In our last story, we outlined our view that a number of positive structural developments are reinforcing the strong economic growth dynamic that has emerged since the turn of the century in Africa — particularly in the most significant economies and investment destinations on the continent. These structural growth drivers in key African markets have taken root against the backdrop of greater peace, political stability and democracy, and include more prudent macroeconomic policies, a growing consumer class driven by rapid urbanization and favorable demographics, and a renewed emphasis on much-needed infrastructure investment and natural resource discoveries.

Across our two blogs on this topic, we’ve aimed to explore these drivers in detail. Here we consider three further drivers likely to sustain the growth take-off experienced in Africa in recent years and conclude that the case for investment in Africa remains compelling.

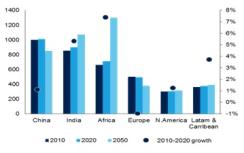

Demographics and rapid urbanization: Africa has two major demographic trends in its favor. It has a youthful population with a favorable ratio of working-age to retired people, and it has rapid rates of urbanization, which have historically been associated with economic growth. According to IMF and World Bank data, the growth in the African working-age population between 2010 and 2020 will exceed that of even other high-growth regions and countries, such as China, India, Latin America and the Caribbean. That demographic grouping, which is critical to the development of a vibrant consumer class and labor force, is expected to grow by 7 to 8 percent in the current decade alone, compared to rates of around 5 percent for India and 4 percent for Latin America and the Caribbean. In most Western economies, as well as in China, the working age population will grow at much slower rates. In Europe it will actually decline as the “baby boom” generation enters retirement. By 2020, the African working age population will start to rival that of India and China; and by 2050, the African working population will be the largest in the world at around 1.3 billion people.

The growth in the working age population is likely to be accompanied by rapid urbanization. Today, African countries are typically among the least urbanized in the world, suggesting enormous potential for the growth of cities on the continent. Economic growth and urbanization tend to accompany and reinforce each other — productivity gains make agriculture less labor intensive, enabling the emergence of an urban consumer class with formal employment in services and manufacturing. The emergence of such urban consumer classes has historically been associated with sustained economic growth and structural change (particularly in the service, manufacturing and construction sectors).

Studies that look at the historic relationship between urbanization and per capita growth have found that there is a “sweet spot” in the urbanization process: as urbanization levels rise from around 30 to 50 percent GDP per capita, growth rates peak. Most African countries will enter this bracket for over the coming decade. Clearly, a concentration of urban consumers is important for businesses and investors in finance, healthcare and retail and wholesale consumer goods. As shown in the chart below, African countries dominate the global “heat map” of the most rapidly urbanizing countries, accounting for the majority of countries where urbanization rates are expected to exceed 2.5 percent per year over the next four decades. In contrast, Latin American countries are largely already highly urbanized, while urbanization rates are expected to decrease in much of Asia.

An emerging consumer class: Rapid growth and urbanization, coupled with the structural growth story described above, is likely to lead to rising domestic demand and consumer spending, as more individuals enter the formal economy. Importantly for investors, the growth in discretionary spending will rise much faster than total consumer spending, which is itself expected to grow at an impressive 6 percent annual rate until 2020. According to our estimates, a base-case 6 percent total consumer growth in sub-Saharan Africa results in an average annual increase in discretionary spending of between 7.12 and 9.95 percent — as households move away from spending all their income on subsistence items such as basic food, housing and electricity, and are able to purchase durable consumer goods and services. This growing urban consumer class underlines the fact that investing in Africa is much more than just a commodity derivative. Already, the role of natural resources in the African growth take-off of the past decade is more limited than commonly assumed, with only 8 out of 53 African countries having a high commodity contribution to GDP. Recent growth in Kenya, Uganda, Ghana and Zambia has little to do with natural resources and more to do with structural changes.

Resources and infrastructure development: While we believe that commodities are only a part — and often a small part — of the African growth story, there is no doubt that the continent’s rich endowment of natural resources has the potential to support growth and infrastructure spending. This is true because new African resource players are only emerging now and will not start production for some time. Sub-Saharan Africa is among the most richly endowed regions in the world in minerals, fossil fuels and precious metals. Most significantly, commodities still account for the bulk of exports. Export growth in sub-Saharan Africa has been 11 percent on average per year since 1995 — but crude oil and petroleum derivatives alone accounted for 65 percent of all exports. Africa is already a major — often dominant — holder and producer of key industrial commodities. Oil and gas exploration and discovery have been significant in many parts of Africa over the past decade. The more stable and encouraging political environment has encouraged exploration that suggests that proven resource stocks, significant as they increasingly are, do little more than scratch the surface of African true resource wealth.

Of course, the management of resource-rich economies is fraught with challenges, as the history of other developing regions clearly shows. However, Africa’s resource wealth remains one of the main reasons the continent has attracted significant foreign direct investment in recent years, with private investment flows to Africa rising steadily since the turn of the century. The bulk of this has come in foreign direct investment, rather than more short-term flows into bond and equity markets. The continent is attracting between $30 to $40 billion in direct investment per year, which is essential to long-term investment and infrastructure development. These capital flows represent an historic opportunity to address Africa’s enormous infrastructure backlog. While most recent developments in infrastructure on the continent have focused on transport infrastructure — such as building roads, rail and ports around natural resources — these positive developments need to be complemented by investment in power, telecommunications, water and sanitation, all of which are additionally important given the rapid rates of urbanization on the continent. Successful “catalytic investments” in infrastructure, broadly understood, will raise productivity and further enhance Africa’s growth prospects.

Natural resource abundance and other growth drivers are not mutually exclusive. In countries where commodities have contributed significantly to growth — for example, Nigeria and Angola — consumer growth, the development of the services sector and increased agricultural production are also an important part of the story. Similarly, in countries where commodities have played little or no role in the enhanced growth performance thus far (such as Ghana, Uganda, Kenya, Tanzania, Mozambique and Zambia), the imminent development of a thriving resource sector can complement other growth drivers already at work.

As investors in Africa, we are encouraged and excited that the continent appears to have turned a corner. Sound governance and macroeconomic policies have established an environment in which a number of highly supportive structural growth drivers — favorable demographics, rapid urbanization, consumer growth, new resource discoveries and infrastructure development — are making their true contribution to Africa’s economic advance.

Chris Derksen is the head of Frontier & Emerging Market Equities at Investec Asset Management.