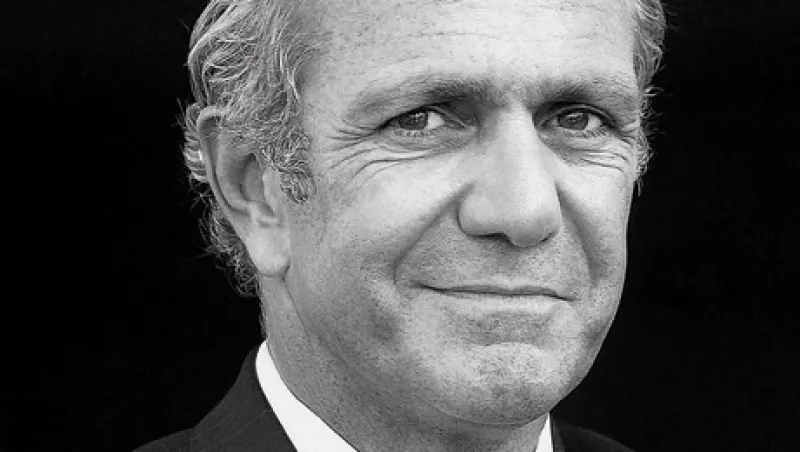

Coming out of the financial crisis, few CEOS had more to lose than Ara Hovnanian. After all, he shares his name with a company, Hovnanian Enterprises, that was founded by his immigrant father and three uncles in 1959, not long after they had fled Baghdad during the Iraqi Revolution. Though the homebuilder has been a public entity since 1983, it is still in many ways a family business (the Hovnanian family owns 20 percent of the company), increasing the pressure on the CEO as he has battled his way out of the worst housing downturn in the U.S. since the Great Depression.

“Clearly, there were nights where you’d worry, and bad days, but we knew we had a great company,” says Hovnanian, 55. “We’d made it through bad periods before. We just knew we had to get liquidity to get through the period.”

It’s been a seven-year downturn for the U.S. residential real estate market, the longest in American history and at the crux of the financial crisis in 2008 and the resulting recession. Hovnanian Enterprises, the sixth-largest publicly traded homebuilder in the U.S., enjoyed record profits in 2005, but as national housing starts fell beginning that year, so did the company’s revenue — from $6.1 billion in 2006 to less than $1.1 billion in 2011.

Real estate markets across the U.S. are finally perking up, particularly outside major metropolitan areas. A combination of low mortgage rates, a dearth of construction during the prolonged malaise and prices that have fallen low enough to make housing affordable again has powered demand. The Hovnanian CEO expects 2013 to be the first profitable year since 2006 for his Red Bank, New Jersey–based company, which has a footprint in 193 communities in 16 states and sells entry-level and luxury homes, as well as active-adult housing, townhomes and condominiums. In the first quarter of this year, the value of Hovnanian’s net contracts was up 42 percent from the same period in 2012, with total revenue increasing 33 percent to $358 million. The net loss for the quarter was $11 million, compared with $34 million for the first quarter of 2012.

Hovnanian’s confidence might stem from spending a lifetime in the homebuilding industry and growing up in an Armenian family steeped in business. His father, Kevork, had grown his father’s construction company into a large concern in Baghdad before being forced to leave. After ten years in the homebuilding business in the U.S., Kevork and his three brothers decided they would rather be family than business partners and amicably split the operation into four parts. Ara Hovnanian worked summers at his father’s company, cleaning out construction sites and sweeping floors. He got a real estate license at 16 and started selling homes in the summer, then went on to the Wharton School of the University of Pennsylvania, earning a joint BS and MBA in finance and real estate. He joined Hovnanian Enterprises, which by then was building 1,000 homes a year, in 1979, immediately after graduation. In 1988 he was appointed president; he ascended to the top position in 1997, when his father retired as CEO and became nonexecutive chairman. Senior Writer Julie Segal recently talked to Hovnanian about housing and demographics, what he learned from the housing collapse and the role of government in the mortgage market.

Institutional Investor: People talk about baby boomers downsizing as they retire and immigration being at historically low levels. It would seem that the demographics don’t support a robust housing market.

Hovnanian: No. That’s absolutely not true. Two of the leading institutions that study this — the Harvard Joint Center for Housing Studies and Moody’s — project that there will be approximately between 1.7 million and 1.9 million housing starts per year for this decade. Homebuilders will start that many homes based on demographics, which is the driver of our business.

Here are the demographics: New households will amount to 1.2 million housing starts per year, factoring in lower immigration patterns than we saw in the past decade. Those higher numbers already factor in less immigration. And by the way, the baby boom generation was followed by a boomlet generation that had just as many births as during the baby boom. That’s the demand we’re starting to feel right now. The total housing start number also factors in demand for second homes, a vacancy factor for overall housing, and demolitions and obsolescence.

