With most aggregate U.S. bond indexes expected to lose value if American interest rates continue to rise, institutional investors are seeking higher returns in global multisector fixed-income funds, which are actively managed bond funds that offer a mix of sovereign, corporate and high-yield credits with a range of durations and yields.

The high level of investor interest in this product category can be seen in trends in online search activity from eVestment. The Marietta, Georgia–based company tracks data on 53,000 investment vehicles and publishes a monthly summary of search activity.

During May, the global multisector fixed-income category was the most popular among eVestment’s 369 broad investment product universes, or categories, receiving more than 29.5 searches per product. This category has steadily moved up the ranks of the top 10 searched universes over the last four months, moving from sixth place in February to fifth in March, third in April and top of the list in May.

The global multisector fixed-income grouping displaced the category of Emerging Market All-Cap Equities, which fell to second place after a three-month reign at No. 1.

“Its definitely an approach that is resonating with investors at the moment and, frankly, historically,” says Sabrina Callin, Newport Beach, California–based product manager for Pacific Investment Management Co.’s Unconstrained Bond Fund. The Pimco fund is a global multisector bond fund, and it was the single most-searched investment vehicle in May, with 197 searches.

Investors turn to funds like the Unconstrained Bond Fund, Callin says, to offset the “concentrated risk” of being in core bond investments tied to popular aggregate bond indexes dominated by U.S. government debt issues with “100 percent U.S. interest rate exposure.”

eVestment classifies products by determining their investment strategies from their actual investing data; it does not rely on funds’ claims about their strategies. Global multisector fixed-income funds have a median average maturity of 6.37 years, says Rich Donnellan, product manager at eVestment. The range of average maturities is quite large, extending from a low of 0.40 years to a high of 24.54 years. “The data certainly indicates managers are seeking maximum return on the yield curve,” says Donnellan.

| Top 10 Searched Products for April 2013 | |||

| Product Name | Quantity of Searches | ||

| PIMCO: Unconstrained Bond | 197 | ||

| Aberdeen: Emerging Markets Equity | 180 | ||

| Walter Scott: Global Equity | 173 | ||

| Eagle Capital: Eagle Equity | 171 | ||

| Sands Capital: Select Growth Equity | 149 | ||

| Vontobel: Emerging Markets Equity | 147 | ||

| Dodge & Cox: Dodge & Cox U.S. Equity | 141 | ||

| Jennison: Large Cap Growth Equity | 141 | ||

| Artisan Partners: Artisan Non-U.S. Growth | 140 | ||

| Brown Advisory: Brown Advisory Large Cap Growth | 139 | ||

| Source: Data from eVestment | |||

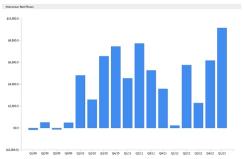

Pimco’s Unconstrained Bond Fund has benefited greatly from the surge in inflows. In the first quarter of 2013, the fund had net inflows of $6.196 billion, boosting its assets under management by 25.8 percent, to $30.445 billion, according to eVestment. The growth boosted the fund into second place by size in this category. Loomis, Sayles & Co.’s Global Bond Fund was No. 1, with $36.31 billion in assets under management, according to eVestment.

Investor interest in this category prompted J.P. Morgan Asset Management to add a new fund in February — the Global Bond Opportunities Fund — in addition to its Global Multi-Sector Income Fund.

“A lot of the interest goes back to the fact that traditional bond indexes reward bad behavior,” says Nicholas J. Gartside, London–based international chief investment officer within J.P. Morgan Asset Management’s Global Fixed Income and Currency Group. “You have a situation where a company or country misbehaves and issues more debt, so the importance of that company or country in the index goes up and investors are lending more money to an entity that’s less creditworthy.” This is “potentially problematic” in the world of today where there is a lot of debt, he adds.

Gartside points out that the allocation to government and government-related entities is rising in traditional aggregate bond indexes. “And so you’ve got an increasing concentration of risk,” he says. The duration of the aggregate indexes is also rising because governments have been lengthening the maturity of their debts. “So, you’ve got increased duration risk and increased concentration of risk at a time when compensation for that is pretty much at a record low,” Gartside says.

With a global multisector fixed-income approach, a fund manager can dispense with the benchmark and “allocate to bonds we feel are going up, irrespective of sector and irrespective of geography,” says Gartside.

Funds in this sector give their bond managers considerable flexibility on choosing the duration of bonds in their portfolios. “Both of our solutions have broad duration bands — from zero to about 8 or 9 years,” says Gartside. The investment strategy for Pimco’s Unconstrained Bond Fund allows for bonds that range from a duration of minus 3 years to plus 8 years. “What that means is we have the flexibility to add value in different types of interest rate environments, including a rising rate environment,” says Callin.

These funds also allow managers to “rotate dynamically between sectors,” says Gartside. For example, the J.P. Morgan Global Multi-Sector Income Fund had 10 percent of its allocation in Australia a few years ago because the managers expected yields there to fall (and prices to rise) — which they subsequently did. “It could be investment-grade corporates or high yield bonds or emerging market corporates,” says Gartside. “Being able to move between sectors will be increasingly appealing in the world we are about to enter.”