The financial innovations of the last few decades have dramatically increased the complexity of the instruments and services offered by the financial services industry. And this has been an extremely positive development for finance, as the complexity of these products has helped to generate a remarkable amount of wealth for the entire community of individuals that... sell these products.

As for the people that bought them, that’s another story.

Last night I finally got around to watching this PBS documentary on the utter insanity of fees and costs in individual retirement accounts. I’d been putting off watching it for a while now, as I knew it would put me in a foul mood... and it did.

The punch line: Financial services firms are charging dozens of hidden costs and fees to individuals that, over a lifetime, can easily (and on average do) get into six figures. In fact, the research cited in the show points to the financial services industry capturing 60+ percent of individuals’ returns, while allowing those same individuals to hold 100 percent of the risk. Yes, that’s craziness.

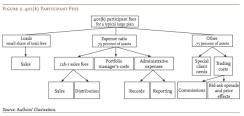

But how do finance firms get away with it? Well, the true cost of investing is very difficult to ascertain, as the complex products today carry higher and more convoluted expense structures that are simply not penetrable by the average saver. (See the charts below for a sense of how fees and costs stack up in a 401k plan – Source is the CRR @BC.)

And in case you thought this was only something affecting individuals (not that you could be that naïve), the CPPIB recently said that one of its big six lessons for the pension fund industry was that “fees are killer”. Here’s a quote: “The difference that 2 per cent in costs can make over long periods of time is huge... If you look out 25 years, a 4 per cent return gives you a 167 per cent total gain, while a 6 per cent return gives you a 329 per cent return. That’s the math of compounding.” And it’s why the CPPIB has been so aggressive about in-sourcing.

The situation is so crazy in finance today that if some serious changes aren’t made to realign interests between the financial “services” industry and its customers, finance may be viewed by my generation in the way “tobacco” was viewed by prior generations.

I’m not even kidding about that.

When you see how much the financial services industry is extracting from social welfare institutions (pensions, foundations, university endowments, charities, governments not to mention individuals, including me) in the form of fees and costs, how can you not see this as being profoundly unhealthy for society? It would seem that finance professionals are enriching themselves at the expense of our most important social welfare institutions. Getting rich at the expense of societal health... Big tobacco? Or finance?

Anyway, I’ll leave you with something the eminent Jack Bogle says in the PBS documentary,

“The magic of compounding returns is overwhelmed by the tyranny of compounding costs...” What to do? “Get Wall Street out of the equation. Get trading out of the equation. Get management fees out of the equation. You own American business and you hold it forever.”

I think that’s sensible. But just don’t hold American financial services firms; I think this industry is ready for some major disruption...