Housing starts are predictable. Even in the 2000s, with an unprecedented boom and bust, there were 1.45 million housing starts, on average, every year. If you went back five decades, housing starts in the U.S. have averaged each and every decade, except for the ’70s, about 1.45 million starts annually.

Tell us about the pent-up demand.

The slowdown began at the tail end of ’05, while the bottom in total housing production was actually in ’09, when it was just over 500,000 starts. Since World War II, prior to this downturn the lowest year of production in the U.S. was 1 million housing starts. Not only that, but in two of the past three major housing downturns, it was at that level for just one year, then it bounced back. This time it dropped to 500,000 for three years.

Couple the recent slowdown with households growing at a slightly faster rate than we ever had before, and you get pent-up demand. Add a little stimulus from the Fed, which lowered mortgage rates, and then you have much-improved affordability and people finally saying: “Okay, I’ve waited long enough. It won’t be this affordable again.” It’s like a snowball. Once the market starts turning, it rolls down the hill and gets bigger.

With real estate on the upswing, what’s the challenge?

One of the big challenges for all builders right now is getting sufficient supply of land to grow. I think we’re making good progress on that, and we feel pretty good about feeding the growth engine. Demand is finally working back to its demographic destiny, so new-home sales are rising. But supply cannot keep up.

Leading up to the subprime crisis, many people became homeowners who probably shouldn’t have. Amid the resulting foreclosures, are there permanent changes in people’s attitudes toward housing?

I still have every bit of faith that home ownership will continue to hold the same value it has traditionally held in this country. There was certainly a time when people were speculating that attitudes would change and home ownership would go out of vogue and people would be happy to be renters for their entire lives. But numerous analysts have done surveys of renters, and while there was a minor diminution in attitudes toward home ownership, it was just that — a minor diminution. The overwhelming majority of renters aspire to home ownership.

Some things have changed. Researchers never expected that people would strategically default on their mortgages in such numbers.

Yes. Now what has changed for sure is the subprime mortgage market. That specific debacle will not likely happen again in our lifetimes. Having said that, there probably will be another problem that we don’t foresee at this time. But I think the likelihood of loose credit — really irresponsible credit — repeating itself is very slim.

What mistakes did you make during the bubble?

In 2005 we had record profits, leading the industry on return on equity and return on investment. We had huge earnings per share growth, and we had grown dramatically and really expanded our footprint. We were managing our capital to maintain a 1-to-1 debt-to-equity ratio. The problem was that we continued in the rapid growth phase through the peak of the market. Just before the peak in ’04, we reinvested in a lot more land and continued to buy homebuilding companies to expand into new geographic territories. We unfortunately continued that into two years that were huge mistakes, ’04 and ’05.

How has this altered how you manage your business?

It all comes down to demographics. We see that housing starts are projected to be between 1.7 million and 1.9 million. Once you get into that mode, the red-alert button light should be flashing because it’s not sustainable. In my mind, we’re going to be very cautious at that point. In this past boom we got to 2.2 million housing starts in a decade when the projected demand was 1.4 million to 1.5 million.

We had an affordability situation that was unsustainable too. When median-income families have that much difficulty buying medium-priced homes, that becomes problematic. That’s completely changed today, but it’s something homebuilders need to pay attention to.

As a public company, Hovnanian has been under pressure until recently. Would it have been easier to have stayed private?

As difficult as it has been for the public builders, and as high as the casualty rate has been for them, the private builders have had quadruple the challenge and probably quadruple the mortality rate. The difference is the access to capital that you have as a public company and the nonreliance on bank debt. Banks went through a very difficult period, and they predictably pulled in the reins on new lending. It made it very difficult for homebuilders that were dependent on that financing.

How will a healthier real estate market impact the economy as a whole?

It is a hugely underestimated impact that is much more powerful to the economy than people realize right now. The stumbling block to the recovery was not Wall Street; it was the construction industry, because the number of houses being built was at historic lows.

Now, as most public builders, including ourselves, are reporting contracts up 25, 30, 45 percent year over year, we have to start building for our customers. We and other builders are out in the marketplace hiring plumbers, carpenters and electricians. That tradesperson does not easily get a job writing articles in Institutional Investor or apps for Apple. They’ve got more-limited options, and they are now in the driver’s seat, with a lot of demand for their skills.

Do you see wages rising as well?

Absolutely. Luckily, home prices are rising more than wages, but they are rising.

What are your views on the government’s role in the mortgage market?

FHA and Fannie Mae were born during the Great Depression because liquidity became unavailable and the housing market would have collapsed back then, only furthering the economic catastrophe. The market needed a safety backstop, if you will. During the latest downturn, there were government enterprises and a private market. But the private market failed, and the government-guaranteed market again became the last resort. It did keep the housing market from collapsing, which would have been far more expensive for the country. Many people are saying Fannie Mae should perhaps play a lesser role, but most are still saying there should be a government guarantee as a last resort, as a backup, when the market fails. I assume somehow we will get to that position where the government is less involved in the day-to-day, but it will be a backer of last resort. • •