeed rebounded during the past few months, albeit within the normal volatility range for this series thus far (see chart 4).

Chart 4: Mexico Manufactured Exports (%)

Source: JPMSI; data through July 2013

In contrast, Central European economies are already experiencing a significant spillover from the spur in developed-markets growth, with stronger export trends feeding through into firmer industrial numbers. This outperformance, compared with other EM regions, stems largely from three factors. First, Central Europe has deep economic links with the euro zone, which itself comprises some emerging markets. During recent months, the euro zone has shown the strongest improvement among developed markets. Second, these economies have been very open to trade, which means exports flow to the overall economy that much more quickly. Third, in the Central European economies as a whole, inflation has been below central bank targets; thus policymakers feel no near-term pressure to lean against growth. Both the Czech Republic and Poland are posting double-digit export increases in sequential terms (see chart 5) and are also experiencing noteworthy acceleration in industrial output. Hungary’s exports, by contrast, have slumped recently after earlier improvement, but overall the country’s economy looks fairly firm, thanks in part to aggressive easing by the central bank.

Chart 5: Central Europe Industrial Production (% 3m/3m, saar)

Source: JPMSI; data through September 2013

From October on through the rest of 2013, growth in the euro zone is poised to continue at a decently positive clip, allowing for sustained expansion in Central Europe. Meanwhile, Russia, South Africa and Turkey are not on a similar growth trajectory, given their less direct connection to the euro zone, at least when compared with their EM counterparts in Central Europe. In the cases of Russia and South Africa, this projection of slower growth is largely on the back of their economic dependence on commodities. As for South Africa and Turkey, their relatively sluggish performance stems from exposure to tighter global credit conditions (see chart 6).

Chart 6: Russia, South Africa, and Turkey Industrial Production (% 3m/3m, saar)

Source: JPMSI; data through August 2013

The uptick in developed-markets expansion benefits emerging-markets economies but so far has been piecemeal. The emerging markets that were the most exposed to the euro zone recession, especially those in Central Europe, are already buoyed by the growth of their developed-markets trading partners. Similar progression in other emerging markets will depend heavily on the business climate in the U.S., as well as a sustained upturn in the global tech cycle. Disappointment on the U.S. or overall tech front would likely lead to another year of weakness in Latin America and Asian emerging markets.

Michael Hood is a market strategist for J.P. Morgan Asset Management.

Get more on emerging markets: “Why a Slowdown in Emerging Markets Could Be a Good Thing”