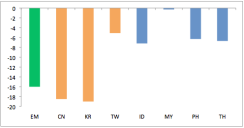

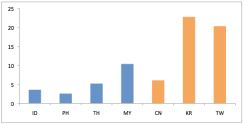

Amid a highly disappointing year for emerging-markets equities, one group of countries has consistently outperformed: the Asean region. Three of the bloc's four big markets have posted large year-to-date declines, but they have fallen much less than the MSCI EM index (see Chart 1). By contrast, the North Asian markets of China and South Korea have stumbled, underperforming the index, although Taiwan has done somewhat better.

Investors have tended to think about Asia as a broad and largely homogeneous region, but the recent pattern favors a more differentiated approach. At the same time, the current experience in the Association of Southeast Asian Nations shines a fresh light on a major driver of emerging-markets growth fluctuations: credit cycles, a factor likely to serve as an eventual brake on these countries' expansions.

Chart 1: MSCI EM Asia components, YTD change (percent)

Source: Bloomberg; data through June 25, 2013

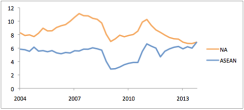

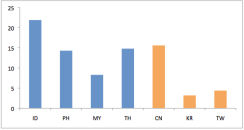

Emerging economies as a whole have been growing significantly more slowly in recent years than their precrisis norm. Emerging-markets real GDP growth has averaged 4.9 percent over the past eight quarters, compared with 7.6 percent during the 2004–'07 period. The North Asian economies of China, Korea and Taiwan have followed that overall pattern. By contrast, the four large Asean countries — Indonesia, Malaysia, the Philippines and Thailand — have accelerated mildly from their previous trend and are now growing more quickly than in the mid-2000s. On our current forecasts, the growth gap between the two blocs, measured over a two-year window, will close entirely by the end of 2013 (see Chart 2). This development represents an upside surprise in the case of Asean and a shortfall relative to expectations for North Asia, helping account for the split in relative equity performance.

Chart 2: Real GDP, North Asia and Asean, 2-year trailing, percent, with forecasts through end-2013

Source: JPMSI, JPMAM; data and forecasts as of June 2013

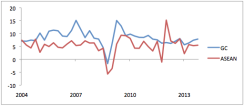

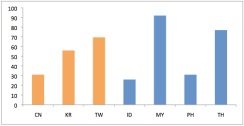

What accounts for the relative growth swing? Oftentimes, differentiated emerging-markets growth reflects varying types of exposure to the broader global economy — a greater or lesser dependence on exports, for example, or different product mixes. In this case, though, the export channel does not fully explain the contrasting growth stories. In an overall sense, the two blocs depend on exports to roughly the same degree (though Indonesia and the Philippines do so to a lesser extent than the others, likely one factor behind their relatively low recent correlation with overall global growth, see Chart 3). Moreover, North Asian and Asean exports display very similar sensitivities to the global business cycle (see Chart 4). Geographic exposures also do not differ greatly, although China's relatively high dependence on the weak European area has almost certainly damaged its growth performance in the past few years relative to its Asian peers (see Chart 5).

Chart 3: Exports of goods and services, percent of GDP, 2008–'12 average

Source: World Bank, data through 2012

Chart 4: Merchandise exports (percent y/y, 3mma) and global manufacturing PMI

Source: JPMSI, JPMAM; data through May 2013

Chart 5: Exports to European Union and euro area, share of total, 2012 (percent)

Source: IMF, data as of 2012

Instead, the differing growth trajectories between North Asia and Asean owe more to internal than external factors. Recent performance reflects, in part, contrasting stages of development. With their relatively high per capita incomes, Korea and Taiwan are in the process of graduating from "emerging economy" status. Their growth rates have already slowed significantly from their peaks and will likely trend gradually downward in coming decades, converging with the developed-economy pace (though Taiwan's rapprochement with mainland China and the associated restructuring of its economy might produce one more burst of relatively rapid expansion). China too has moved up a rung on the development ladder. While its income remains low by developed market standards, it is no longer capable of growing at a double-digit pace. Indeed, much of the uncertainty and volatility surrounding Chinese markets in the past few years represents investors' attempt to discern the current pace of trend growth for China — likely something in the 7 to 8 percent range for now, compared with 10 to 11 percent before the global recession.

As a group, the Asean countries possess more room to run as they close the income gap between themselves and developed-market economies. Indonesia and the Philippines display per capita incomes of below $5,000, and Thailand's does not stand much higher. All three, at their current stages of development, should be able to sustain fairly fast growth for some years to come as they move toward the global technology frontier. Malaysia lies well above the other three in this respect but remains noticeably less well-off than Korea or Taiwan.

One factor that tends to accompany the process of income convergence is financial deepening, as banks and intermediation become more prevalent in the economy. Greater access to credit for businesses and households not only comes alongside fast growth but also helps fuel it. Credit expansion, however, occurs in waves rather than smoothly, fluctuating with the changing availability of capital inflows (which help drive bank funding), labor market trends (which influence demand for credit as well as the perceived creditworthiness of households), and regulatory forbearance (as bank supervisors attempt to lean against asset price bubbles and deteriorating underwriting standards). The Asean economies currently find themselves in the middle of a strong credit cycle, a major factor in underpinning their rapid recent growth in a generally sluggish world. Bank credit has been climbing at a nearly 15 percent clip in the Philippines and Thailand and above 20 percent in Indonesia. By contrast, credit in Korea and Taiwan is rising only slightly, the Chinese credit growth has downshifted to a rate broadly in line with Asean (after touching 20 percent-plus in the mid-2000s cycle and surging beyond 30 percent during the postrecession stimulus phase).

The North Asian economies share relatively built-out financial systems, with credit representing 100 percent of GDP or more. Malaysia and Thailand also possess large banking systems (meaning that strong credit growth in the latter likely faces a fairly imminent constraint), but Indonesia and the Philippines are at a fairly early point in the financial-deepening process. They look to be more capable of sustaining fast rates of credit growth for an extended period. This expansion, however, will ebb and flow with the abovementioned factors, meaning that Asean economic growth will not necessarily run evenly at its current pace in the years to come. One particular caveat at the moment concerns foreign capital inflows, which have been strong in the Asean region recently and which appear to be reversing, in part, as the tone of U.S. monetary policy changes at the margin. This shift represents a particular worry for Indonesia, which has been running a current account deficit on the order of 2.5 percent of GDP.

Three broad lessons for investors emerge from this examination of recent growth trends within Emerging Asia. First, much of the recent sluggishness in overall emerging-markets growth owes to the weak expansion in developed economies. Emerging-markets exports, and by extension emerging-markets growth, are performing about as would be expected given developed-market sluggishness. Signs of improvement in the developed-market backdrop — including the resilience of the U.S. economy, possible stabilization under way in the euro area and the recent burst of growth from Japan — thus point to somewhat brighter prospects for emerging markets in coming months. A better environment in Europe would represent a particular boost for China. Second, although globalization has reduced economic divergence within emerging markets, significantly differentiated growth trends do sometimes emerge. A well-constructed macro overlay thus seems likely to add value to an emerging-markets equity investment process. Third, credit cycles accompany and help drive phases of rapid growth within emerging-markets economies. Such cycles wax and wane. Investors need to proceed cautiously in extrapolating fast growth, especially when — as is the case currently in Asean — booming credit represents a significant part of the story.

Michael Hood is a market strategist for J.P. Morgan Asset Management.